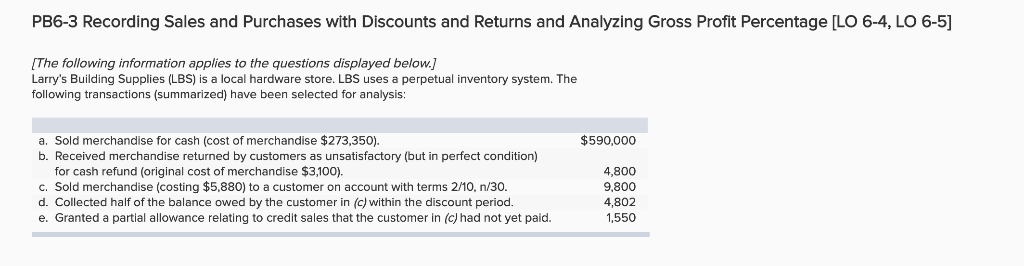

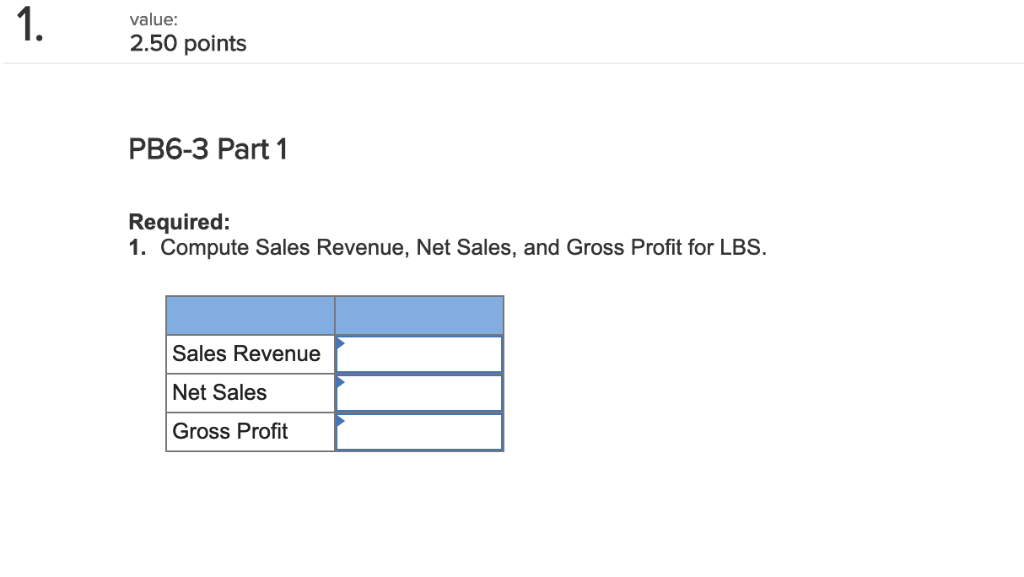

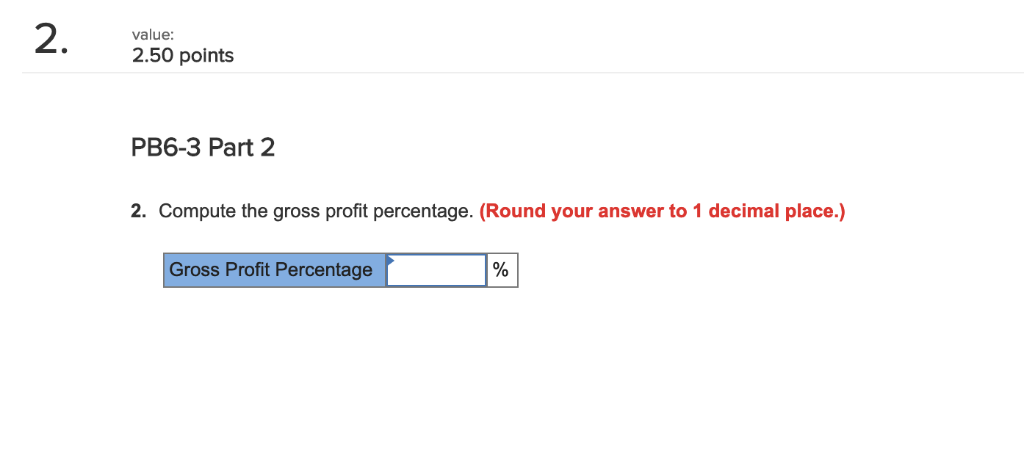

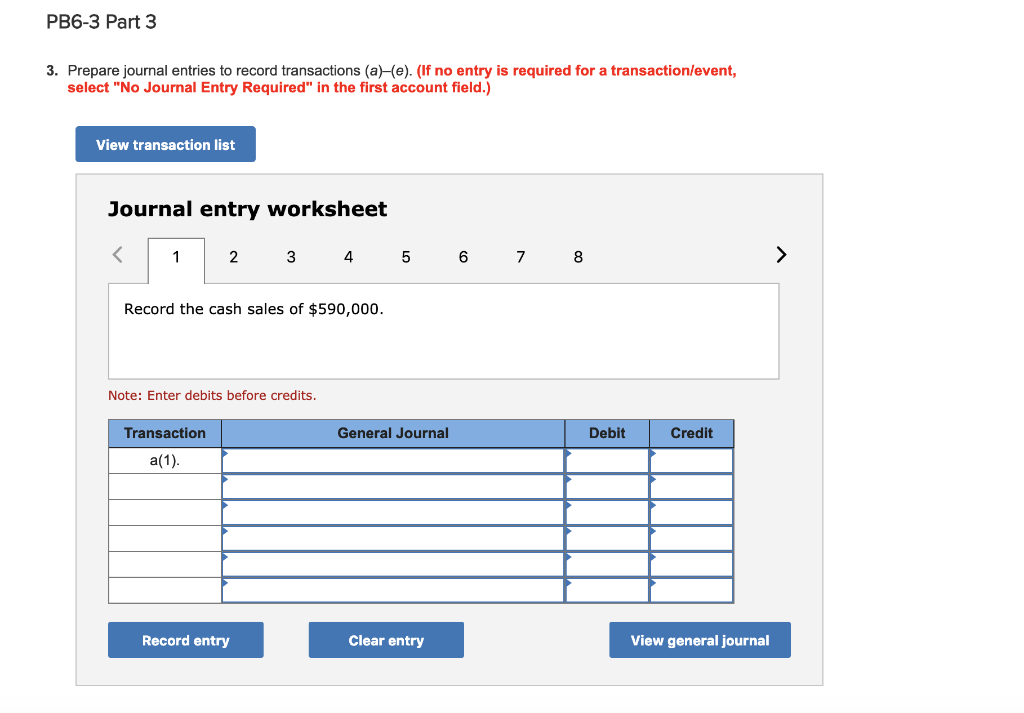

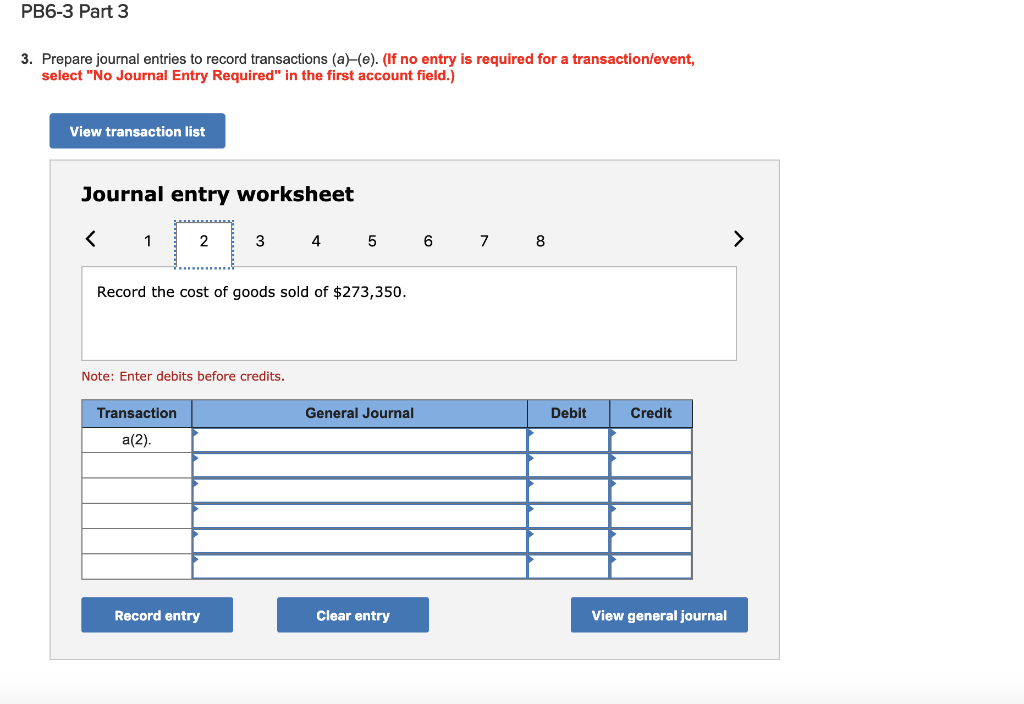

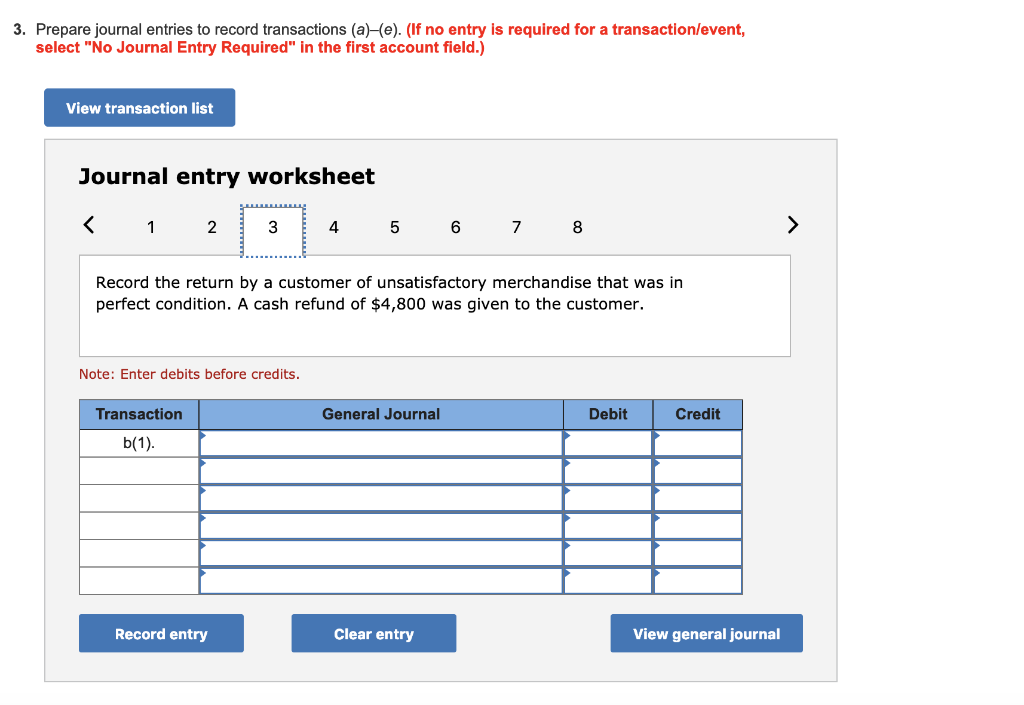

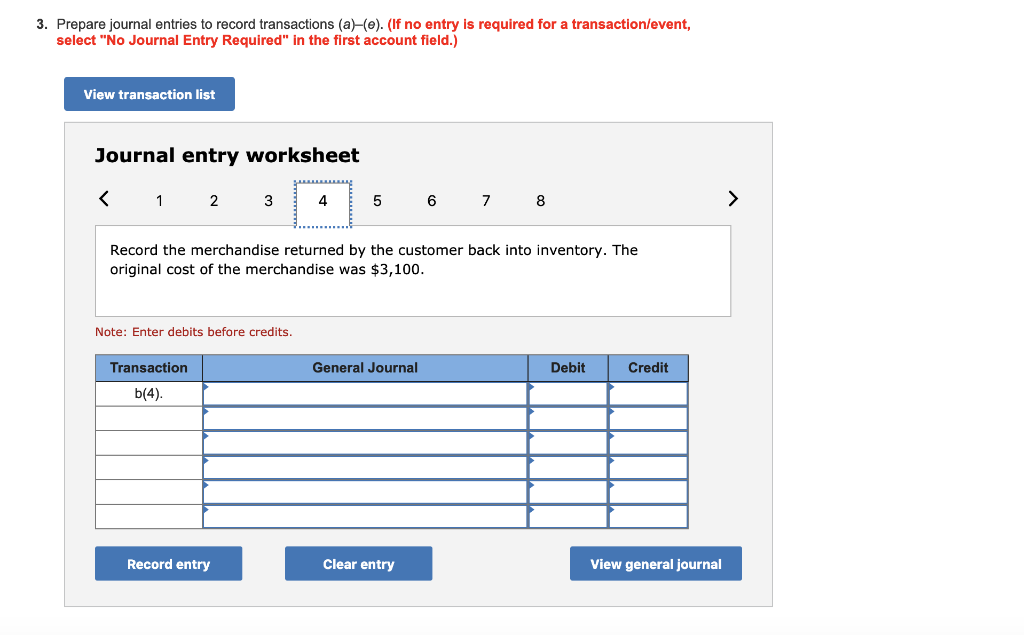

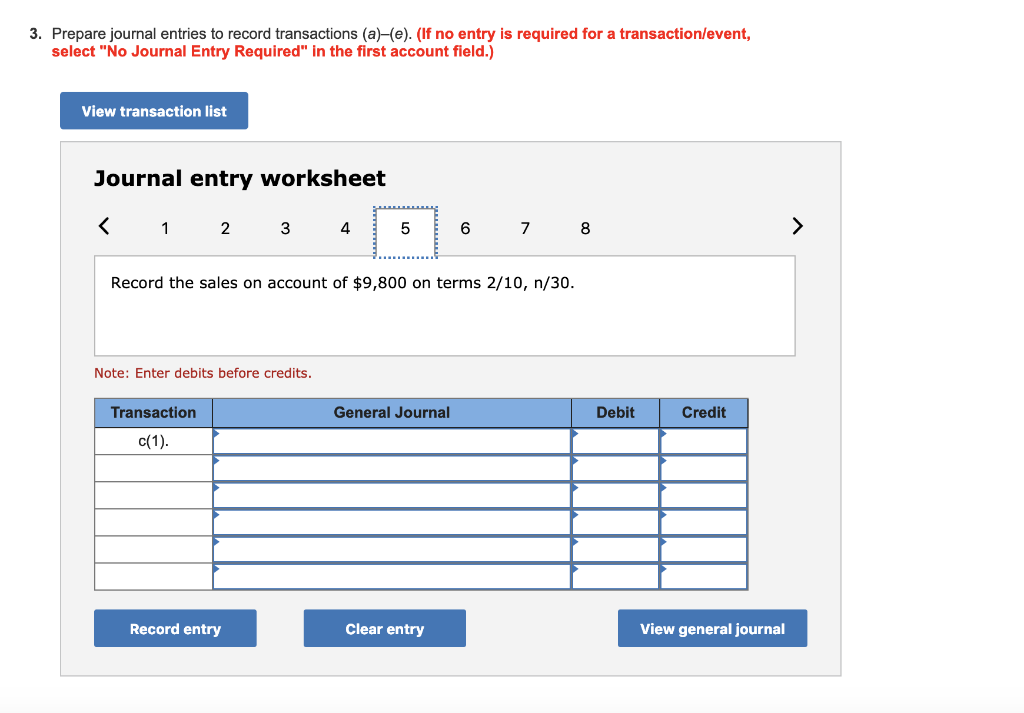

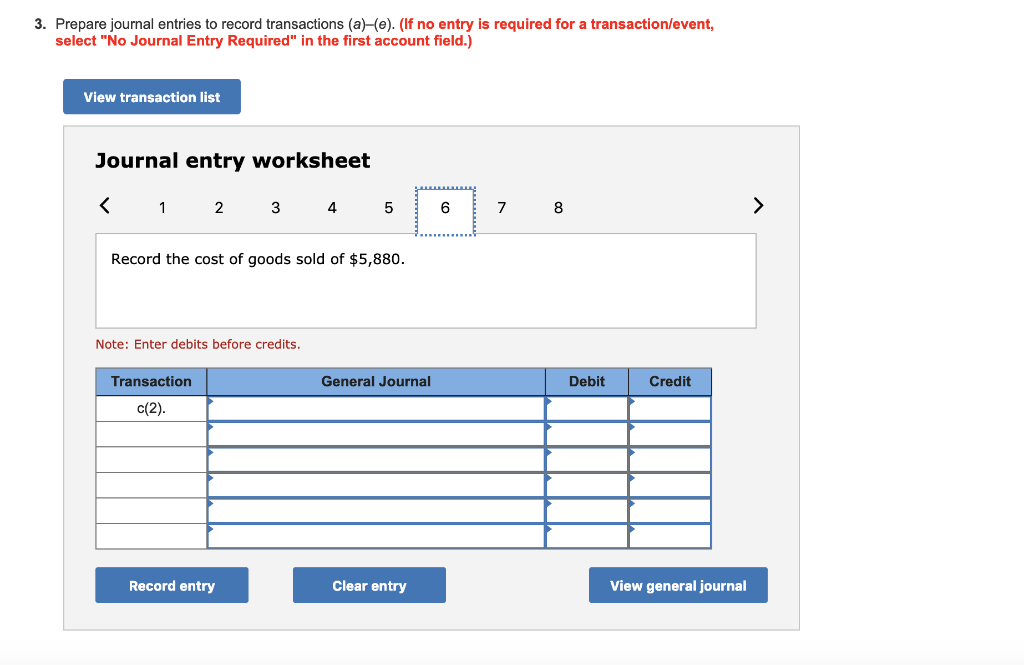

