Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ABC Corporation, a U.S. company, sold equipment to a French company for Euro 100 million. Payment is due in 90 days. Answer the following

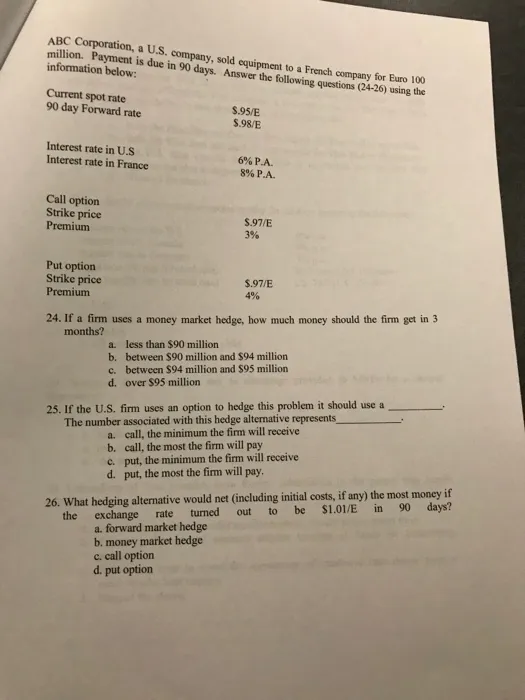

ABC Corporation, a U.S. company, sold equipment to a French company for Euro 100 million. Payment is due in 90 days. Answer the following questions (24-26) using the information below: Current spot rate 90 day Forward rate Interest rate in U.S Interest rate in France Call option Strike price Premium Put option Strike price Premium $.95/E $.98/E 6% P.A. 8% P.A. $.97/E 3% $.97/E 4% 24. If a firm uses a money market hedge, how much money should the firm get in 3 months? a. less than $90 million b. between $90 million and $94 million c. between $94 million and $95 million d. over $95 million 25. If the U.S. firm uses an option to hedge this problem it should use a The number associated with this hedge alternative represents a. call, the minimum the firm will receive b. call, the most the firm will pay c. put, the minimum the firm will receive d. put, the most the firm will pay. 26. What hedging alternative would net (including initial costs, if any) the most money if 90 days? the rate out be to $1.01/E in turned exchange a. forward market hedge b. money market hedge c. call option d. put option

Step by Step Solution

There are 3 Steps involved in it

Step: 1

24 To determine the amount of money the firm should get in 3 months using a money market hedge we ne...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started