Answered step by step

Verified Expert Solution

Question

1 Approved Answer

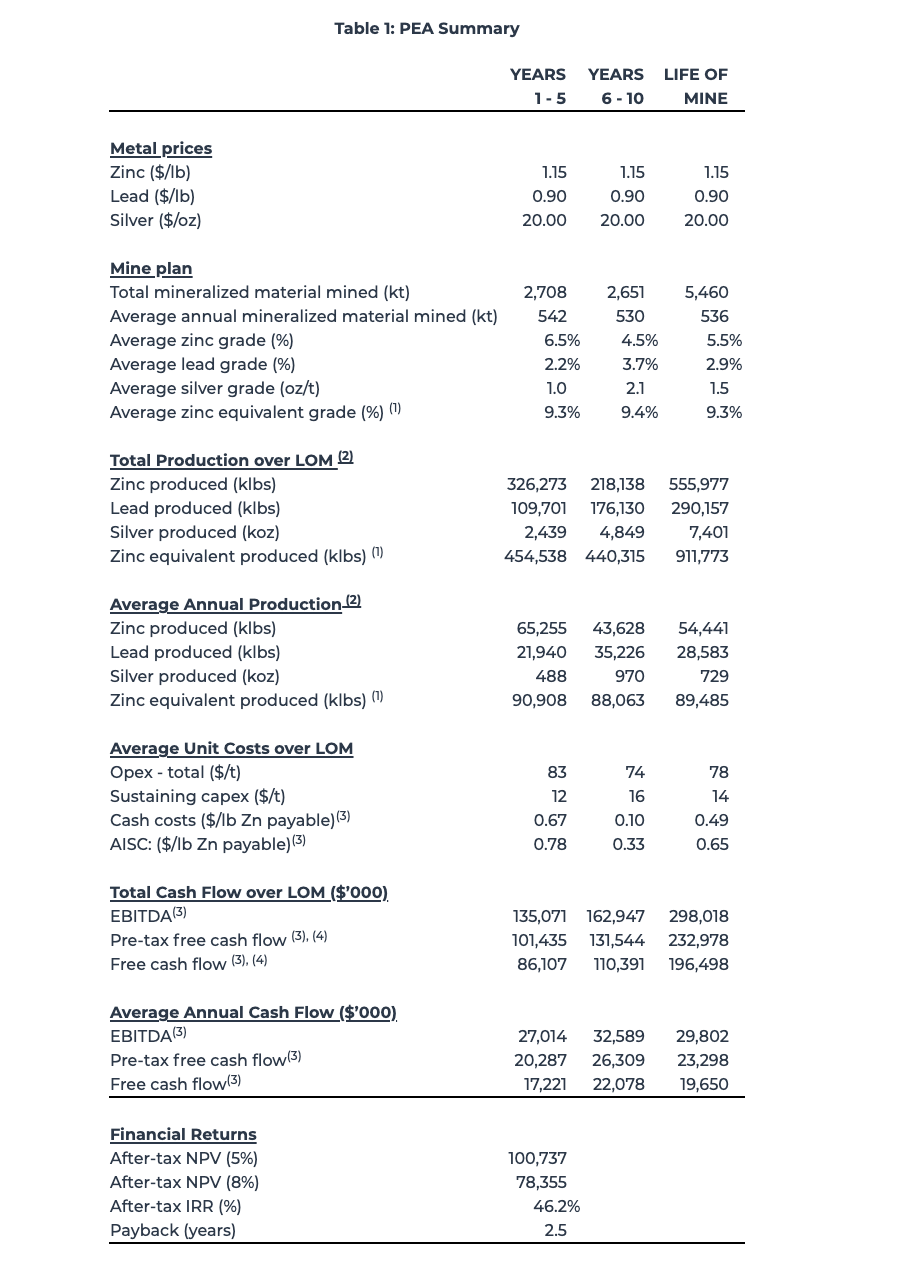

PEA: $101M NPV, 46% IRR, 2.5 Year Payback, $42M Initial Capex, $20M Average Annual FCF Over 10 Years Is this a good investment based on

PEA: $101M NPV, 46% IRR, 2.5 Year Payback, $42M Initial Capex, $20M Average Annual FCF Over 10 Years

Is this a good investment based on the information given? Explain

Table 1: PEA Summary YEARS 1 - 5 YEARS 6 - 10 LIFE OF MINE 1.15 Metal prices Zinc ($/1b) Lead ($/b) Silver ($/oz) 0.90 20.00 1.15 0.90 20.00 1.15 0.90 20.00 Mine plan Total mineralized material mined (kt) Average annual mineralized material mined (kt) Average zinc grade (%) Average lead grade (%) Average silver grade (oz/t) Average zinc equivalent grade (%) (1) 2,708 542 6.5% 2.2% 1.0 9.3% 2,651 530 4.5% 3.7% 2.1 9.4% 5,460 536 5.5% 2.9% 1.5 9.3% Total Production over LOM (2) Zinc produced (klbs) Lead produced (klbs) Silver produced (koz) Zinc equivalent produced (klbs) (1) 326,273 218,138 109,701 176,130 2,439 4,849 454,538 440,315 555,977 290,157 7,401 911,773 Average Annual Production (2) Zinc produced (klbs) Lead produced (klbs) Silver produced (koz) Zinc equivalent produced (klbs) (1) 65,255 21,940 488 90,908 43,628 35,226 970 88,063 54,441 28,583 729 89,485 83 Average Unit Costs over LOM Opex - total ($/t) Sustaining capex ($/t) Cash costs ($/1b Zn payable)(3) AISC: ($/1b Zn payable)(3) 12 0.67 0.78 74 16 0.10 0.33 78 14 0.49 0.65 Total Cash Flow over LOM ($'000). EBITDA(3) Pre-tax free cash flow (3), (4) Free cash flow (3), (4) 135,071 162,947 298,018 101,435 131,544 232,978 86,107 110,391 196,498 Average Annual Cash Flow ($'000). EBITDA(3) Pre-tax free cash flow(3) Free cash flow(3) 27,014 20,287 17,221 32,589 26,309 22,078 29,802 23,298 19,650 Financial Returns After-tax NPV (5%) After-tax NPV (8%) After-tax IRR (%) Payback (years) 100,737 78,355 46.2% 2.5Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started