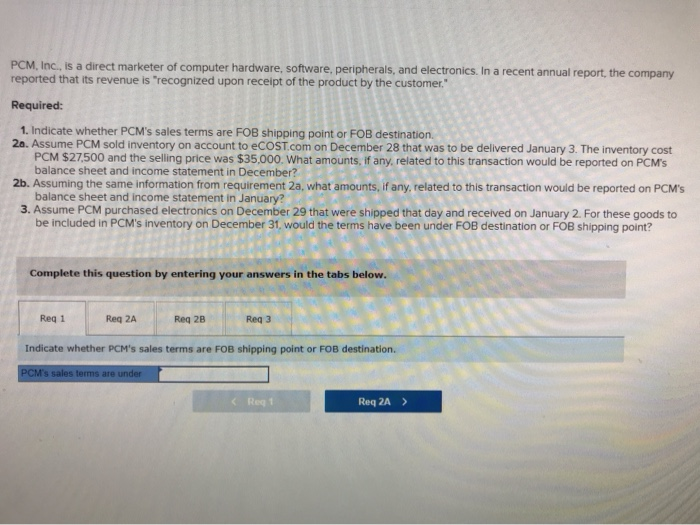

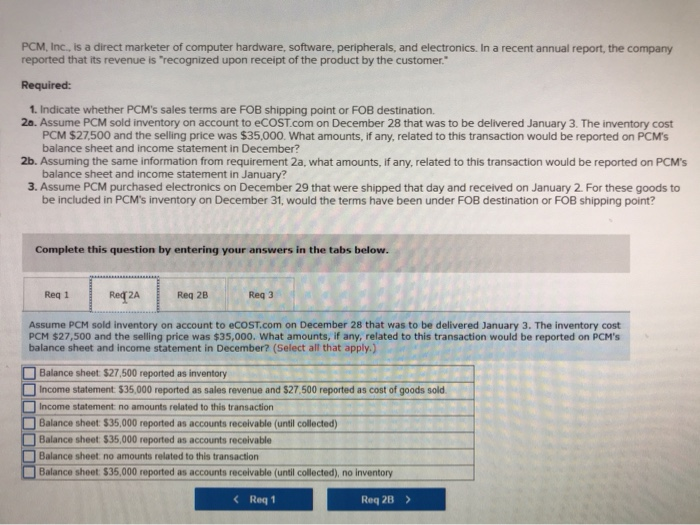

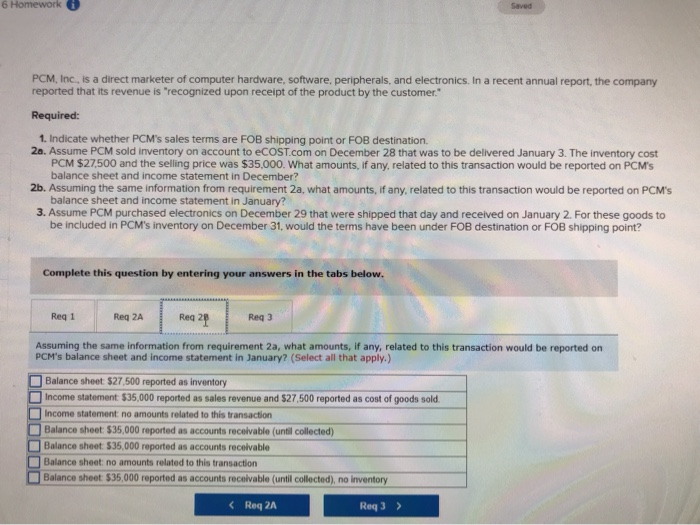

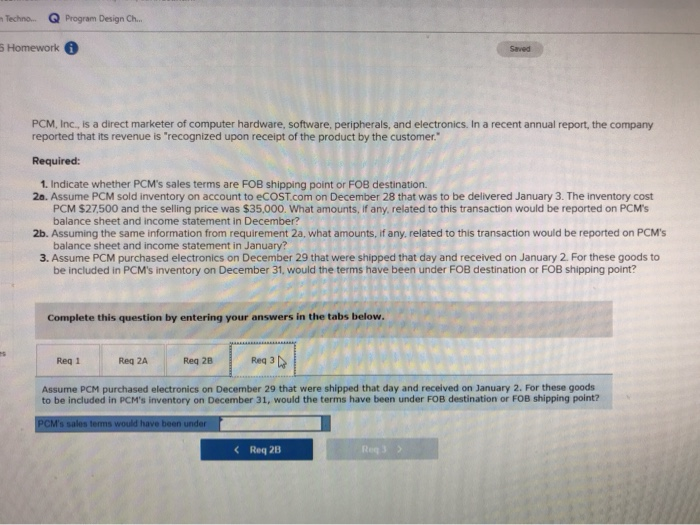

PCM, Inc., is a direct marketer of computer hardware, software, peripherals, and electronics. In a recent annual report, the company reported that its revenue is "recognized upon receipt of the product by the customer. Required: 1. Indicate whether PCM's sales terms are FOB shipping point or FOB destination 2a. Assume PCM sold inventory on account to eCOST.com on December 28 that was to be delivered January 3. The inventory cost PCM $27,500 and the selling price was $35,000. What amounts, if any, related to this transaction would be reported on PCM's balance sheet and income statement in December? 2b. Assuming the same information from requirement 2a, what amounts, if any, related to this transaction would be reported on PCM's balance sheet and income statement in January? 3. Assume PCM purchased electronics on December 29 that were shipped that day and received on January 2. For these goods to be included in PCM's inventory on December 31, would the terms have been under FOB destination or FOB shipping point? Complete this question by entering your answers in the tabs below. Req 1 Req 2A Req 2B Req 3 Indicate whether PCM's sales terms are FOB shipping point or FOB destination. PCM's sales terms are under Req 1 Req 2A PCM, Inc., is a direct marketer of computer hardware, software, peripherals, and electronics. In a recent annual report, the company reported that its revenue is "recognized upon receipt of the product by the customer." Required: 1. Indicate whether PCM's sales terms are FOB shipping point or FOB destination. 2a. Assume PCM sold inventory on account to eCOST.com on December 28 that was to be delivered January 3. The inventory cost PCM $27,500 and the selling price was $35,000. What amounts, if any, related to this transaction would be reported on PCM's balance sheet and income statement in December? 2b. Assuming the same information from requirement 2a, what amounts, if any, related to this transaction would be reported on PCM's balance sheet and income statement in January? 3. Assume PCM purchased electronics on December 29 that were shipped that day and received on January 2. For these goods to be included in PCM's inventory on December 31, would the terms have been under FOB destination or FOB shipping point? Complete this question by entering your answers in the tabs below. Red 2A Req 1 Req 2B Req 3 Assume PCM sold inventory on account to eCOST.com on December 28 that was to be delivered January 3. The inventory cost PCM $27,500 and the selling price was $35,000. What amounts, if any, related to this transaction would be reported on PCM's balance sheet and income statement in December? (Select all that apply.) Balance sheet $27,500 reported as inventory Income statement $35,000 reported as sales revenue and $27,500 reported as cost of goods sold Income statement no amounts related to this transaction Balance sheet $35,000 reported as accounts receivable (until collected) Balance sheet $35,000 reported as accounts receivable Balance sheet no amounts related to this transaction Balance sheet $35,000 reported as accounts receivable (until collected), no inventory Req 1 Req 2B> 6 Homework Saved PCM, Inc., is a direct marketer of computer hardware, software, peripherals, and electronics. In a recent annual report, the company reported that its revenue is "recognized upon receipt of the product by the customer. Required: 1. Indicate whether PCM's sales terms are FOB shipping point or FOB destination. 