Answered step by step

Verified Expert Solution

Question

1 Approved Answer

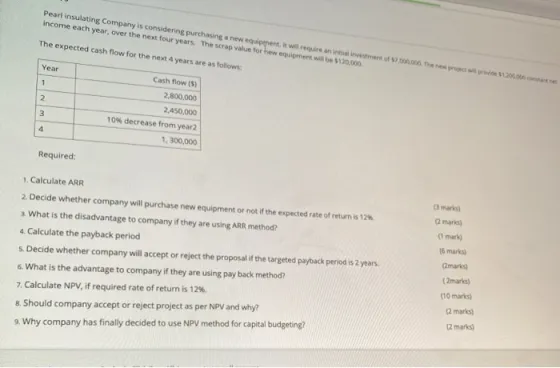

Pearl insulating Company is considering purchasing a new equipment, it will require an innven of bond the income each year, over the next four

Pearl insulating Company is considering purchasing a new equipment, it will require an innven of bond the income each year, over the next four years. The scrap value for hew equipment will be $120.000 The expected cash flow for the next 4 years are as follows: Year 1 2 3 Required: Cash flow (5) 2,800.000 2,450,000 10% decrease from year2 1,300,000 1. Calculate ARR 2. Decide whether company will purchase new equipment or not if the expected rate of return is 12% What is the disadvantage to company if they are using ARR method? 4. Calculate the payback period s. Decide whether company will accept or reject the proposal if the targeted payback period is 2 years 6. What is the advantage to company if they are using pay back method? 7. Calculate NPV, if required rate of return is 12% 8. Should company accept or reject project as per NPV and why? 9. Why company has finally decided to use NPV method for capital budgeting? (mark) 16 marks) mark (2marks) (10 mark) (2 marks) (2 marks)

Step by Step Solution

★★★★★

3.50 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Sure I can help you with these calculations and decisions 1 Calculate ARR Accounting Rate of Return ARR Average Annual Profit Average Investment Average Annual Profit Cash flow for Year 1 Cash flow fo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started