Answered step by step

Verified Expert Solution

Question

1 Approved Answer

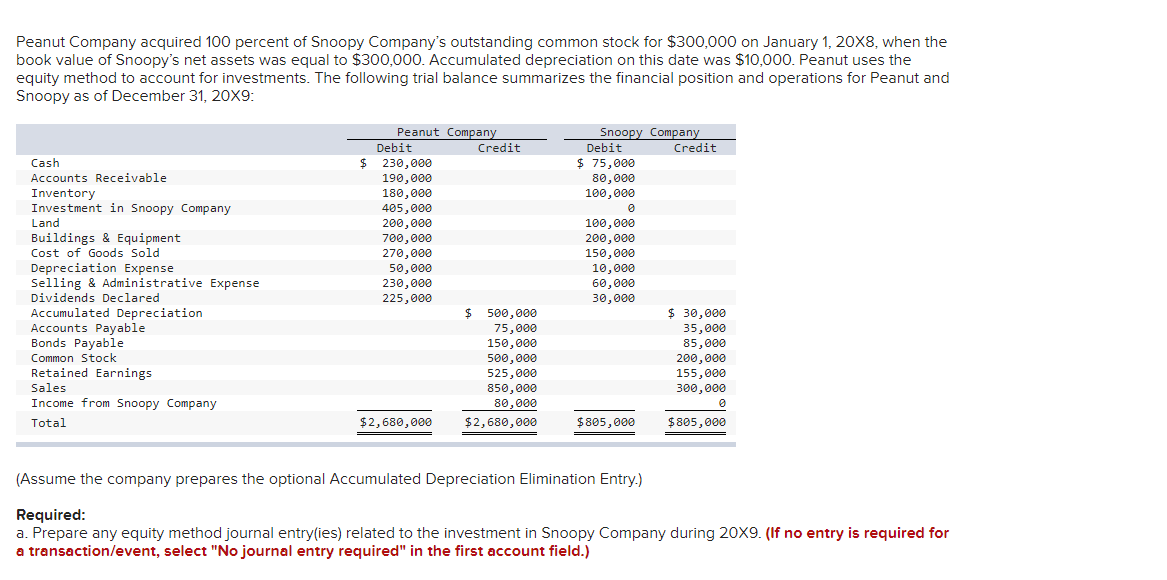

Peanut Company acquired 100 percent of Snoopy Company's outstanding common stock for $300,000 on January 1, 20X8, when the book value of Snoopy's net

