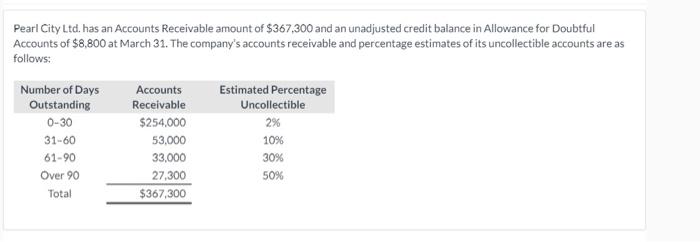

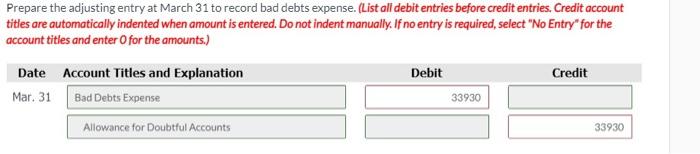

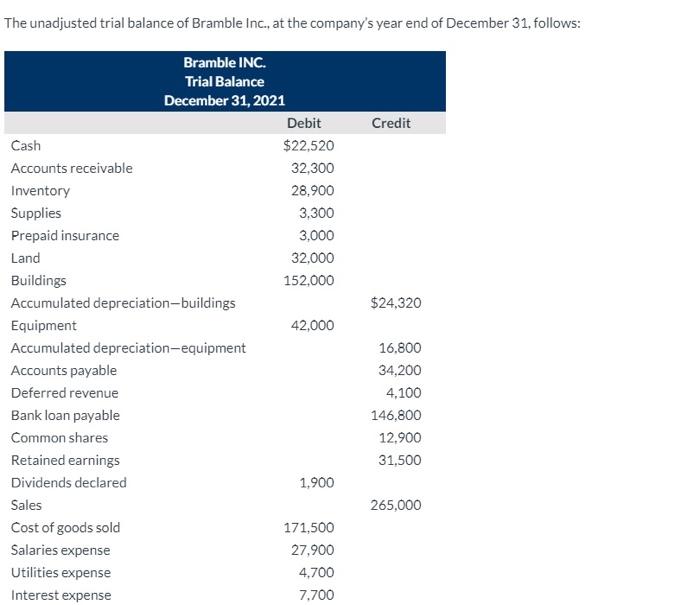

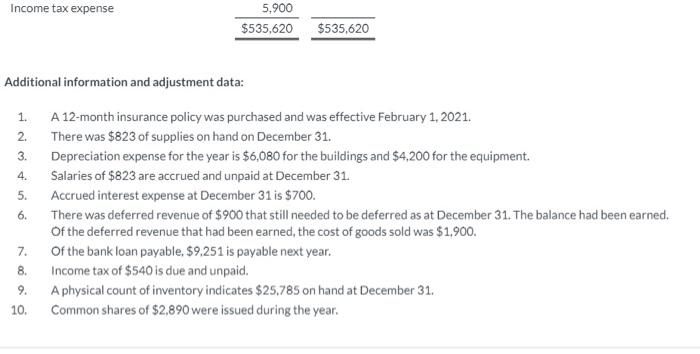

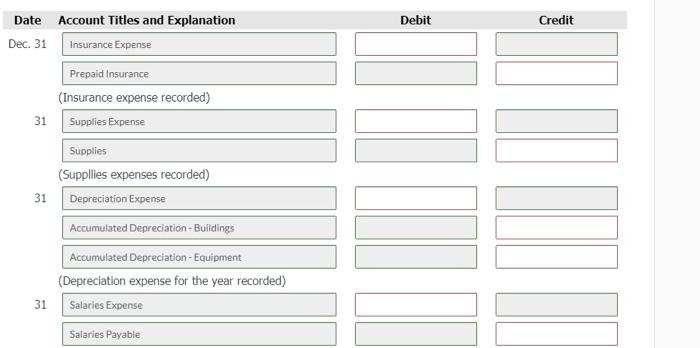

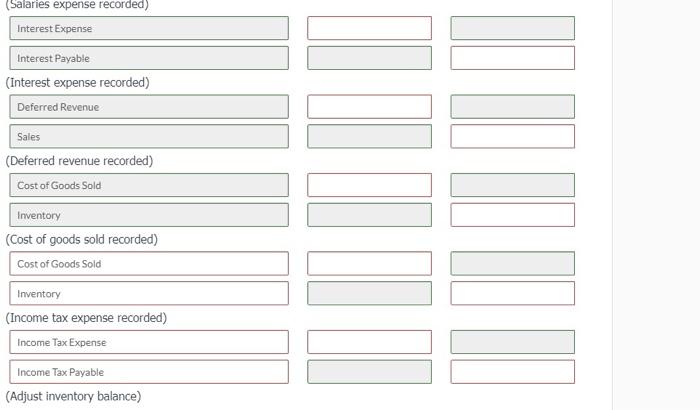

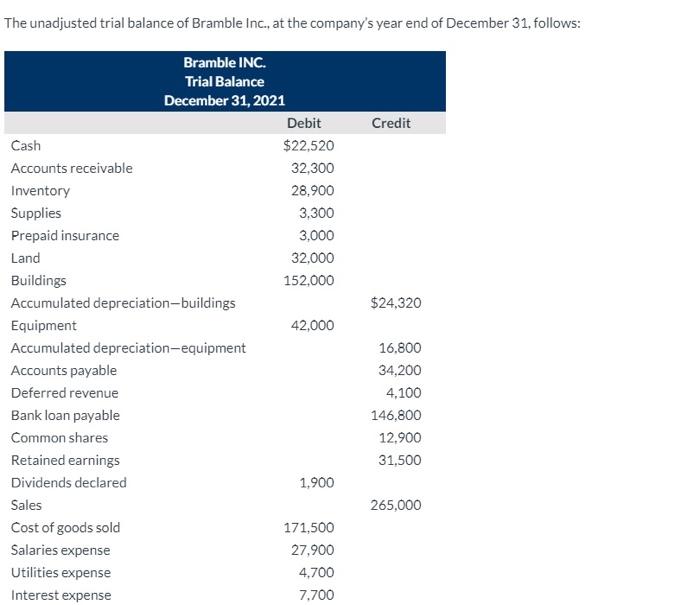

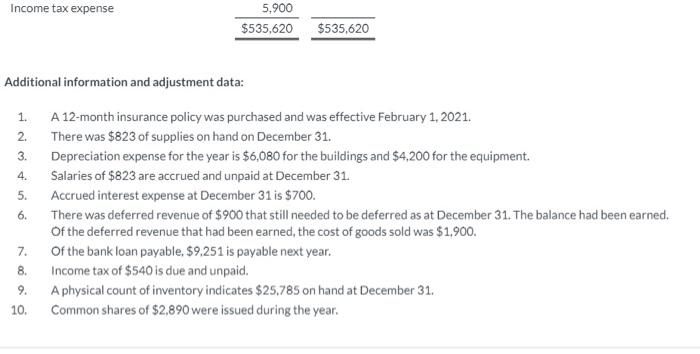

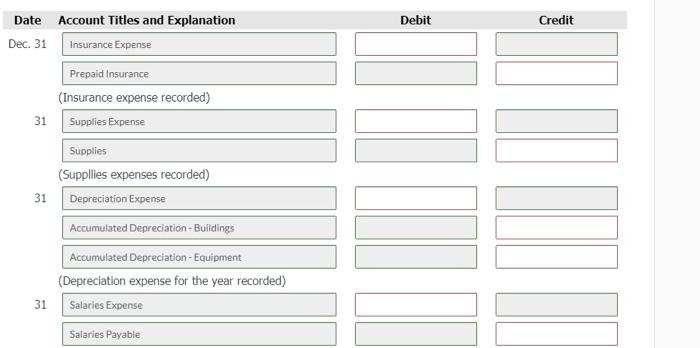

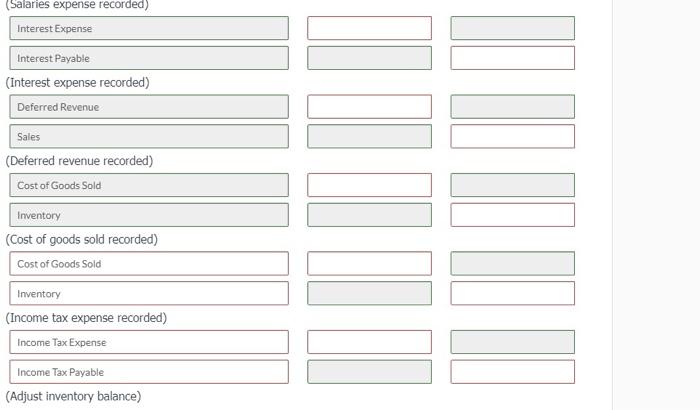

Pearl City Ltd. has an Accounts Receivable amount of $367,300 and an unadjusted credit balance in Allowance for Doubtful Accounts of $8,800 at March 31. The company's accounts receivable and percentage estimates of its uncollectible accounts are as follows: Estimated Percentage Uncollectible 2% Number of Days Outstanding 0-30 31-60 61-90 Over 90 Total Accounts Receivable $254.000 53,000 33,000 27,300 $367,300 10% 30% 50% Prepare the adjusting entry at March 31 to record bad debts expense. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts.) Debit Credit Date Account Titles and Explanation Mar. 31 Bad Debts Expense 33930 Allowance for Doubtful Accounts 33930 The