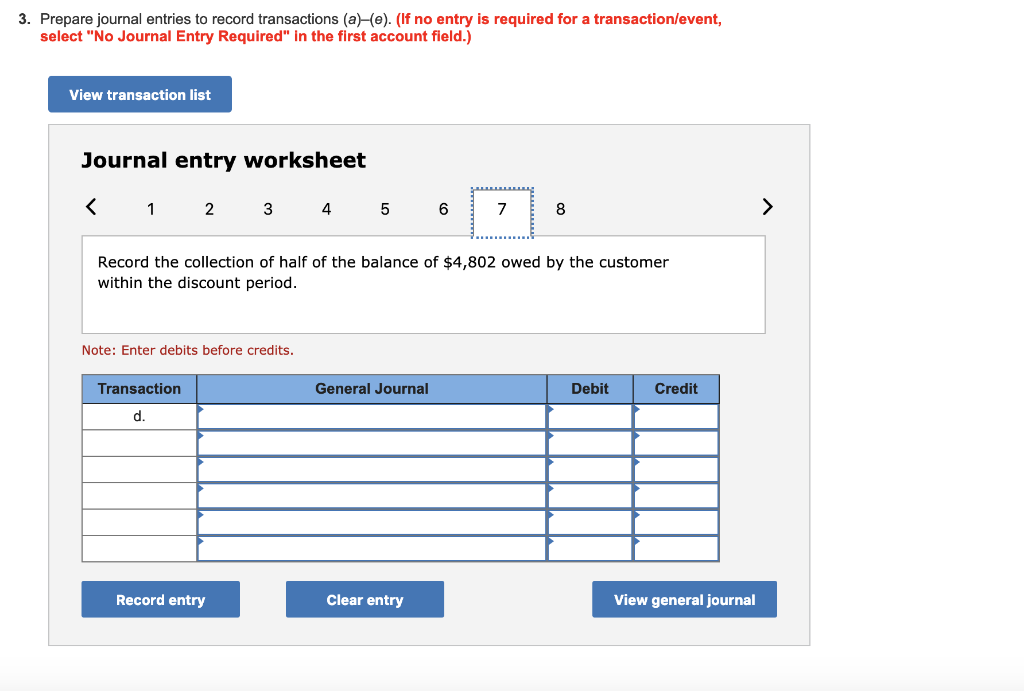

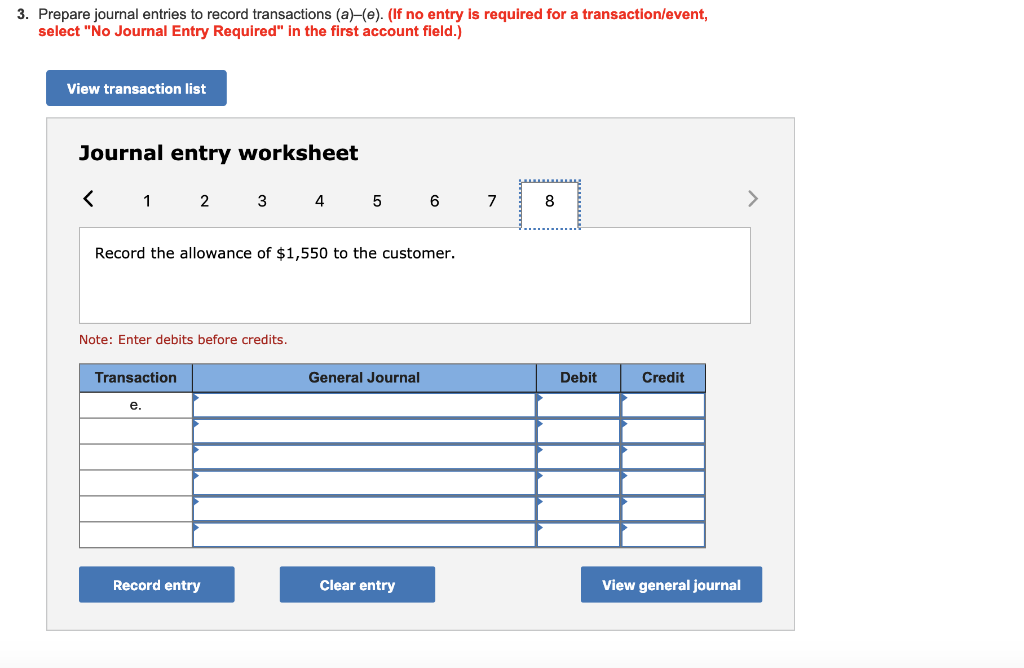

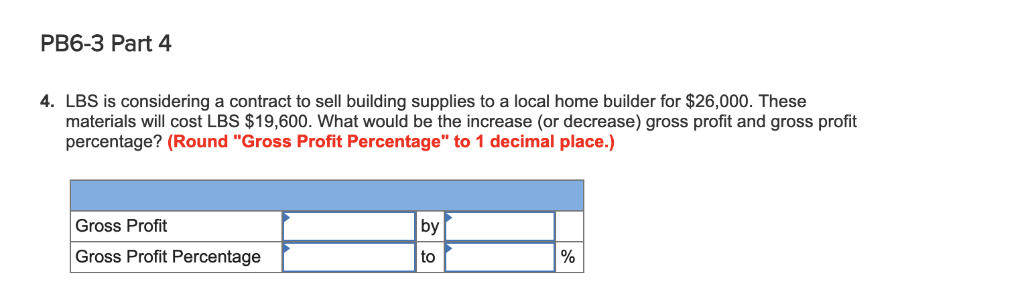

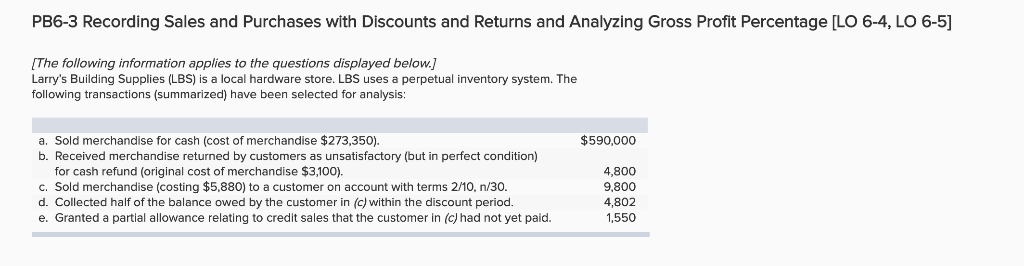

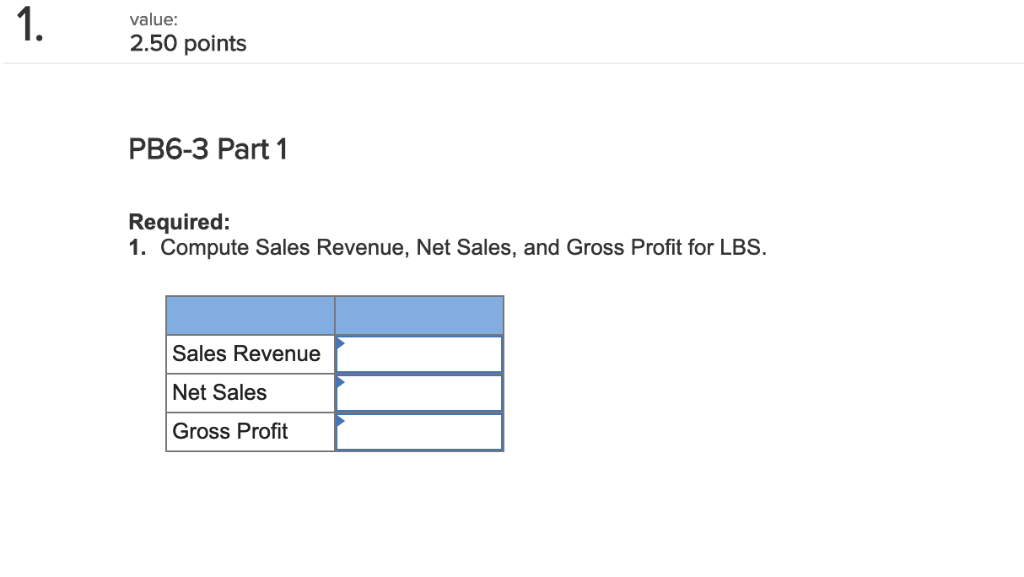

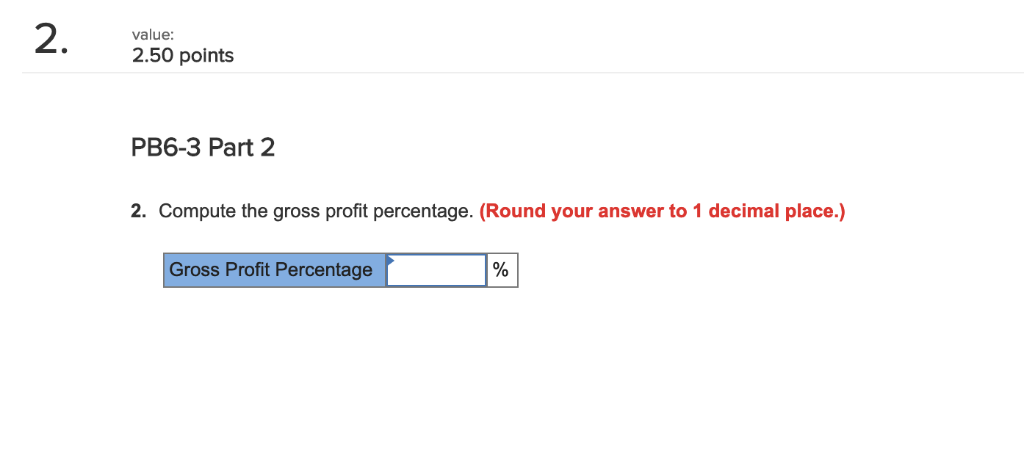

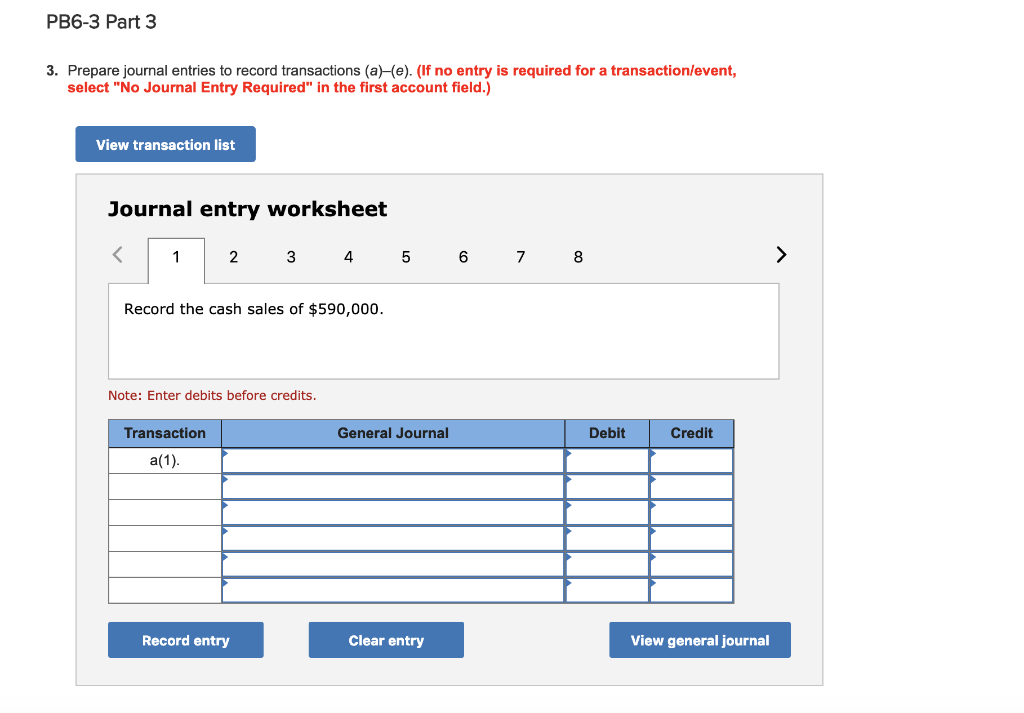

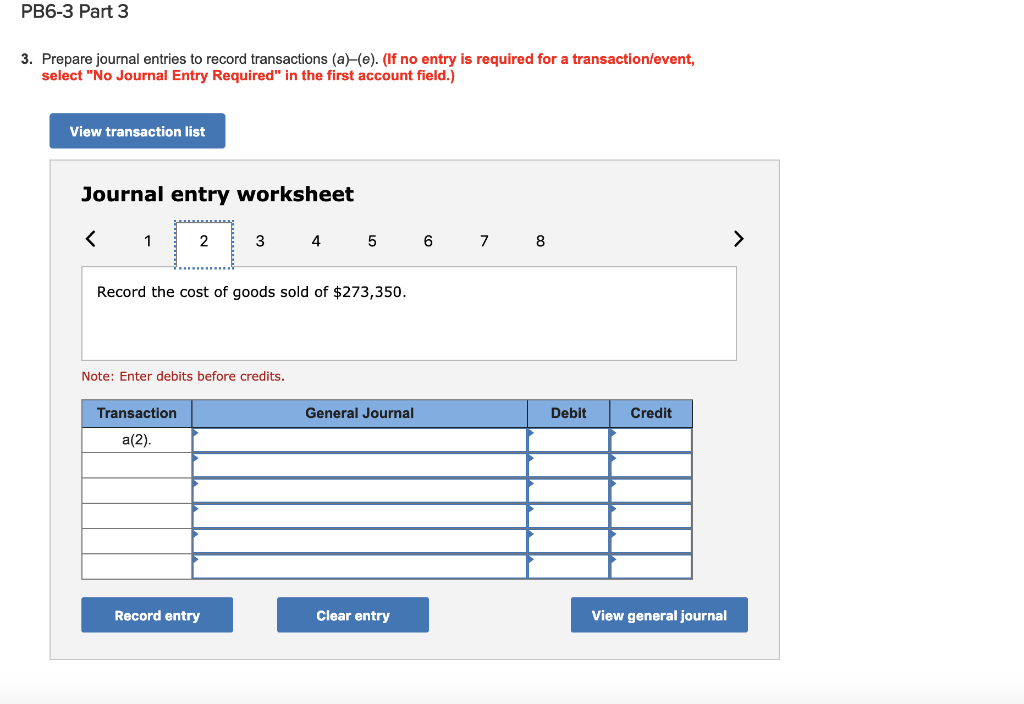

