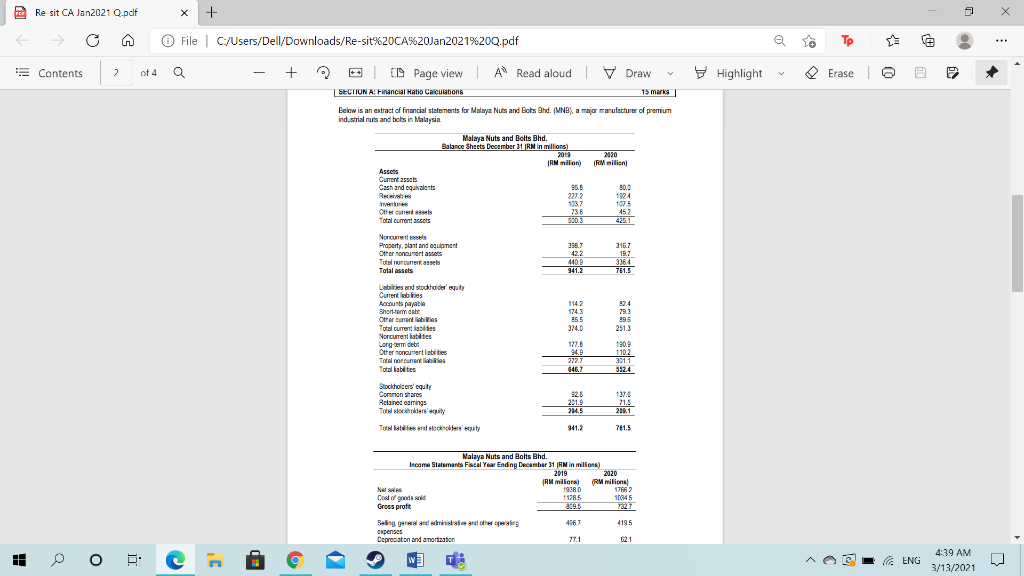

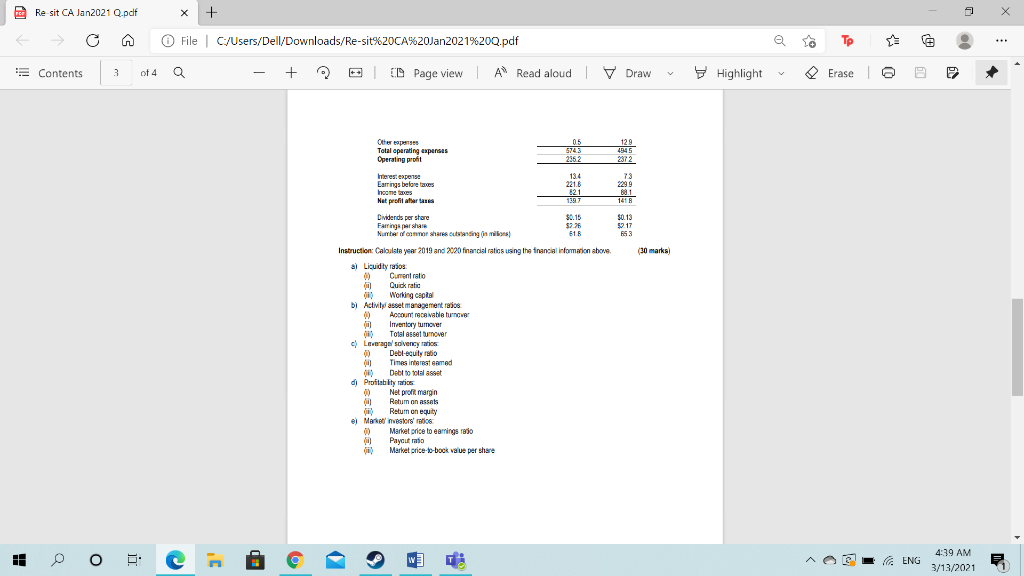

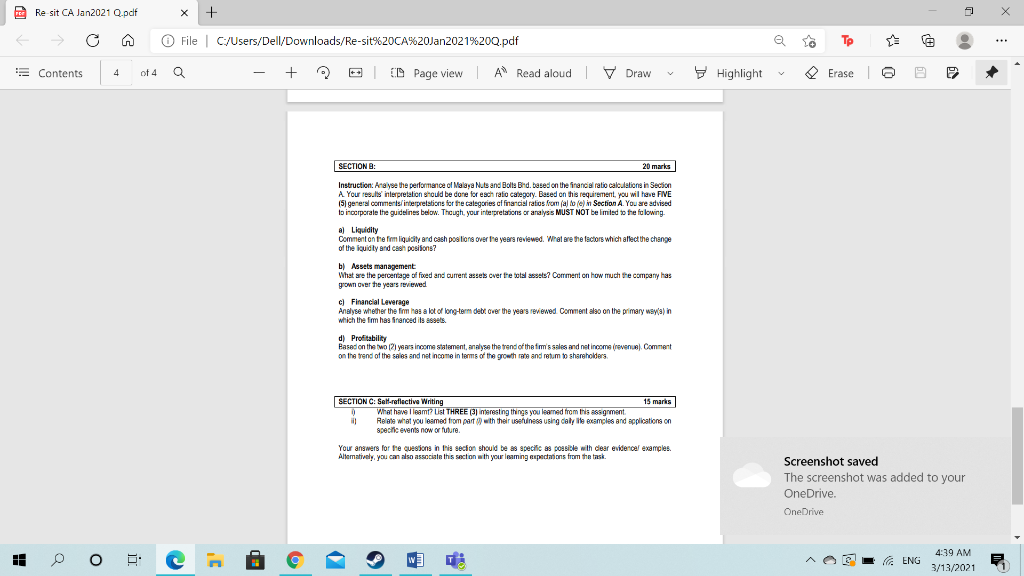

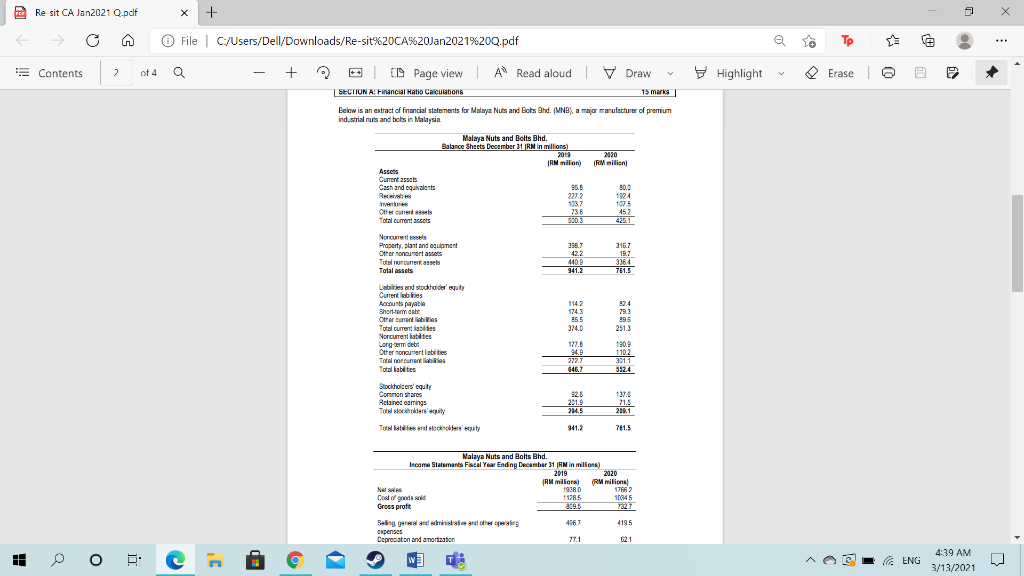

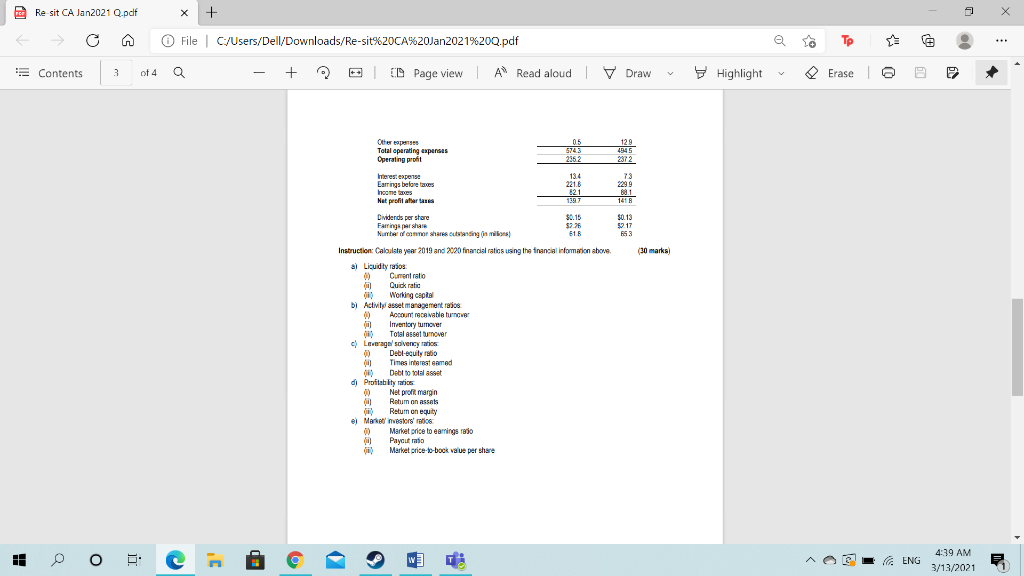

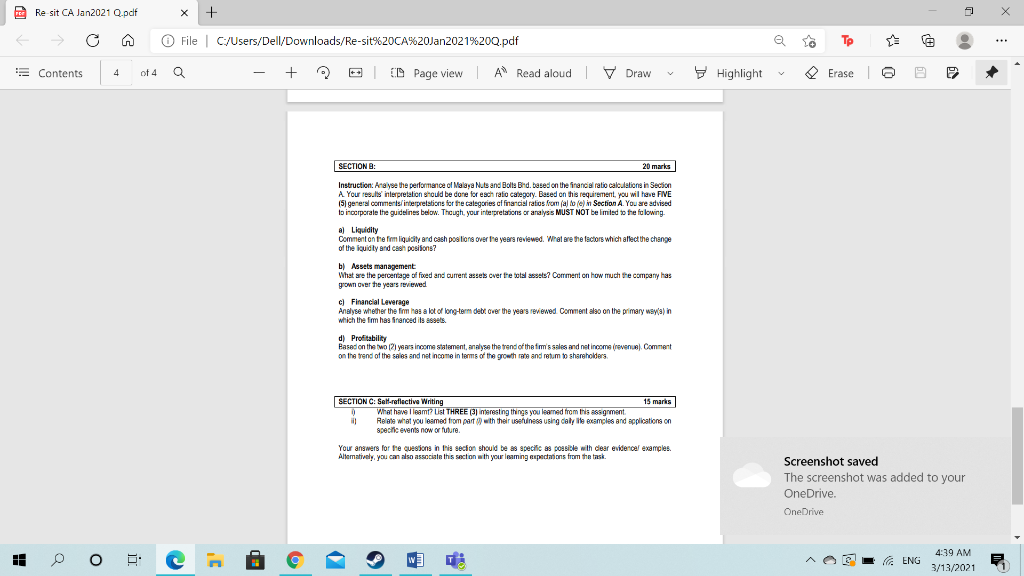

PE Re sit CA Jan2021 Q.pdf + X O File C:/Users/Dell/Downloads/Re-sit%20CA%20Jan2021%200.pdf E Contents 2 of 4 0 + Page view | A Read aloud | Draw Highlight Erase SECTION A: Financial Ratio Calculations 15 marks Below is an extract of financial statements for Malaya Nusand Bots Bhd. (MNB), a major manufacturer of premium industrials and bols in Malaysia Malaya Nuts and Belts Bhd. Balance Sheets December 31 RN in millions) 2013 2030 IRN milioni RM milioni Assets Current assets Cash and equivalents 80.0 1924 1987 1975 Otter Contents 735 452 Total current assets 4351 2272 Noncurrent Prasetya and equipment Other concertas Total Total assets 338.7 42.2 4409 941.2 2157 19.7 3364 761.5 114.2 1743 374.0 Labies and stockholder' equity Currenties As payable Shortare Other current liabi Fries Total currentielles Noncurrent states Long term debi Other monumentisbites Tourer Total abilities Stockholders' equity Common shares Retained earrings Towsockery 324 79.3 29.8 251.3 190.9 1102 3311 5524 1776 646.7 92.6 2212 214.5 137.6 LS 209.1 Totes and set it 941.2 761.5 Malaya Nuts and Bolts Bhd. Income Statements Fiscal Year Ending December 31 RN in millions) 2019 2020 IRM miliona) RM miliona Net 193RD 1762 Colofnod sold 11505 10645 Gross profit 219.5 Seling general and me and other alig 4567 4195 expenses Deprecaton and a normation 77.1 12 IH a C ENG 4:39 AM 3/13/2021 PE Re sit CA Jan2021 Q.pdf + O File C:/Users/Dell/Downloads/Re-sit%20CA%20Jan2021%200.pdf E Contents 3 of 4 0 + ID Page view | A Read aloud IV Draw Highlight Erase