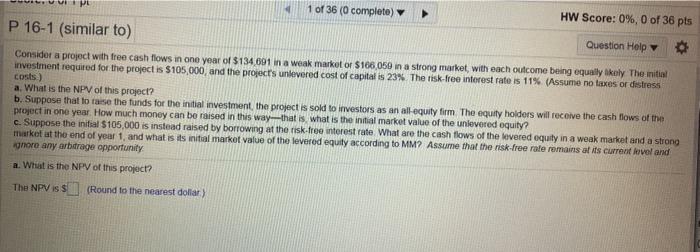

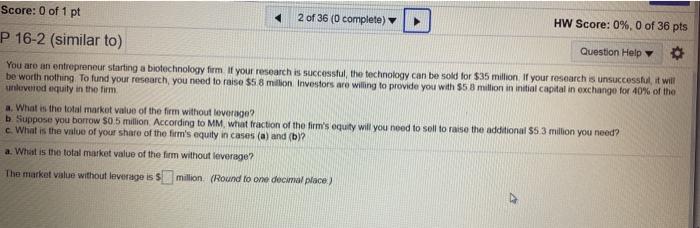

PE 1 of 36 (0 complete) HW Score: 0%, 0 of 36 pts P 16-1 (similar to) Question Help Consider a project with free cash flows in one year of $134 691 in a weak market or $106.059 in a strong market, with each outcome being equally likely The nitial investment required for the project is $105,000, and the project's unlovered cost of capital is 23%. The risk-free interest rate is 11% (Assume no taxes or distress costs) a. What is the NPV of this project? b. Suppose that to raise the funds for the initial investment, the project is sold to investors as an all equity firm The equity holders will receive the cash flows of the project in one year How much money can be raised in this way that is what is the initial market value of the unlevered equity? c. Suppose the initial $105,000 is instead raised by borrowing at the risk free interest rate What are the cash flows of the lovered equity in a weak market and a strong market at the end of year 1, and what is its initial market value of the levered equity according to MM? Assume that the risk-free rate remains at its current level and hore any arbitrage opportunity a. What is the NPV of this project? The NPV is $ (Round to the nearest dollar) Score: 0 of 1 pt 2 of 36 (0 complete) HW Score: 0%, 0 of 36 pts P 16-2 (similar to) Question Help You are an entrepreneur starting a biotechnology firm. If your research is successful the technology can be sold for $35 million. If your research is unsuccessful it will be worth nothing to fund your research, you need to raise $58 million Investors are willing to provide you with $58 million in initial capital in exchange for 40% of the veled euity in the firm a. What is the total market value of the firm without loverage b Suppose you borrow $0.5 million. According to MM, what fraction of the firm's equity will you need to sell to raise the additional $5.3 million you need? c. What is the value of your share of the firm's equity in cases (a) and (b)? a. What is the total market value of the firm without leverage? The market value without leverage is s million (Round to one decimal place) PE 1 of 36 (0 complete) HW Score: 0%, 0 of 36 pts P 16-1 (similar to) Question Help Consider a project with free cash flows in one year of $134 691 in a weak market or $106.059 in a strong market, with each outcome being equally likely The nitial investment required for the project is $105,000, and the project's unlovered cost of capital is 23%. The risk-free interest rate is 11% (Assume no taxes or distress costs) a. What is the NPV of this project? b. Suppose that to raise the funds for the initial investment, the project is sold to investors as an all equity firm The equity holders will receive the cash flows of the project in one year How much money can be raised in this way that is what is the initial market value of the unlevered equity? c. Suppose the initial $105,000 is instead raised by borrowing at the risk free interest rate What are the cash flows of the lovered equity in a weak market and a strong market at the end of year 1, and what is its initial market value of the levered equity according to MM? Assume that the risk-free rate remains at its current level and hore any arbitrage opportunity a. What is the NPV of this project? The NPV is $ (Round to the nearest dollar) Score: 0 of 1 pt 2 of 36 (0 complete) HW Score: 0%, 0 of 36 pts P 16-2 (similar to) Question Help You are an entrepreneur starting a biotechnology firm. If your research is successful the technology can be sold for $35 million. If your research is unsuccessful it will be worth nothing to fund your research, you need to raise $58 million Investors are willing to provide you with $58 million in initial capital in exchange for 40% of the veled euity in the firm a. What is the total market value of the firm without loverage b Suppose you borrow $0.5 million. According to MM, what fraction of the firm's equity will you need to sell to raise the additional $5.3 million you need? c. What is the value of your share of the firm's equity in cases (a) and (b)? a. What is the total market value of the firm without leverage? The market value without leverage is s million (Round to one decimal place)