Answered step by step

Verified Expert Solution

Question

1 Approved Answer

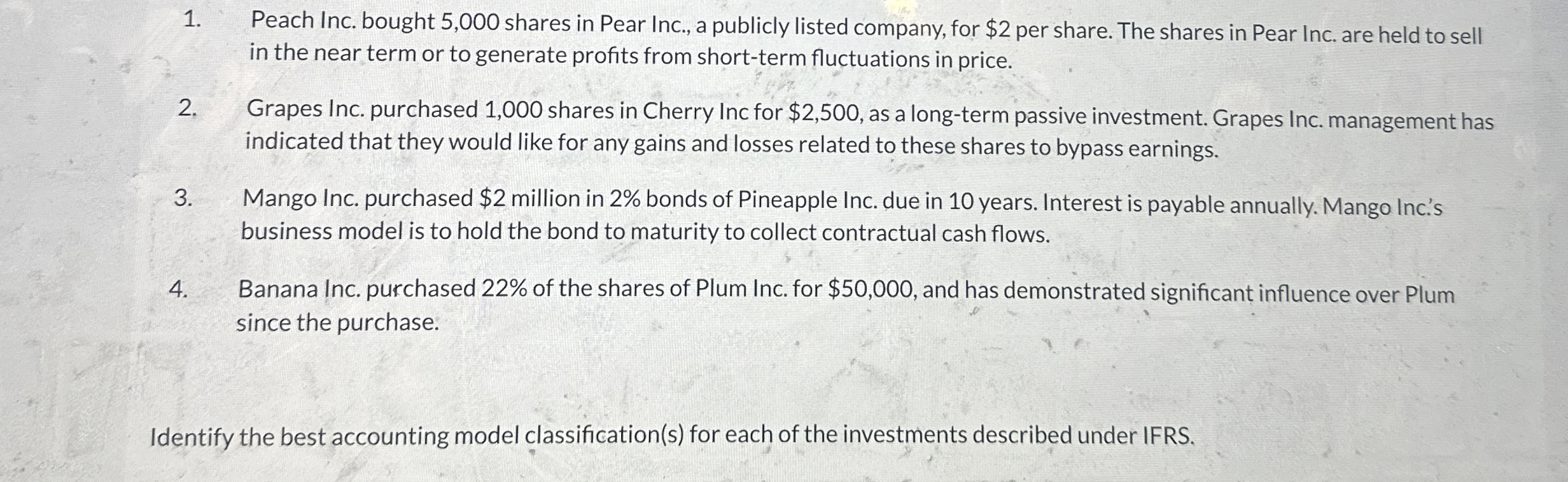

Peach Inc. bought 5 , 0 0 0 shares in Pear Inc., a publicly listed company, for $ 2 per share. The shares in Pear

Peach Inc. bought shares in Pear Inc., a publicly listed company, for $ per share. The shares in Pear Inc. are held to sell

in the near term or to generate profits from shortterm fluctuations in price.

Grapes Inc. purchased shares in Cherry Inc for $ as a longterm passive investment. Grapes Inc. management has

indicated that they would like for any gains and losses related to these shares to bypass earnings.

Mango Inc. purchased $ million in bonds of Pineapple Inc. due in years. Interest is payable annually. Mango Inc.s

business model is to hold the bond to maturity to collect contractual cash flows.

Banana Inc. purchased of the shares of Plum Inc. for $ and has demonstrated significant influence over Plum

since the purchase.

Identify the best accounting model classifications for each of the investments described under IFRS.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started