Answered step by step

Verified Expert Solution

Question

1 Approved Answer

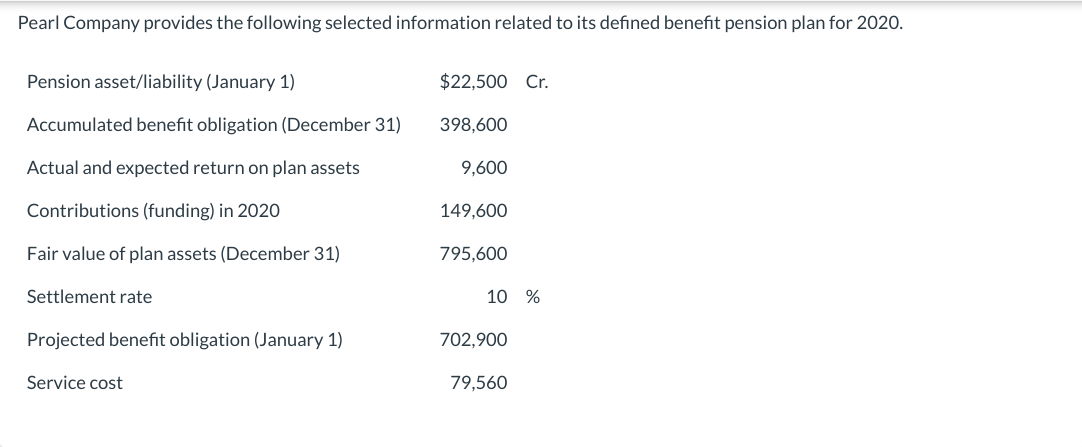

Pearl Company provides the following selected information related to its defined benefit pension plan for 2020. Pension asset/liability (January 1) $22,500 Cr. Accumulated benefit obligation