Other Total operating expenses Operating profit 05 5743 2952 129 4545 237 2 73 2299 1 1440 1897 $0.19 5917 FS 3 (30 marks Interes: expense 13.4 Earrings before taxes 221.6 home taves 191 361 Net profiter dames Dividends per stare $0.15 Farringparshare $2.76 Nurte donner shares outstanding in mi 618 Instruction: Calculate year 2019 and 2000 financial ratios using the financial information show al Liquidity rados 0) Current ratio Quick ratic Working capital b) Activity asset management raios Account neceivable burger 00 Inventory tumover Total asset turnover Leverage solvency ratios 0) Debl-equity ratio 00 Times interest Gamed 080 Debt to total asset di Profitability ratios 0) Net prof. margin 00 Rohurn on assets Return on equity e) Market investors retos 0) Market price to earnings ratio 00 Payout ratio Market price to book value per share o IH c O : la ENG 4:39 AM 3/13/2021 FE Resit CA Jan2021 Q.pdf + O File C:/Users/Dell/Downloads/Re-sit%20CA%20Jan2021%200.pdf E Contents 4 of 4 a + | Page view | A Read aloud | Draw Highlight Erase SECTION : 20 marks Instruction Analyse the performance of Malaya Nuts and Bolte Bhd. based on the financial ratio calculations in Section A Your results interpretation should be done for each ratio category. Based on this requirement, you will have FIVE (5) general comments/interpretations for the categories of financial ratios from(a) o (e) in Section A. You are advised Io incorporate the guidelines below. Though your interpretations or analysis MUST NOT be limited to the flowing. aj Liquidity Comment on the form liquidity and cash positions over the years reviewed. What are the factors which allect the change of the liquidity and can positions? b) Assets management What are the percentage of foved and current assets over the