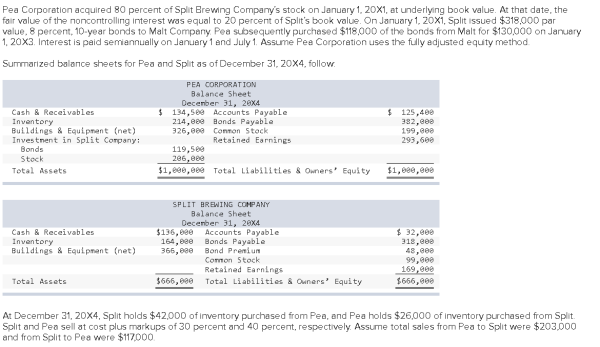

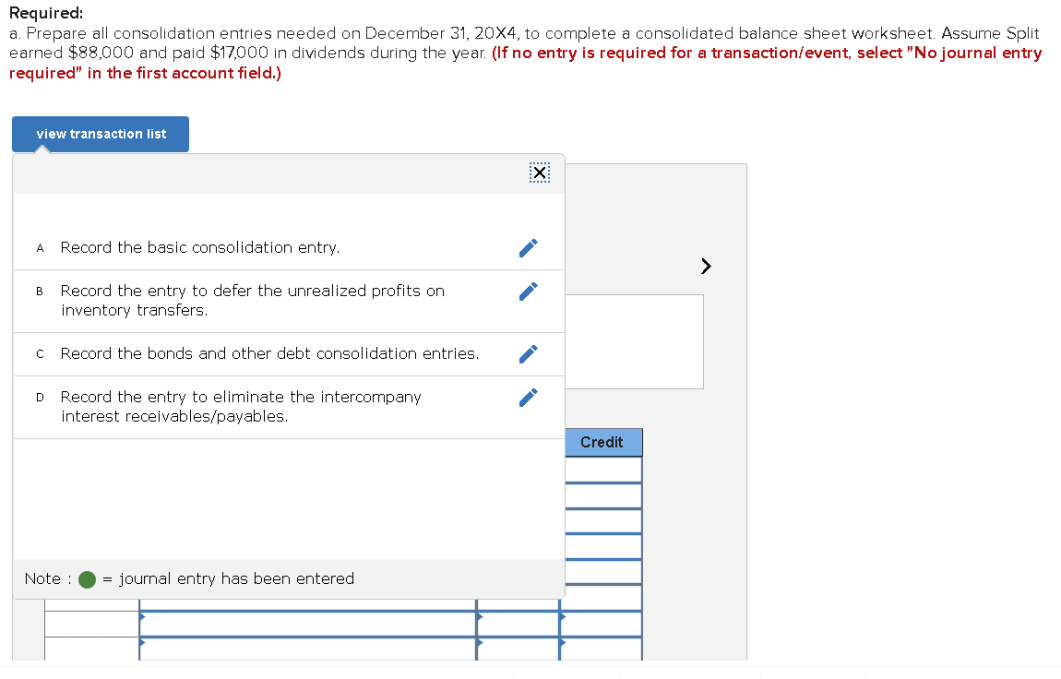

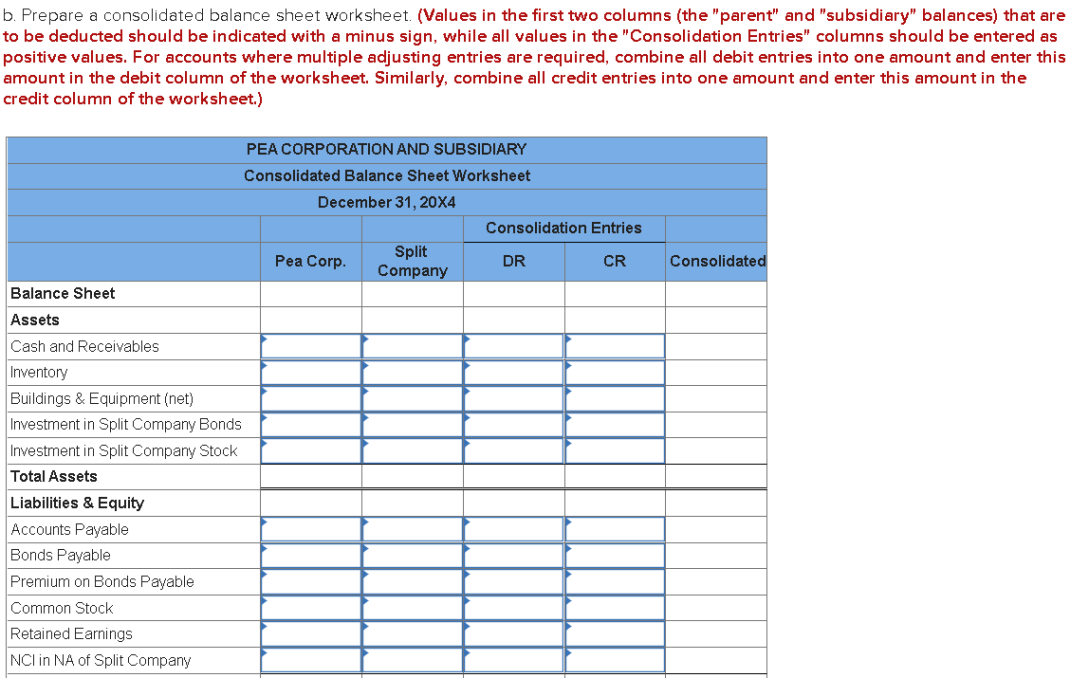

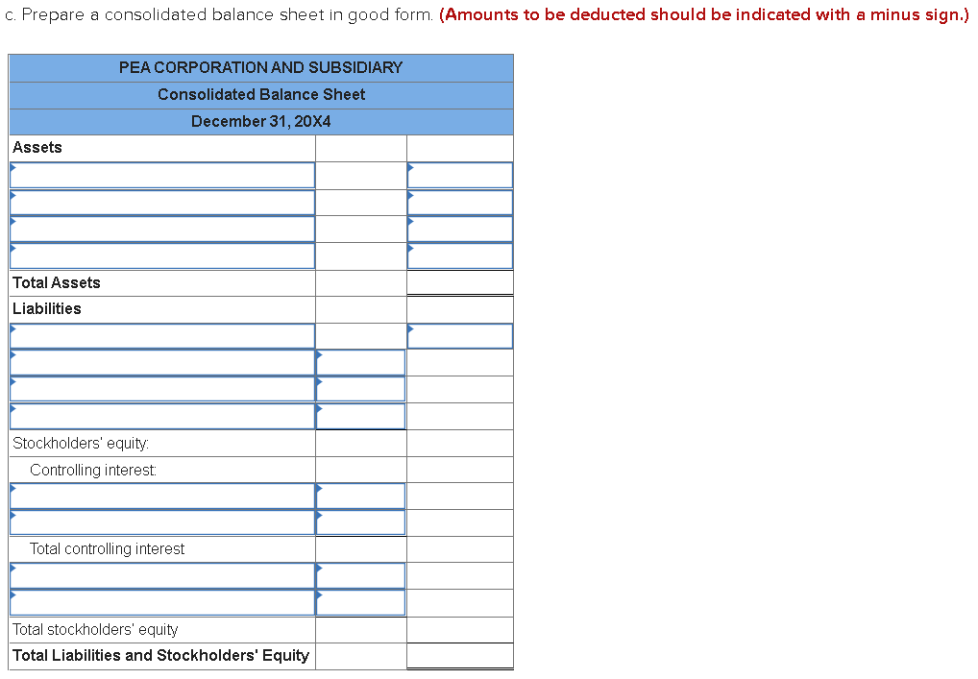

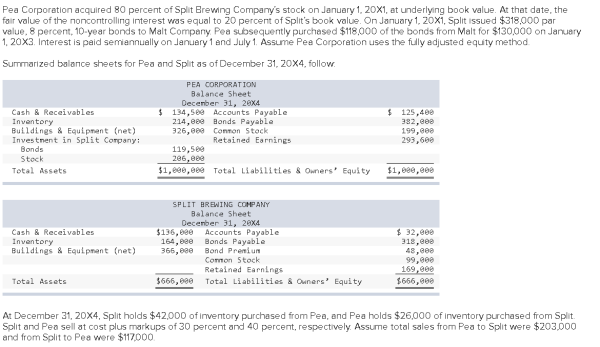

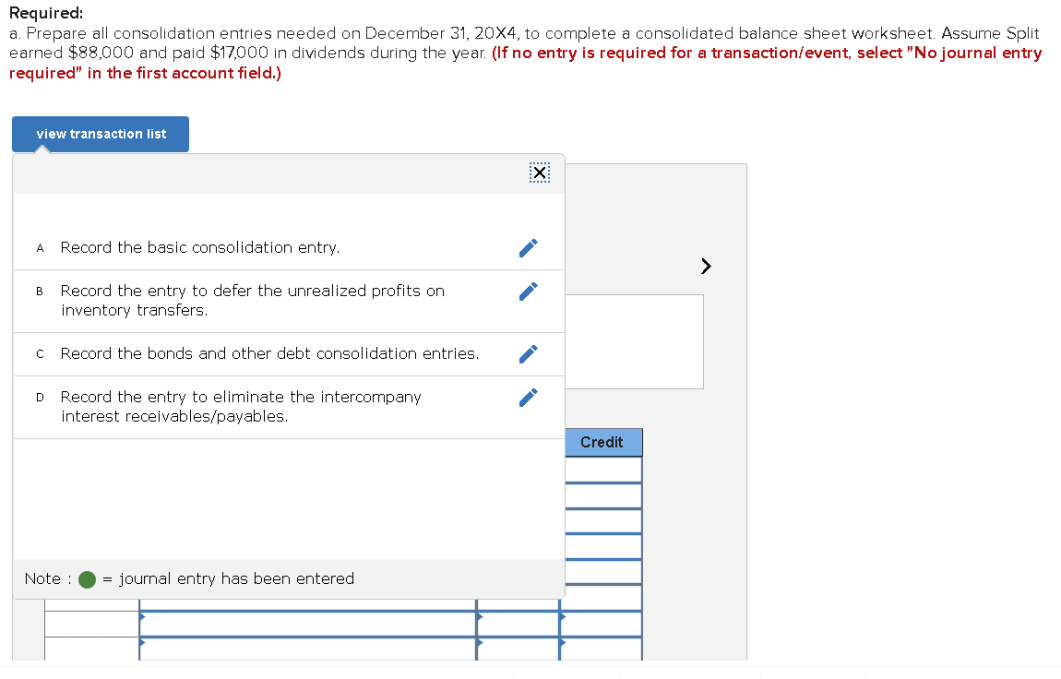

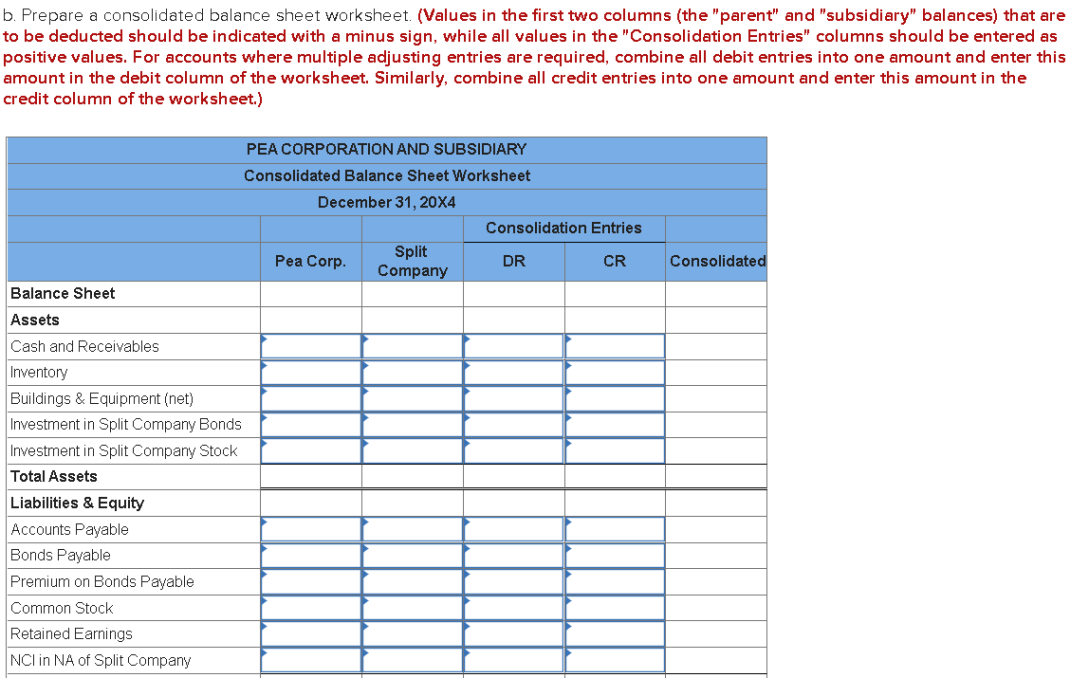

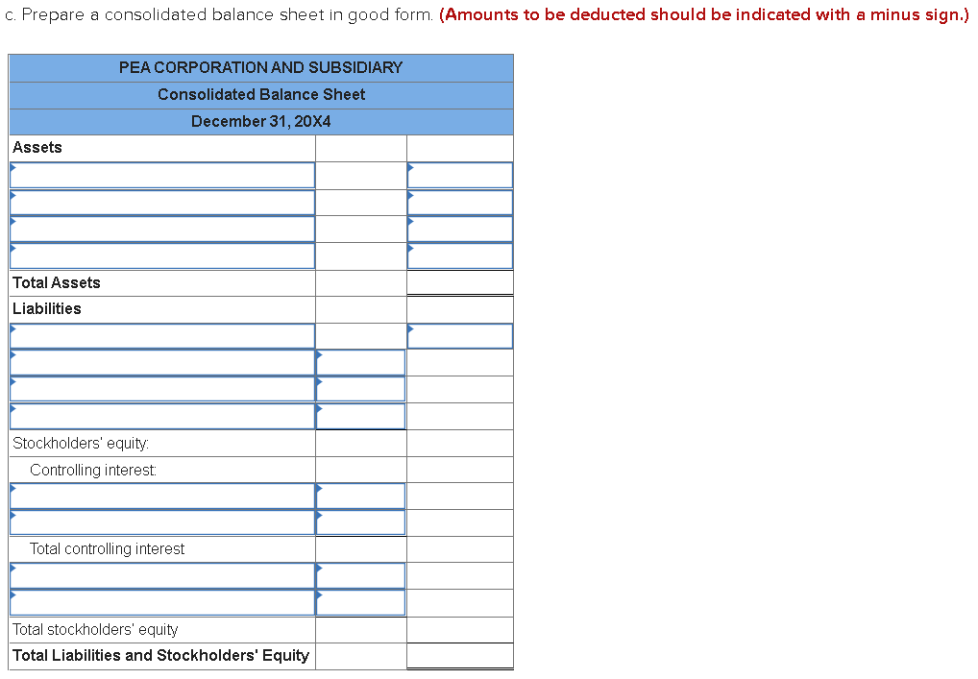

Pea Corporation acquired 80 percent of Split Brewing Company's stock on January 1, 20x1, at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 20 percent of Split's book value. On January 1, 20x1, Split issued $318,000 par value. 8 percent 10-year bonds to Malt Company Pea subsequently purchased $118.000 of the bonds from Malt for $130,000 on January 1. 20X3. Interest is paid semiannually on January 1 and July 1. Assume Pee Corporation uses the fully adjusted equity method Summarized balance sheets for Pea and Split as of December 31, 20X4, follow. PEA CORPORATION Balance Sheet December 31, 26x4 Cash & Receivables $134,580 Accounts Payable $125,400 Inventory 214,828 Bonds Payable 382,00 Buildings & Equipment (net) 326,608 Common Stock 199, see Investment in Split Company: Retained Earnings 293,600 Bonds 119,500 Stock 286,00 Total Assets $1,800,8ee Total Liabilities & Owners' Equity $1,08e,eee Cash & Receivables Inventory Buildings & Equipment (net) SPLIT BREWING COMPANY Balance Sheet December 31, 2ex $136,eee Accounts Payable 164, bee Bonds Payable 365,00 Bond Premium Common Stock Retained Earnings $666,620 Total Liabilities & Ouners' Equity $ 32,90 318,00 48, mee 99,000 169,280 $666,660 Total Assets At December 31, 20X4, Split holds $42,000 of inventory purchased from Pea, and Pea holds $26,000 of inventory purchased from Split Split and Pea sellat cost plus markups of 30 percent and 40 percent, respectively. Assume total sales from Pea to Split were $203.000 and from Split to Pea were $117000 Required: a. Prepare all consolidation entries needed on December 31, 20X4, to complete a consolidated balance sheet worksheet. Assume Split earned $88,000 and paid $17,000 in dividends during the year. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) view transaction list X A Record the basic consolidation entry. > B Record the entry to defer the unrealized profits on inventory transfers. Record the bonds and other debt consolidation entries. D Record the entry to eliminate the intercompany interest receivables/payables. Credit Note: = journal entry has been entered b. Prepare a consolidated balance sheet worksheet. (Values in the first two columns (the "parent" and "subsidiary" balances) that are to be deducted should be indicated with a minus sign, while all values in the "Consolidation Entries" columns should be entered as positive values. For accounts where multiple adjusting entries are required, combine all debit entries into one amount and enter this amount in the debit column of the worksheet. Similarly, combine all credit entries into one amount and enter this amount in the credit column of the worksheet.) PEA CORPORATION AND SUBSIDIARY Consolidated Balance Sheet Worksheet December 31, 20X4 Consolidation Entries Split Pea Corp. DR CR Company Consolidated Balance Sheet Assets Cash and Receivables Inventory Buildings & Equipment (net) Investment in Split Company Bonds Investment in Split Company Stock Total Assets Liabilities & Equity Accounts Payable Bonds Payable Premium on Bonds Payable Common Stock Retained Earnings NClin NA of Split Company c. Prepare a consolidated balance sheet in good form. (Amounts to be deducted should be indicated with a minus sign.) PEA CORPORATION AND SUBSIDIARY Consolidated Balance Sheet December 31, 20X4 Assets Total Assets Liabilities Stockholders' equity Controlling interest Total controlling interest Total stockholders' equity Total Liabilities and Stockholders' Equity