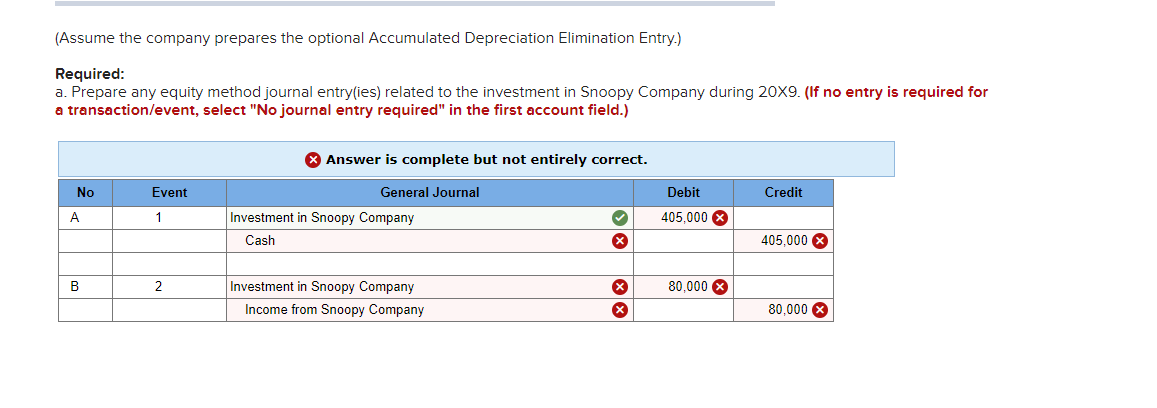

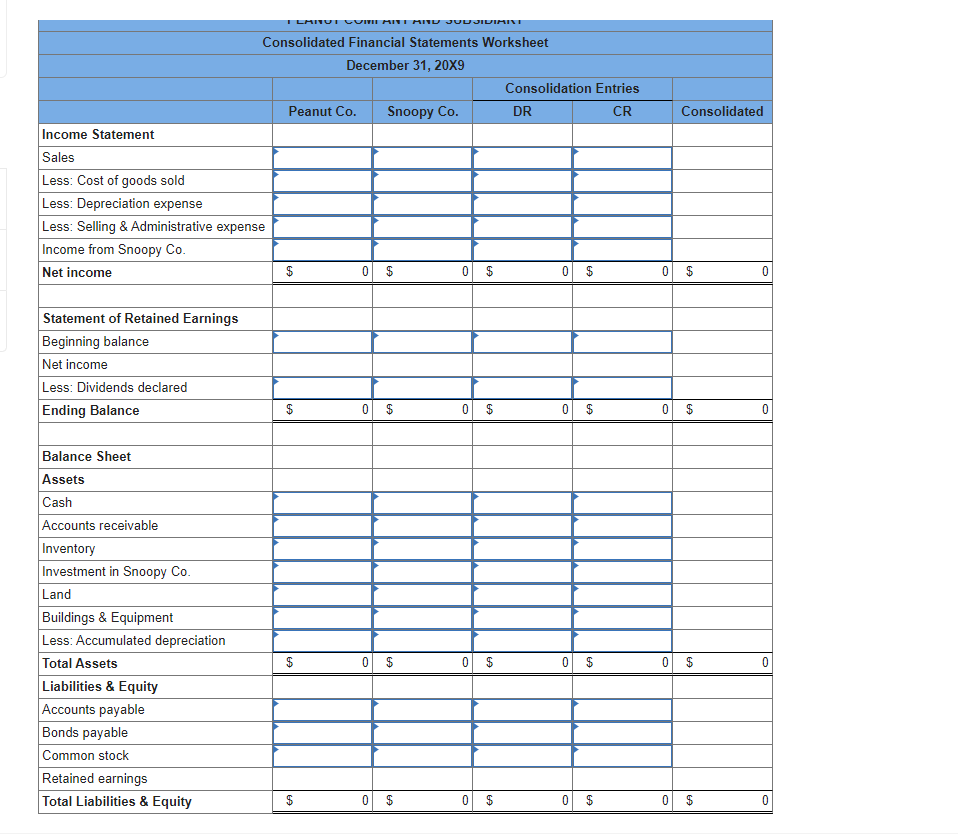

Peanut Company acquired 100 percent of Snoopy Company's outstanding common stock for $300,000 on January 1, 20X8, when the book value of Snoopy's net assets was equal to $300,000. Accumulated depreciation on this date was $10,000. Peanut uses the equity method to account for investments. The following trial balance summarizes the financial position and operations for Peanut and Snoopy as of December 31, 20X9: Debit Snoopy Company Debit $ 75,000 Credit Peanut Company Credit Cash Accounts Receivable Inventory Investment in Snoopy Company Land Buildings & Equipment $ 230,000 190,000 180,000 405,000 200,000 700,000 Cost of Goods Sold 270,000 80,000 100,000 0 100,000 200,000 150,000 Depreciation Expense 50,000 10,000 Selling & Administrative Expense 230,000 60,000 Dividends Declared 225,000 30,000 Accumulated Depreciation $ 500,000 $ 30,000 Accounts Payable 75,000 35,000 Bonds Payable 150,000 85,000 Common Stock 500,000 200,000 Retained Earnings 525,000 155,000 Sales 850,000 300,000 Income from Snoopy Company 80,000 0 Total $2,680,000 $2,680,000 $805,000 $805,000 (Assume the company prepares the optional Accumulated Depreciation Elimination Entry.) Required: a. Prepare any equity method journal entry(ies) related to the investment in Snoopy Company during 20X9. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) (Assume the company prepares the optional Accumulated Depreciation Elimination Entry.) Required: a. Prepare any equity method journal entry(ies) related to the investment in Snoopy Company during 20X9. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) No A Answer is complete but not entirely correct. Event General Journal 1 Investment in Snoopy Company Cash B 2 Investment in Snoopy Company Income from Snoopy Company Debit Credit 405,000 405,000 80,000 80,000 Income Statement Sales Less: Cost of goods sold Less: Depreciation expense Less: Selling & Administrative expense Income from Snoopy Co. Net income Statement of Retained Earnings Beginning balance Net income Less: Dividends declared Ending Balance Balance Sheet Assets Cash Accounts receivable Inventory Investment in Snoopy Co. Land Buildings & Equipment Less: Accumulated depreciation Total Assets Liabilities & Equity TLANOT COME MITT AND JUDIDIMINT Consolidated Financial Statements Worksheet December 31, 20X9 Consolidation Entries Peanut Co. Snoopy Co. DR CR Consolidated $ 0 $ 0 $ 0 $ 0 $ 0 $ 0 $ 0 $ 0 $ 0 $ 0 $ 0 $ 0 $ 0 $ 0 $ 0 Accounts payable Bonds payable Common stock Retained earnings Total Liabilities & Equity $ 0 $ 69 0 $ 0 $ 0 $ 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started