total assets? Comment on how much the company has grow over the years reviewed c) Financial Loverage Analyse whether the firm has a lot of long-term debl over the years reviewed. Comment also on the primary wayla) in which the firm has financed its assets. Based on the two 12 years income statement, analyse the trend of the firm's sales and net income (revenue). Comment on the trend of the sales and net income in terms of the growthree and retum to shareholders SECTION C: Self-reflective Writing 15 marks What have leamt US THREE (3) resting things you learned from this assignment Relate what you learned from part with their use iness using daily neecamples and applications on specific events now or future. Your answers for the questions in this section should be as specific as possible with clear evidencal examples Alternatively, you can also associate this section with your naming expectations from the task Screenshot saved The screenshot was added to your OneDrive. OneDrive a c . IH ENG 4:39 AM 3/13/2021 PE Re sit CA Jan2021 Q.pdf + X O File C:/Users/Dell/Downloads/Re-sit%20CA%20Jan2021%200.pdf E Contents 2 of 4 0 + Page view | A Read aloud | Draw Highlight Erase SECTION A: Financial Ratio Calculations 15 marks Below is an extract of financial statements for Malaya Nusand Bots Bhd. (MNB), a major manufacturer of premium industrials and bols in Malaysia Malaya Nuts and Belts Bhd. Balance Sheets December 31 RN in millions) 2013 2030 IRN milioni RM milioni Assets Current assets Cash and equivalents 80.0 1924 1987 1975 Otter Contents 735 452 Total current assets 4351 2272 Noncurrent Prasetya and equipment Other concertas Total Total assets 338.7 42.2 4409 941.2 2157 19.7 3364 761.5 114.2 1743 374.0 Labies and stockholder' equity Currenties As payable Shortare