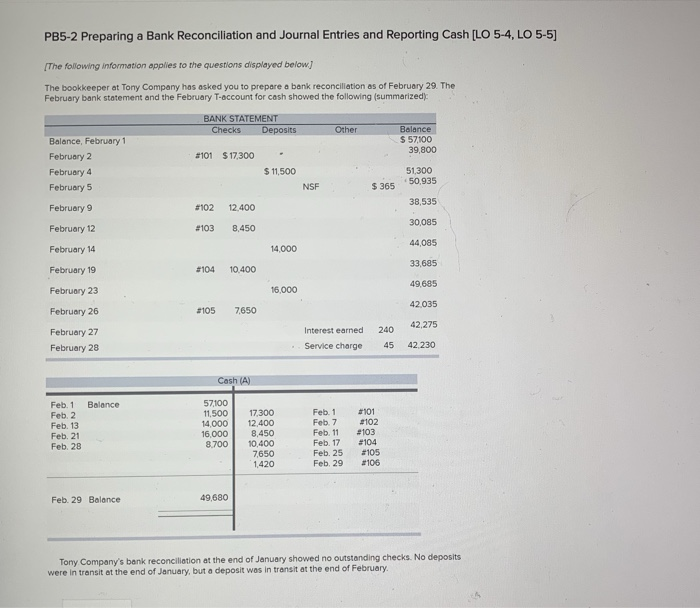

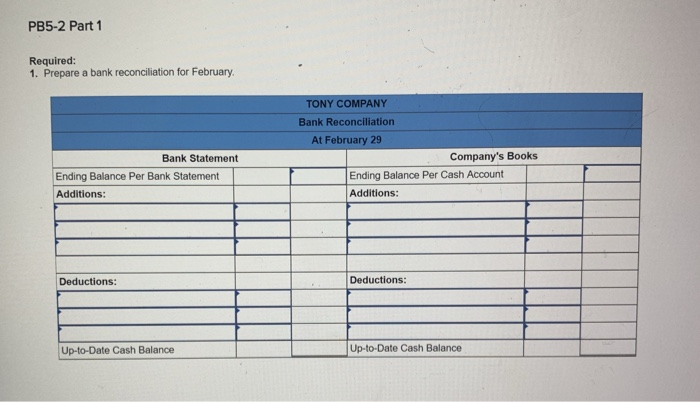

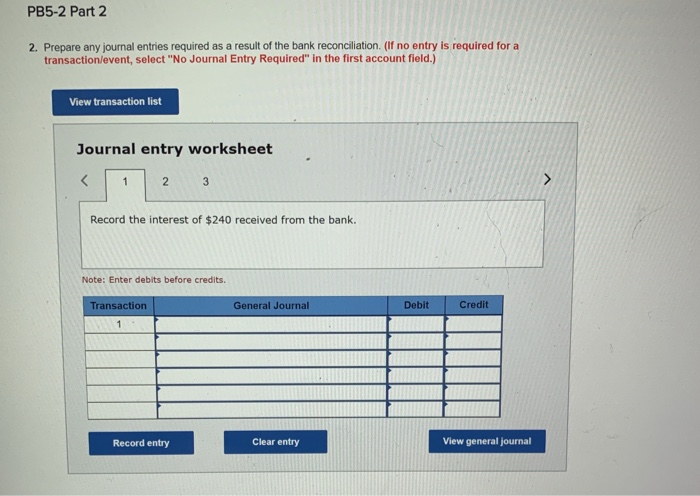

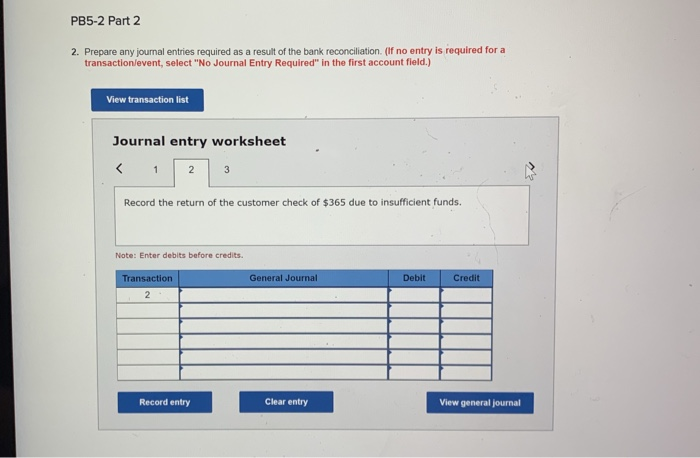

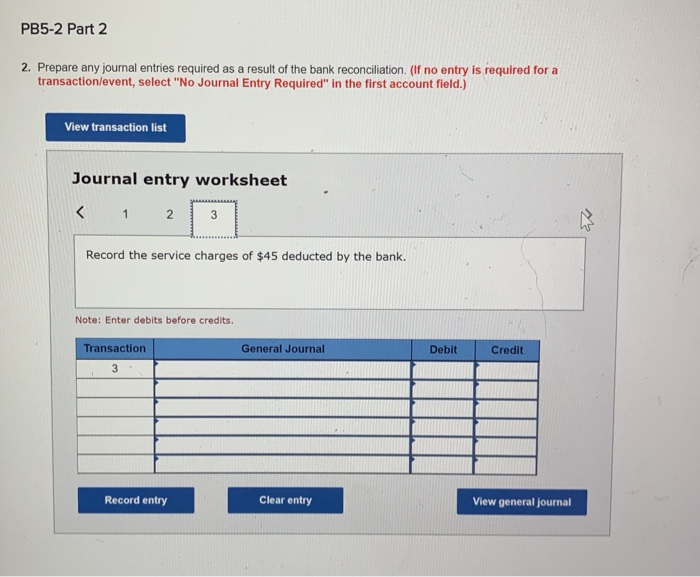

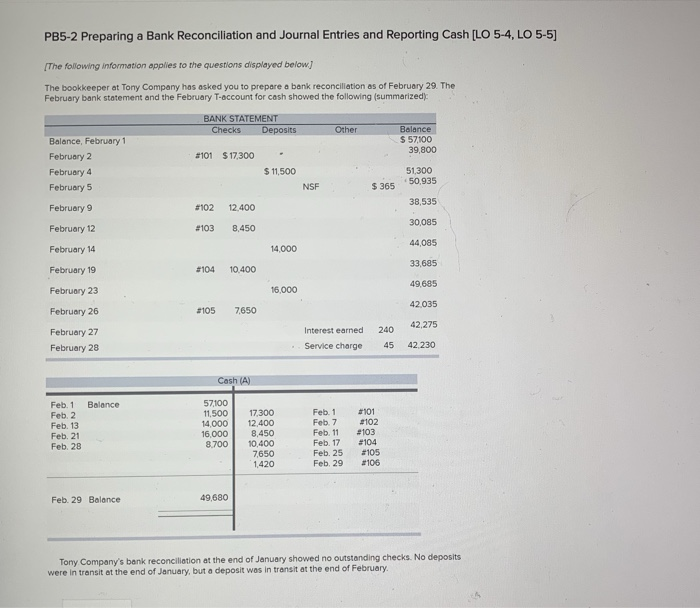

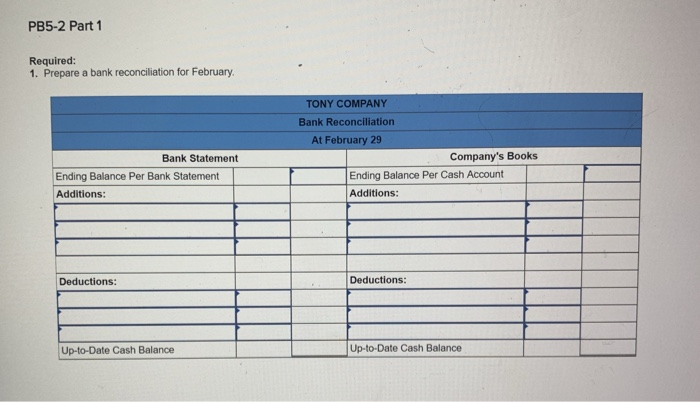

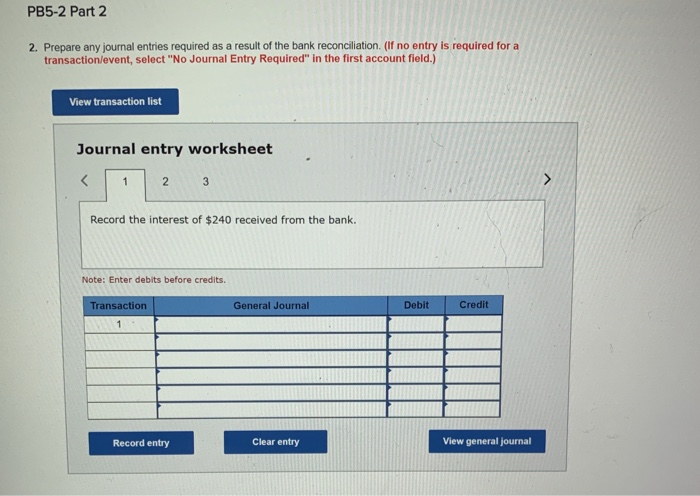

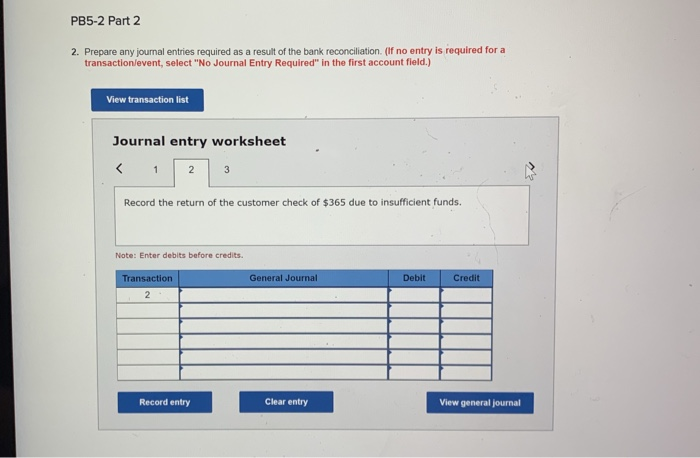

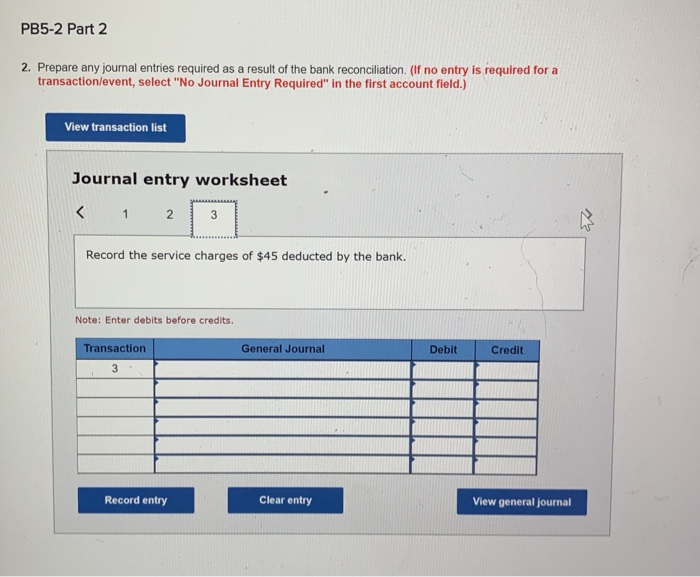

PB5-2 Preparing a Bank Reconciliation and Journal Entries and Reporting Cash [LO 5-4, LO 5-5] The following information applies to the questions displayed below The bookkeeper at Tony Company has asked you to prepare a bank reconciliation as of February 29. The February bank statement and the February T-occount for cosh showed the following (summarized) BANK STATEMENT Checks Deposits Other Balance S 57100 39,800 Balance, February 1 February 2 February 4 February 5 February S February 12 February 14 February 19 February 23 February 26 February 27 February 28 #101 $17,300 $11,500 51,300 NSF $ 365 50,935 38,535 30,085 44,085 33,685 49,685 42.035 42.275 Service charge 45 42,230 #102 12.400 #103 8.450 14,000 #104 10400 16,000 #105 7650 Interest earned 240 Cash (A) 57100 Feb. 1 Balance Feb. 2 Feb. 13 Feb. 21 Feb. 28 11,500 17,300 14,000 12,400 16,000 8,450 8.70010,400 7650 1420 Feb. 1 Feb 7 Feb 11 Feb. 17 Feb. 25 Feb. 29 #101 #102 #103 #104 #105 #106 Feb. 29 Balance 49,680 Tony Company's bank reconcillation at the end of January showed no outstanding checks. No deposits were in transit et the end of January, but a deposit was in transit at the end of February. PB5-2 Part1 Required 1. Prepare a bank reconciliation for February TONY COMPANY Bank Reconciliation At February 29 Bank Statement Company's Books Ending Balance Per Bank Statement Additions: Ending Balance Per Cash Account Additions: Deductions: Deductions: Up-to-Date Cash Balance Up-to-Date Cash Balance PB5-2 Part2 2. Prepare any journal entries required as a result of the bank reconciliation. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Record the interest of $240 received from the bank Note: Enter debits before credits. Debit Credit Transaction General Journal Record entry Clear entry View general journal PB5-2 Part 2 2. Prepare any journal entries required as a result of the bank reconciliation. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Record the return of the customer check of $365 due to insufficient funds. Note: Enter debits before credits General Journal Debit Credit Record entry Clear entry View general journal PB5-2 Part 2 2. Prepare any journal entries required as a result of the bank reconciliation. (If no entry is required for a transaction/event, select "No Journal Entry Required in the first account field.) View transaction list Journal entry worksheet Record the service charges of $45 deducted by the bank. Note: Enter debits before credits. Transaction General Journal Debit Credit 3 Record entry Clear entry View general journal