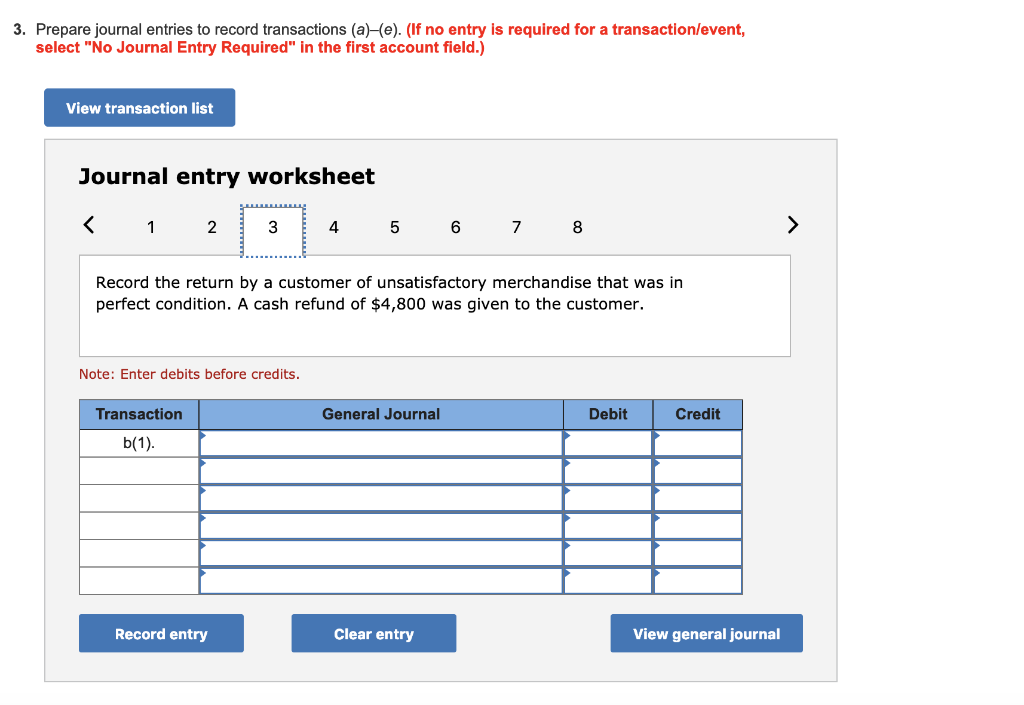

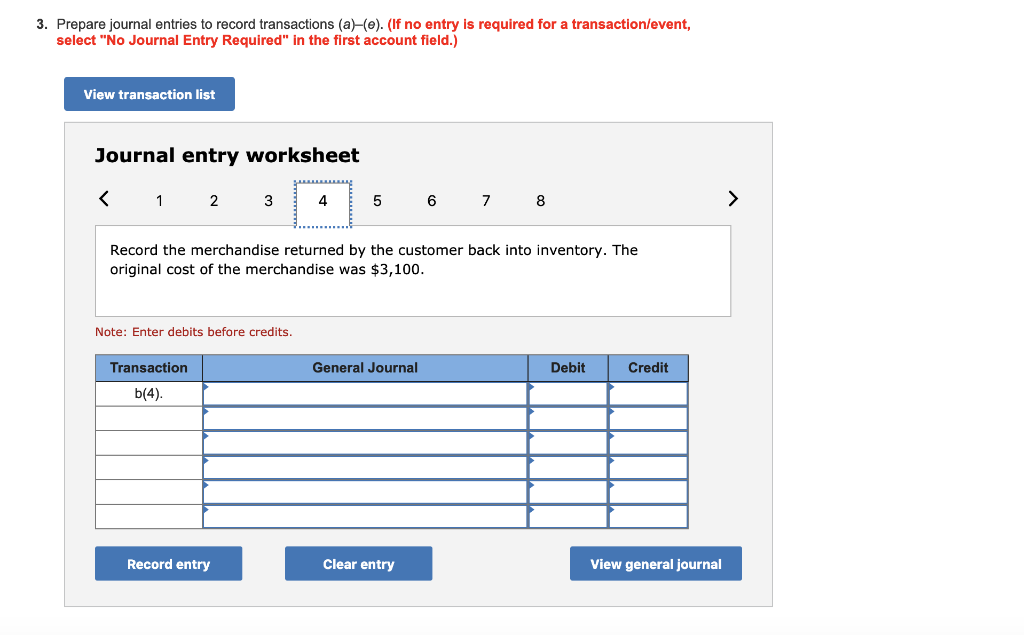

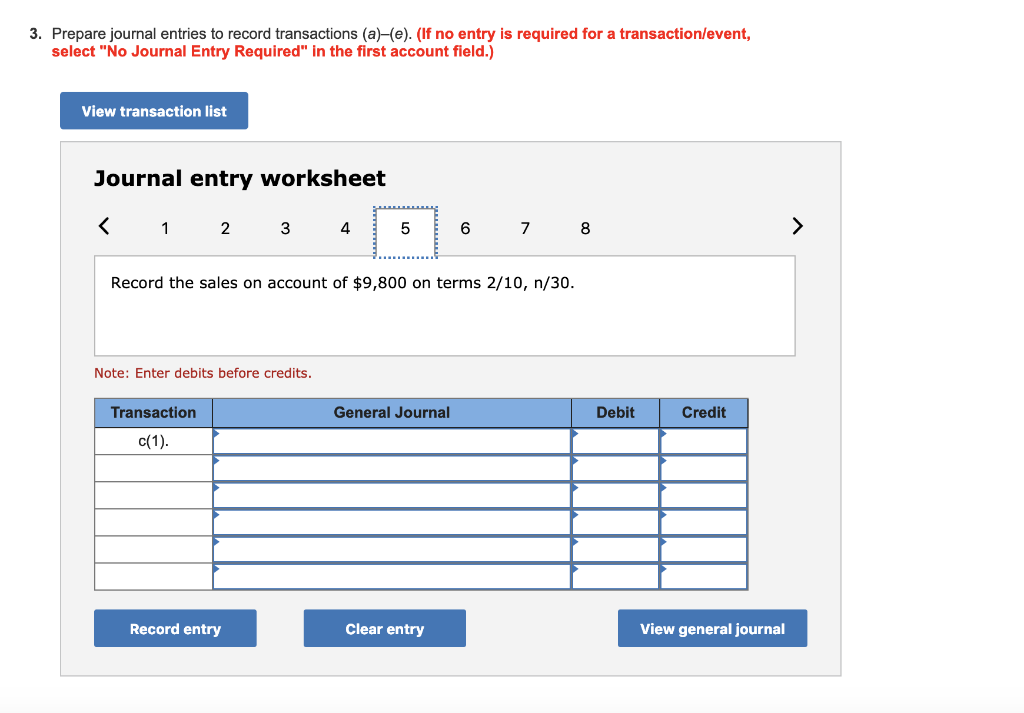

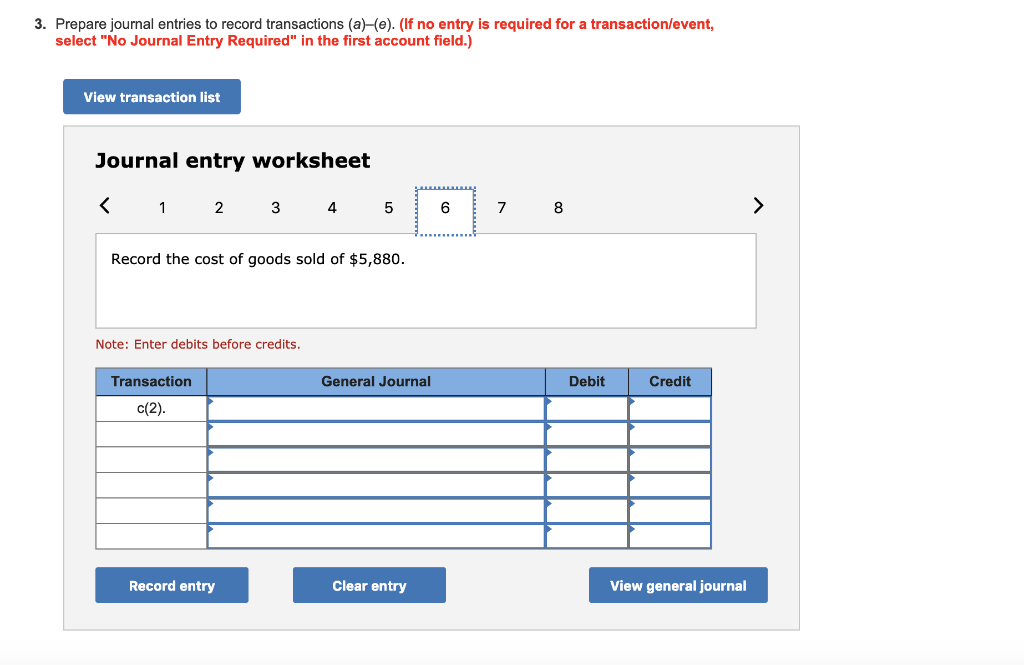

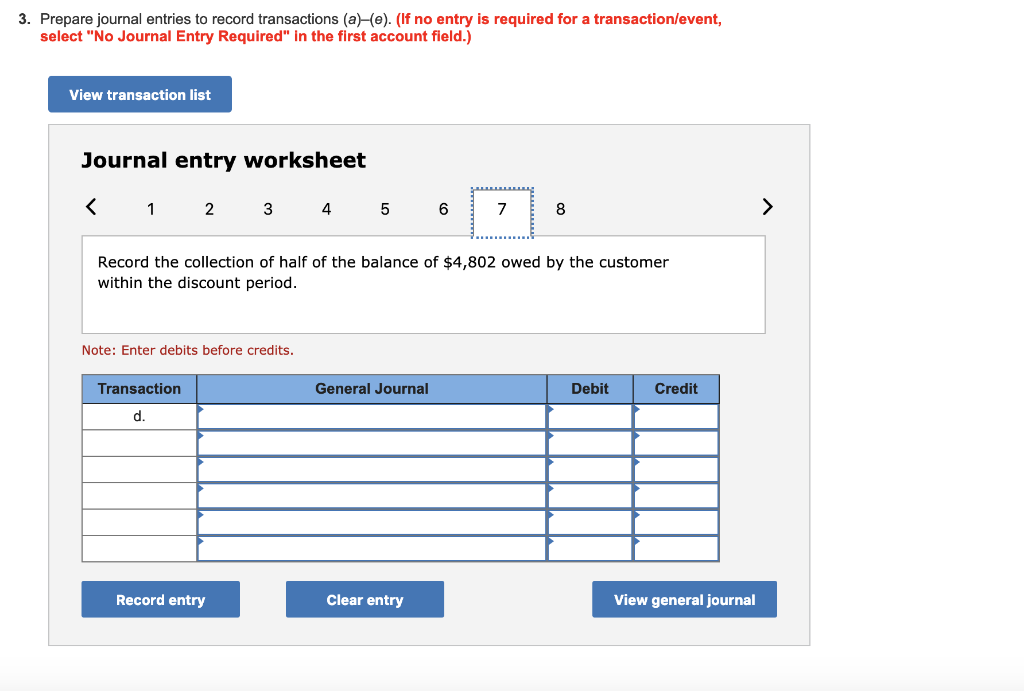

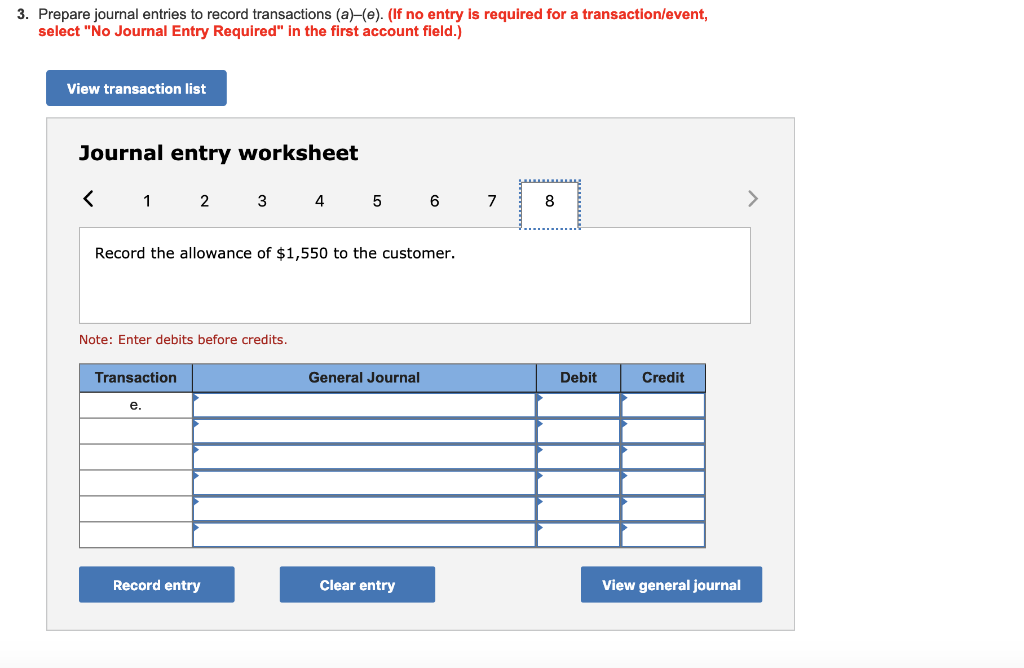

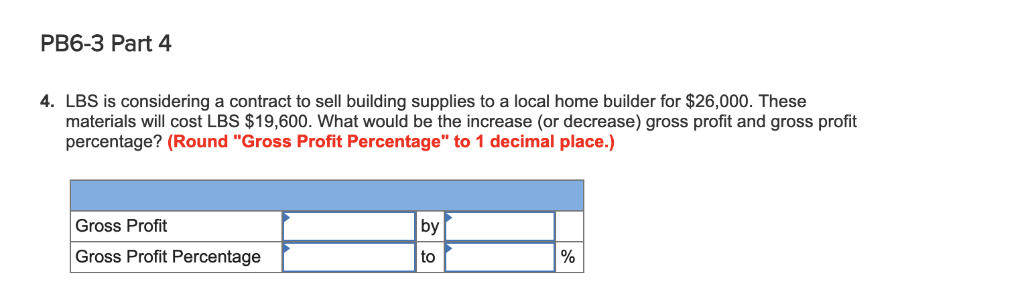

PB6-3 Recording Sales and Purchases with Discounts and Returns ad