Other current liabi Fries Total currentielles Noncurrent states Long term debi Other monumentisbites Tourer Total abilities Stockholders' equity Common shares Retained earrings Towsockery 324 79.3 29.8 251.3 190.9 1102 3311 5524 1776 646.7 92.6 2212 214.5 137.6 LS 209.1 Totes and set it 941.2 761.5 Malaya Nuts and Bolts Bhd. Income Statements Fiscal Year Ending December 31 RN in millions) 2019 2020 IRM miliona) RM miliona Net 193RD 1762 Colofnod sold 11505 10645 Gross profit 219.5 Seling general and me and other alig 4567 4195 expenses Deprecaton and a normation 77.1 12 IH a C ENG 4:39 AM 3/13/2021 PE Re sit CA Jan2021 Q.pdf + O File C:/Users/Dell/Downloads/Re-sit%20CA%20Jan2021%200.pdf E Contents 3 of 4 0 + ID Page view | A Read aloud IV Draw Highlight Erase Other Total operating expenses Operating profit 05 5743 2952 129 4545 237 2 73 2299 1 1440 1897 $0.19 5917 FS 3 (30 marks Interes: expense 13.4 Earrings before taxes 221.6 home taves 191 361 Net profiter dames Dividends per stare $0.15 Farringparshare $2.76 Nurte donner shares outstanding in mi 618 Instruction: Calculate year 2019 and 2000 financial ratios using the financial information show al Liquidity rados 0) Current ratio Quick ratic Working capital b) Activity asset management raios Account neceivable burger 00 Inventory tumover Total asset turnover Leverage solvency ratios 0) Debl-equity ratio 00 Times interest Gamed 080 Debt to total asset di Profitability ratios 0) Net prof. margin 00 Rohurn on assets Return on equity e) Market investors retos 0) Market price to earnings ratio 00 Payout ratio Market price to book value per share o IH c O : la ENG 4:39 AM 3/13/2021 FE Resit CA Jan2021 Q.pdf + O File C:/Users/Dell/Downloads/Re-sit%20CA%20Jan2021%200.pdf E Contents 4 of 4 a + | Page view | A Read