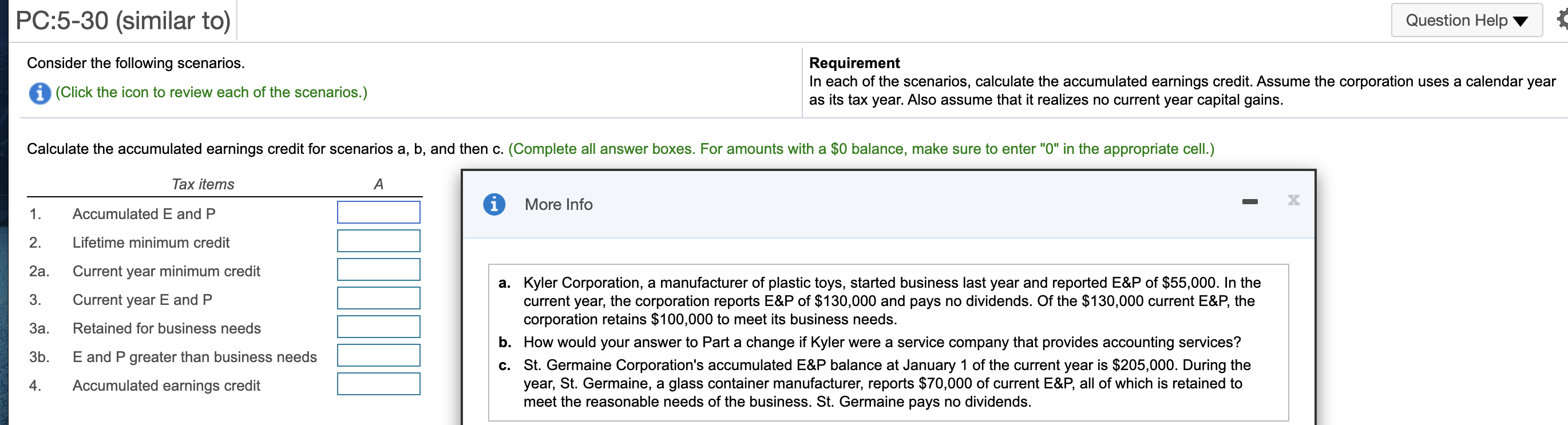

PC:5-30 (similar to) Question Help Consider the following scenarios. (Click the icon to review each of the scenarios.) Requirement In each of the scenarios, calculate the accumulated earnings credit. Assume the corporation uses a calendar year as its tax year. Also assume that it realizes no current year capital gains. Calculate the accumulated earnings credit for scenarios a, b, and then c. (Complete all answer boxes. For amounts with a $0 balance, make sure to enter "O" in the appropriate cell.) Tax items A i More Info - X 1. Accumulated E and P 2. Lifetime minimum credit 2a. Current year minimum credit 3. Current year E and P 3a. Retained for business needs a. Kyler Corporation, a manufacturer of plastic toys, started business last year and reported E&P of $55,000. In the current year, the corporation reports E&P of $130,000 and pays no dividends. Of the $130,000 current E&P, the corporation retains $100,000 to meet its business needs. b. How would your answer to Part a change if Kyler were a service company that provides accounting services? c. St. Germaine Corporation's accumulated E&P balance at January 1 of the current year is $205,000. During the year, St. Germaine, a glass container manufacturer, reports $70,000 of current E&P, all of which is retained to meet the reasonable needs of the business. St. Germaine pays no dividends. 3b. E and P greater than business needs 4. Accumulated earnings credit PC:5-30 (similar to) Question Help Consider the following scenarios. (Click the icon to review each of the scenarios.) Requirement In each of the scenarios, calculate the accumulated earnings credit. Assume the corporation uses a calendar year as its tax year. Also assume that it realizes no current year capital gains. Calculate the accumulated earnings credit for scenarios a, b, and then c. (Complete all answer boxes. For amounts with a $0 balance, make sure to enter "O" in the appropriate cell.) Tax items A i More Info - X 1. Accumulated E and P 2. Lifetime minimum credit 2a. Current year minimum credit 3. Current year E and P 3a. Retained for business needs a. Kyler Corporation, a manufacturer of plastic toys, started business last year and reported E&P of $55,000. In the current year, the corporation reports E&P of $130,000 and pays no dividends. Of the $130,000 current E&P, the corporation retains $100,000 to meet its business needs. b. How would your answer to Part a change if Kyler were a service company that provides accounting services? c. St. Germaine Corporation's accumulated E&P balance at January 1 of the current year is $205,000. During the year, St. Germaine, a glass container manufacturer, reports $70,000 of current E&P, all of which is retained to meet the reasonable needs of the business. St. Germaine pays no dividends. 3b. E and P greater than business needs 4. Accumulated earnings credit