Analyzing Gross Profit Percentage [LO 6-4, LO 6-5] [The following information applies to the questions displayed below. Larry's Building Supplies (LBS) is a local hardware store. LBS uses a perpetual inventory system. The following transactions (summarized) have been selected for analysis: a. Sold merchandise for cash (cost of merchandise $273,350). b. Received merchandise returned by customers as unsatisfactory (but in perfect condition) $590,000 for cash refund (original cost of merchandise $3,100). c. Sold merchandise (costing $5,880) to a customer on account with terms 2/10, n/30. d. Collected half of the balance owed by the customer in (c)within the discount period. e. Granted a partial allowance relating to credit sales that the customer in (c) had not yet paid. 4,800 9,800 4,802 1,550 value 2.50 points PB6-3 Part 1 Required: 1. Compute Sales Revenue, Net Sales, and Gross Profit for LBS Sales Revenue Net Sales Gross Profit PB6-3 Part 3 3. Prepare journal entries to record transactions (a)He.f no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Record the cash sales of $590,000. Note: Enter debits before credits. Transaction General Journal Debit Credit Record entry Clear entry View general journal PB6-3 Part 3 3. Prepare journal entries to record transactions (a)-(e). (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Record the cost of goods sold of $273,350. Note: Enter debits before credits. Transaction General Journal Debit Credit a(2) Record entry Clear entry View general journal 3. Prepare journal entries to record transactions (a)-(e). (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Record the cost of goods sold of $5,880 Note: Enter debits before credits. Transaction General Journal Debit Credit c(2) Record entry Clear entry View general journal