aloud | Draw Highlight Erase SECTION : 20 marks Instruction Analyse the performance of Malaya Nuts and Bolte Bhd. based on the financial ratio calculations in Section A Your results interpretation should be done for each ratio category. Based on this requirement, you will have FIVE (5) general comments/interpretations for the categories of financial ratios from(a) o (e) in Section A. You are advised Io incorporate the guidelines below. Though your interpretations or analysis MUST NOT be limited to the flowing. aj Liquidity Comment on the form liquidity and cash positions over the years reviewed. What are the factors which allect the change of the liquidity and can positions? b) Assets management What are the percentage of foved and current assets over the total assets? Comment on how much the company has grow over the years reviewed c) Financial Loverage Analyse whether the firm has a lot of long-term debl over the years reviewed. Comment also on the primary wayla) in which the firm has financed its assets. Based on the two 12 years income statement, analyse the trend of the firm's sales and net income (revenue). Comment on the trend of the sales and net income in terms of the growthree and retum to shareholders SECTION C: Self-reflective Writing 15 marks What have leamt US THREE (3) resting things you learned from this assignment Relate what you learned from part with their use iness using daily neecamples and applications on specific events now or future. Your answers for the questions in this section should be as specific as possible with clear evidencal examples Alternatively, you can also associate this section with your naming expectations from the task Screenshot saved The screenshot was added to your OneDrive. OneDrive a c . IH ENG 4:39 AM 3/13/2021