Question

Pearl Yacht is considering a new project that requires $1,800,000 initial cash outlay and is expected to produce cash flows of $480,000 per year for

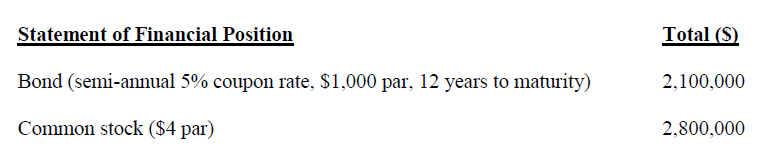

Pearl Yacht is considering a new project that requires $1,800,000 initial cash outlay and is expected to produce cash flows of $480,000 per year for the next five years. Sam, the finance manager, hired you as an associate to review the capital structure of the company, estimate its cost of capital and the net present value for the project. An extract of the capital structure on the statement of financial position of Pearl Yacht for the year ended 31 December 2020 is shown as below:

The current market price are $880 for bonds and $5.25 for common stocks. Pearl Yacht just paid the dividend of $0.18 per share to common stock shareholders and the market expects that future dividends are projected to have an annual growth rate of 5% indefinitely. The firm is in the 38% tax bracket.

Required: (a) Calculate Pearl Yachts weighted average cost of capital (WACC). (b) Pearl Yacht estimates that the flotation costs associated with the equity finance would be 3% of all new equity capital raised and which should be deducted from initial cash outlay. Using the WACC computed in above part (a) as the appropriate discount rate under current capital structure, estimate the net present value (NPV) of the new project

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started