unadjusted trial balance of Bramble Inc., at the company's year end of December 31, follows: Credit 3,300 3,000 $24,320 Bramble INC. Trial Balance December 31, 2021 Debit Cash $22,520 Accounts receivable 32,300 Inventory 28,900 Supplies Prepaid insurance Land 32,000 Buildings 152,000 Accumulated depreciation-buildings Equipment 42,000 Accumulated depreciation equipment Accounts payable Deferred revenue Bank loan payable Common shares Retained earnings Dividends declared 1,900 Sales Cost of goods sold 171,500 Salaries expense 27,900 Utilities expense 4.700 Interest expense 7.700 16.800 34,200 4.100 146,800 12.900 31,500 265,000 Income tax expense 5.900 $535,620 $535,620 Additional information and adjustment data: 1. 2. 3. 4. 5. 6. A 12-month insurance policy was purchased and was effective February 1, 2021. There was $823 of supplies on hand on December 31. Depreciation expense for the year is $6,080 for the buildings and $4,200 for the equipment. Salaries of $823 are accrued and unpaid at December 31. Accrued interest expense at December 31 is $700. There was deferred revenue of $900 that still needed to be deferred as at December 31. The balance had been earned. Of the deferred revenue that had been earned, the cost of goods sold was $1,900. Of the bank loan payable $9.251 is payable next year. Income tax of $540 is due and unpaid. A physical count of inventory indicates $25,785 on hand at December 31. Common shares of $2.890 were issued during the year. 7. 8. 9. 10. Debit Credit Date Account Titles and Explanation Dec. 31 Insurance Expense Prepaid Insurance (Insurance expense recorded) Supplies Expense 31 31 Supplies (Suppllies expenses recorded) Depreciation Expense Accumulated Depreciation - Buildings Accumulated Depreciation - Equipment (Depreciation expense for the year recorded) Salaries Expense Salaries Payable 31 (Salaries expense recorded) Interest Expense Interest Payable (Interest expense recorded) Deferred Revenue Sales (Deferred revenue recorded) Cost of Goods Sold Inventory (Cost of goods sold recorded) Cost of Goods Sold Inventory (Income tax expense recorded) Income Tax Expense TUNNET Income Tax Payable (Adjust inventory balance)