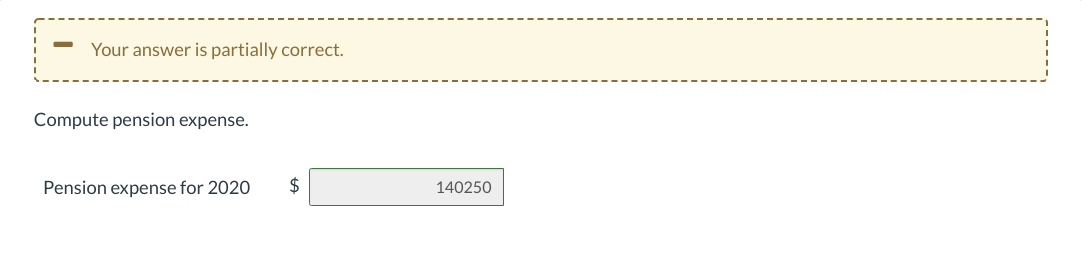

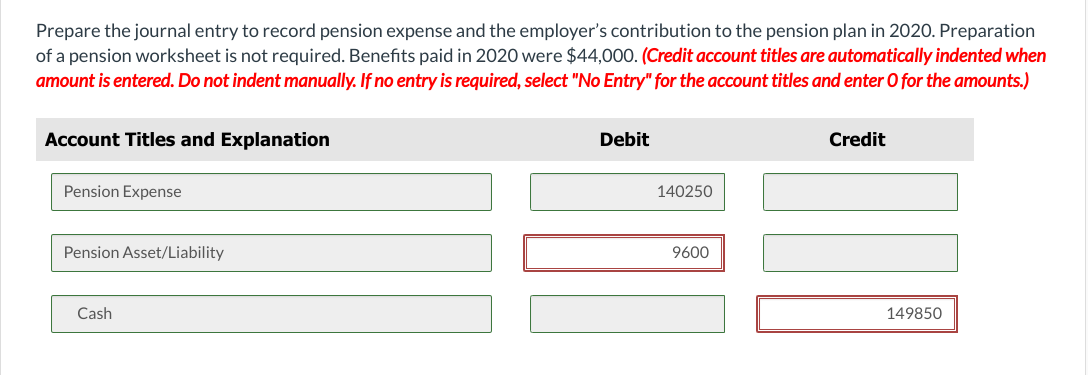

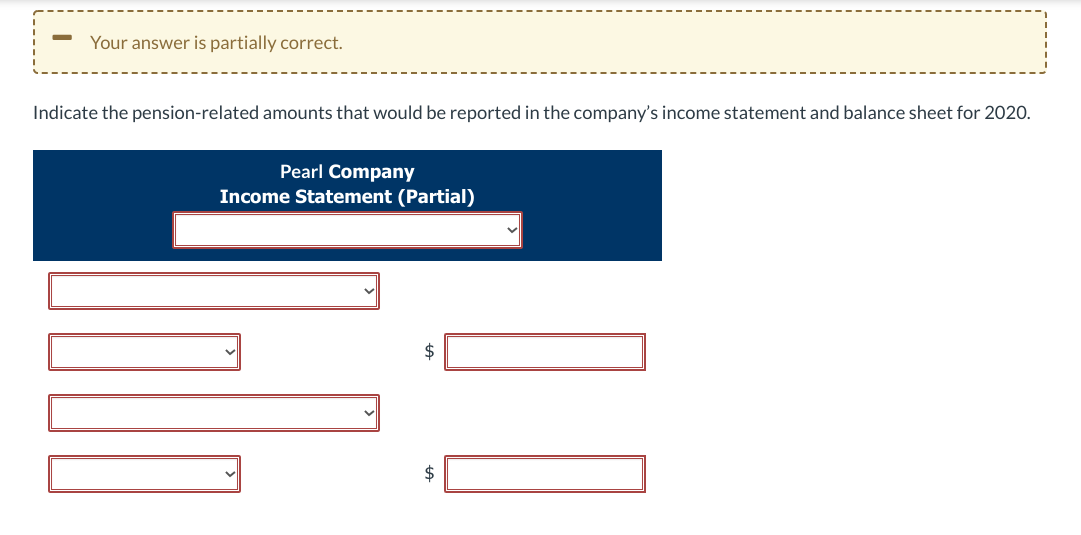

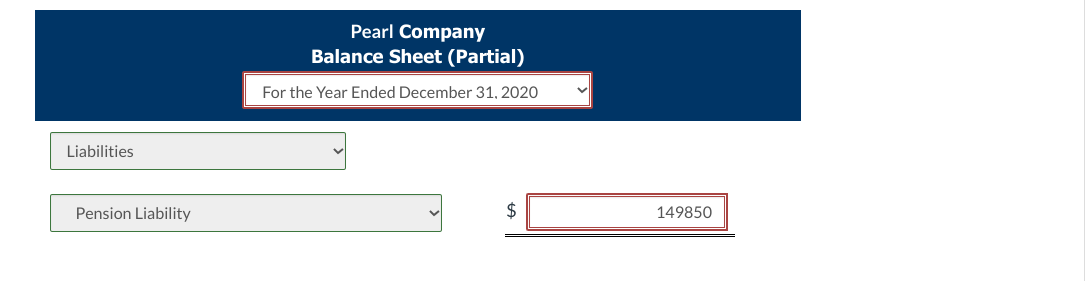

Pearl Company provides the following selected information related to its defined benefit pension plan for 2020. Pension asset/liability (January 1) $22,500 Cr. Accumulated benefit obligation (December 31) 398,600 Actual and expected return on plan assets 9,600 Contributions (funding) in 2020 149,600 Fair value of plan assets (December 31) 795,600 Settlement rate 10 % Projected benefit obligation (January 1) 702,900 Service cost 79,560 - Your answer is partially correct. Compute pension expense. Pension expense for 2020 $ 140250 Prepare the journal entry to record pension expense and the employer's contribution to the pension plan in 2020. Preparation of a pension worksheet is not required. Benefits paid in 2020 were $44,000. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Credit Pension Expense 140250 Pension Asset/Liability 9600 Cash 149850 Your answer is partially correct. Indicate the pension-related amounts that would be reported in the company's income statement and balance sheet for 2020. Pearl Company Income Statement (Partial) $ $ Pearl Company Balance Sheet (Partial) For the Year Ended December 31, 2020 Liabilities Pension Liability $ 149850

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started