Question

Peace Corporation acquired 100 percent of Soft Inc. in a nontaxable transaction on December 31, 20X1. The following balance sheet information is available immediately following

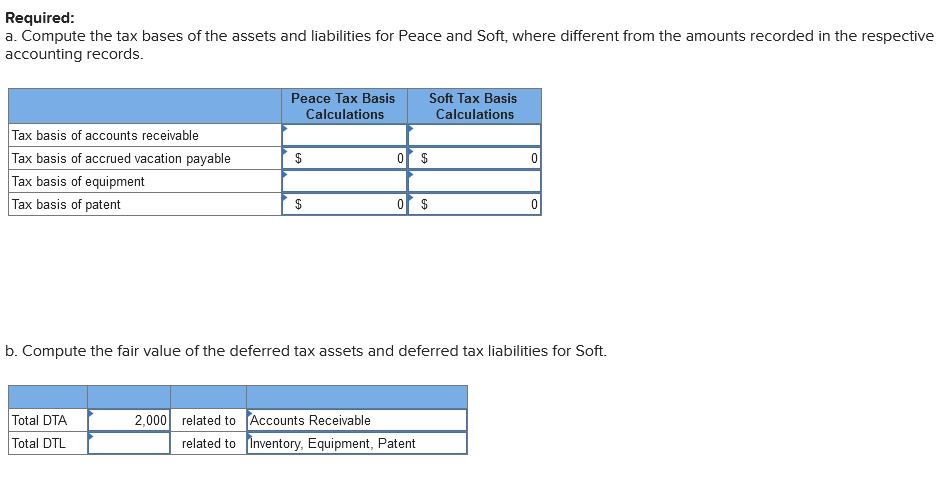

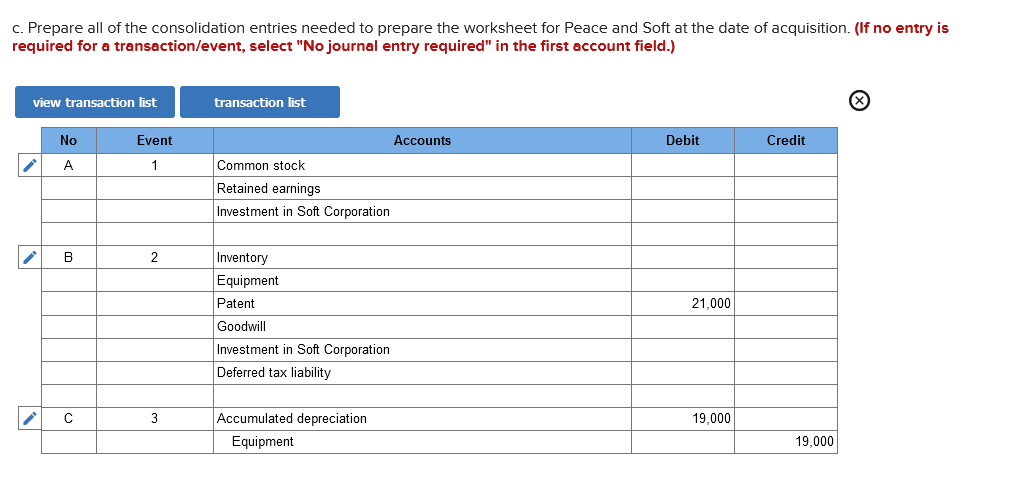

Peace Corporation acquired 100 percent of Soft Inc. in a nontaxable transaction on December 31, 20X1. The following balance sheet information is available immediately following the transaction: Peace Corporation Soft Inc. Book Value Fair Values Book Value Fair Values Cash $ 36,000 $ 36,000 $ 10,000 $ 10,000 Accounts Receivable, net 55,000 55,000 16,000 16,000 Inventory 75,000 82,000 7,000 9,000 Deferred Tax Asset 9,000 2,000 ? Investment in Soft 90,000 90,000 Equipment, net 175,000 210,000 29,000 41,000 Patent 0 21,000 Total Assets $ 440,000 $ 64,000 Accounts Payable $ 56,000 $ 56,000 $ 12,000 $ 12,000 Accrued Vacation Payable 10,000 10,000 Deferred Tax Liability 3,000 3,000 ? Long-Term Debt 95,000 105,000 9,000 9,000 Common Stock 150,000 8,000 Retained Earnings 126,000 32,000 Total Liabilities and Equity $ 440,000 $ 64,000 Additional Information The current and future effective tax rate for both Peace and Soft is 40 percent. The recorded deferred tax asset for Peace relates to the book-tax differences arising from the allowance for doubtful Accounts and the Accrued vacation payable. The expenses associated with each of these amounts will not be deductible for tax purposes until the related accounts receivable are written off or until the employee vacation is actually paid out. The recorded deferred tax asset for Soft is related solely to the book-tax difference arising from the allowance for doubtful accounts. The recorded deferred tax liability in both Peace and Soft relates solely to the book-tax differences arising from the depreciation of their respective equipment. Accumulated depreciation on the financial accounting records of Peace and Soft is $40,000 and $19,000, respectively. The Soft patent was identified by Peace in the due diligence process and has not previously been recorded in the accounting records of Soft. The book and tax bases of all other assets and liabilities of Peace and Soft are the same. Required: a. Compute the tax bases of the assets and liabilities for Peace and Soft, where different from the amounts recorded in the respective accounting records.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started