Answered step by step

Verified Expert Solution

Question

1 Approved Answer

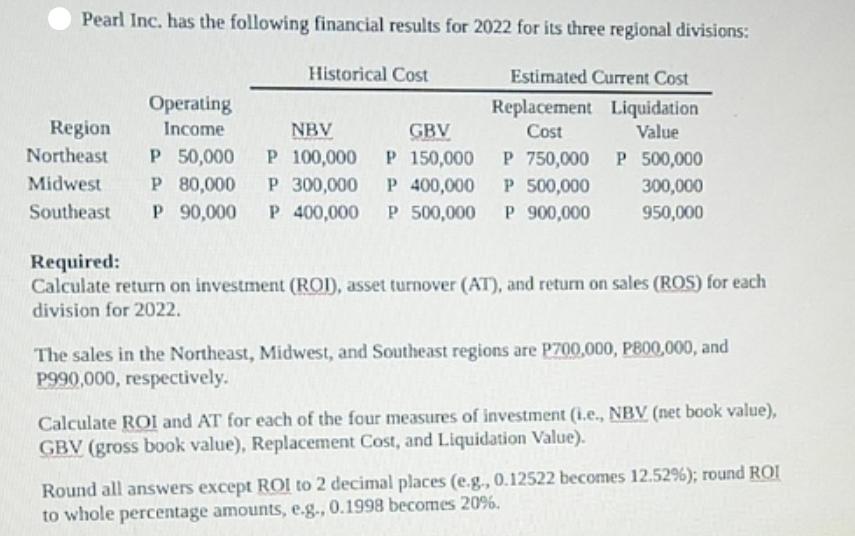

Pearl Inc. has the following financial results for 2022 for its three regional divisions: Historical Cost Estimated Current Cost Replacement Liquidation Cost Value Operating

Pearl Inc. has the following financial results for 2022 for its three regional divisions: Historical Cost Estimated Current Cost Replacement Liquidation Cost Value Operating Income Region NBV GBV Northeast P 50,000 P 100,000 P 150,000 Midwest P 80,000 P 300,000 P 400,000 Southeast P 90,000 P 400,000 P 500,000 P 900,000 P 750,000 P 500,000 P 500,000 300,000 950,000 Required: Calculate return on investment (ROI), asset turnover (AT), and return on sales (ROS) for each division for 2022. The sales in the Northeast, Midwest, and Southeast regions are P700,000, P800,000, and P990,000, respectively. Calculate ROI and AT for each of the four measures of investment (i.e., NBV (net book value), GBV (gross book value), Replacement Cost, and Liquidation Value). Round all answers except ROI to 2 decimal places (e.g., 0.12522 becomes 12.52 % ) ; round ROI to whole percentage amounts, e.g., 0.1998 becomes 20%.

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the return on investment ROI asset turnover AT and return on sales ROS for each division as well as for each measure of investment well u...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started