2a. Assume PCM sold inventory on account to ecOST.com on December 28 that was to be delivered January 3. The inventory cost PCM $27,500 and the selling price was $35,000. What amounts, if any, related to this transaction would be reported on PCM's balance sheet and income statement in December? 2b. Assuming the same information from requirement 2a, what amounts, if any, related to this transaction would be reported on PCM's balance sheet and income statement in January? 3. Assume PCM purchased electronics on December 29 that were shipped that day and received on January 2. For these goods to be included in PCM's inventory on December 31, would the terms have been under FOB destination or FOB shipping point? Complete this question by entering your answers in the tabs below. Req 2 Req 2A Req 1 Req 3 Assuming the same information from requirement 2a, what amounts, if any, related to this transaction would be reported on PCM's balance sheet and income statement in January? (Select all that apply.) Balance sheet $27,500 reported as inventory Income statement $35,000 reported as sales revenue and $27,500 reported as cost of goods sold. Income statement no amounts related to this transaction Balance sheet: $35,000 reported as accounts receivable (until collected) Balance sheet $35,000 reported as accounts receivable Balance sheet no amounts related to this transaction Balance sheet $35,000 reported as accounts receivable (until collected), no inventory Req 2A Req 3 Q Program Design Ch.. Techno.. 6 Homework Saved PCM, Inc., is a direct marketer of computer hardware, software, peripherals, and electronics. In a recent annual report, the company reported that its revenue is "recognized upon receipt of the product by the customer. Required: 1. Indicate whether PCM's sales terms are FOB shipping point or FOB destination. 2. Assume PCM sold inventory on account to eCOST.com on December 28 that was to be delivered January 3. The inventory cost PCM $27,500 and the selling price was $35,000. What amounts, if any, related to this transaction would be reported on PCM's balance sheet and income statement in December? 2b. Assuming the same information from requirement 2a, what amounts, if any, related to this transaction would be reported on PCM's balance sheet and income statement in January? 3. Assume PCM purchased electronics on December 29 that were shipped that day and received on January 2. For these goods to be included in PCM's inventory on December 31, would the terms have been under FOB destination or FOB shipping point? Complete this question by entering your answers in the tabs below. Req 3 Req 1 Reg 2A Req 2B Assume PCM purchased electronics on December 29 that were shipped that day and received on January 2. For these goods to be included in PCM's inventory on December 31, would the terms have been under FOB destination or FOB shipping point? PCM's sales tems would have been under