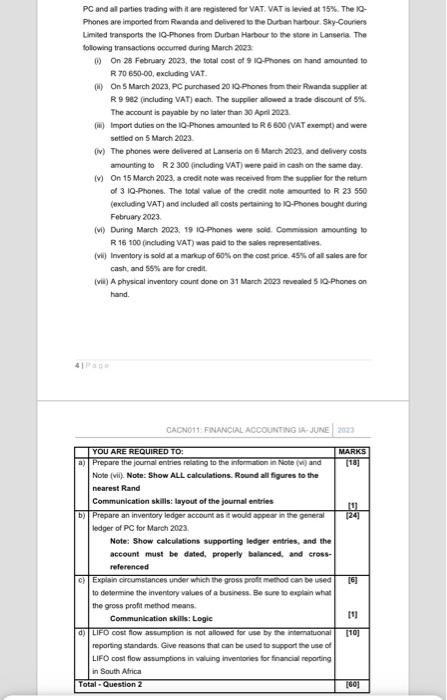

PC and al parties trading with it are registeced for VAT. VAT is levied at 15%. The KaPhones are imported trom Rwanda and delivered to the Durtan habour. Sky-Couriers Limited transports the IQ-Phones froen Durban Harbour to the store in Lanserta. The following transactions occurred during March 2023 . 0) On 28 February 2023, the total cost of 9 IQ-Phones on hand amounted to R 70 650-00, excluding VAT. (ii) On 5 March 2023, PC purchased 20 10 Phones trom their Pwanda suppler at R 9982 (including VAT) each. The suppler allowed a trade discount of 5%. The account is payable by no later than 30 Aprl 2023. (iii) Import duties on the IQ Phones amounted to R 6600 (VAT exempt) and were settled on 5 March 2023 (iv) The phones were delivered at Lanseris on 6 Match 2023, and delivery costs arnounting to R 2300 (including VAT) were paid in cash on the same day. (v) On 15 March 2023, a credi note was received from the supplier for the retum o. 310 -Phones. The tots value of the cresit nole amounted to R 23550 (excluding VAT) and included all costs pertaining to 10-Phones bought buring February 2023. (vi) During March 20Q3. 19 iQ-Phones were selid. Cemmission amounting to R 16100 (including VAT) was paid to the sales representubives. (vii) Inventory is sold at a markup of 60% on the cost price. 45% of all sales ane for cash, and 56% are for credil. (vii) A physical inventory count done on 31 March 2023 revealed 5 i. Phenes on hand. PC and al parties trading with it are registeced for VAT. VAT is levied at 15%. The KaPhones are imported trom Rwanda and delivered to the Durtan habour. Sky-Couriers Limited transports the IQ-Phones froen Durban Harbour to the store in Lanserta. The following transactions occurred during March 2023 . 0) On 28 February 2023, the total cost of 9 IQ-Phones on hand amounted to R 70 650-00, excluding VAT. (ii) On 5 March 2023, PC purchased 20 10 Phones trom their Pwanda suppler at R 9982 (including VAT) each. The suppler allowed a trade discount of 5%. The account is payable by no later than 30 Aprl 2023. (iii) Import duties on the IQ Phones amounted to R 6600 (VAT exempt) and were settled on 5 March 2023 (iv) The phones were delivered at Lanseris on 6 Match 2023, and delivery costs arnounting to R 2300 (including VAT) were paid in cash on the same day. (v) On 15 March 2023, a credi note was received from the supplier for the retum o. 310 -Phones. The tots value of the cresit nole amounted to R 23550 (excluding VAT) and included all costs pertaining to 10-Phones bought buring February 2023. (vi) During March 20Q3. 19 iQ-Phones were selid. Cemmission amounting to R 16100 (including VAT) was paid to the sales representubives. (vii) Inventory is sold at a markup of 60% on the cost price. 45% of all sales ane for cash, and 56% are for credil. (vii) A physical inventory count done on 31 March 2023 revealed 5 i. Phenes on hand