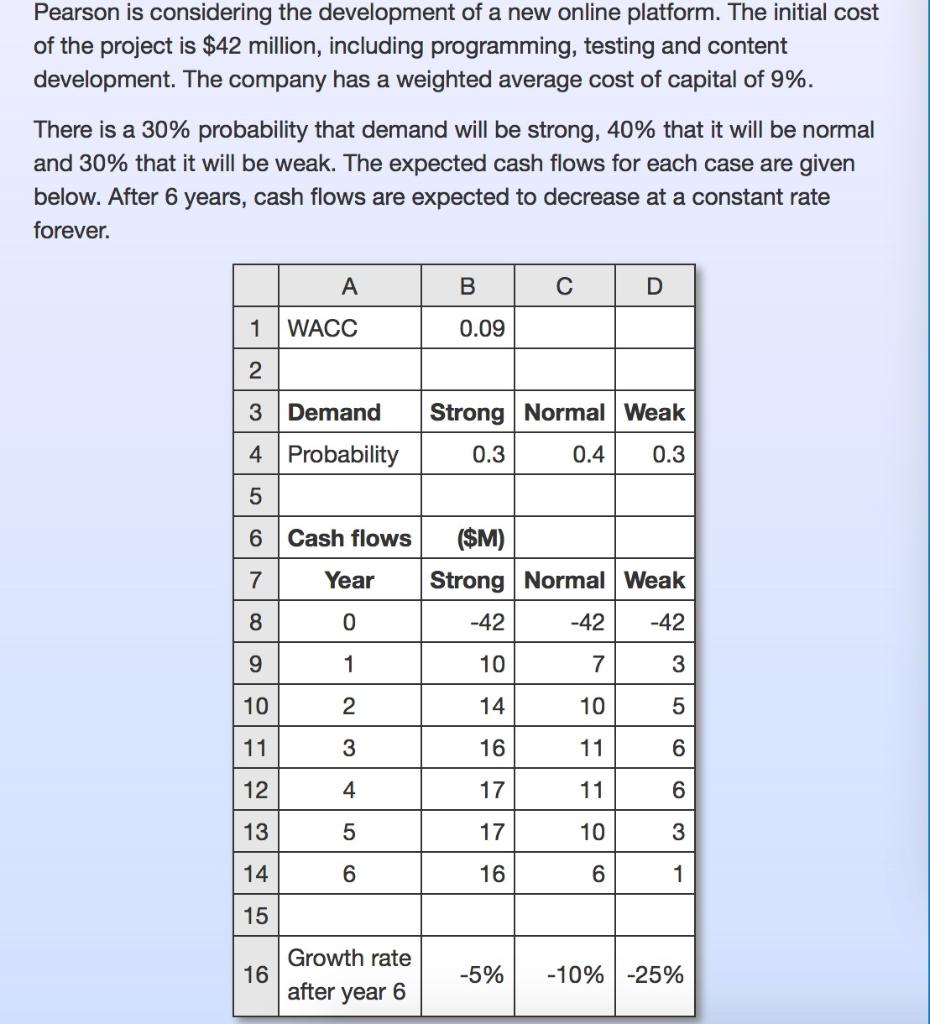

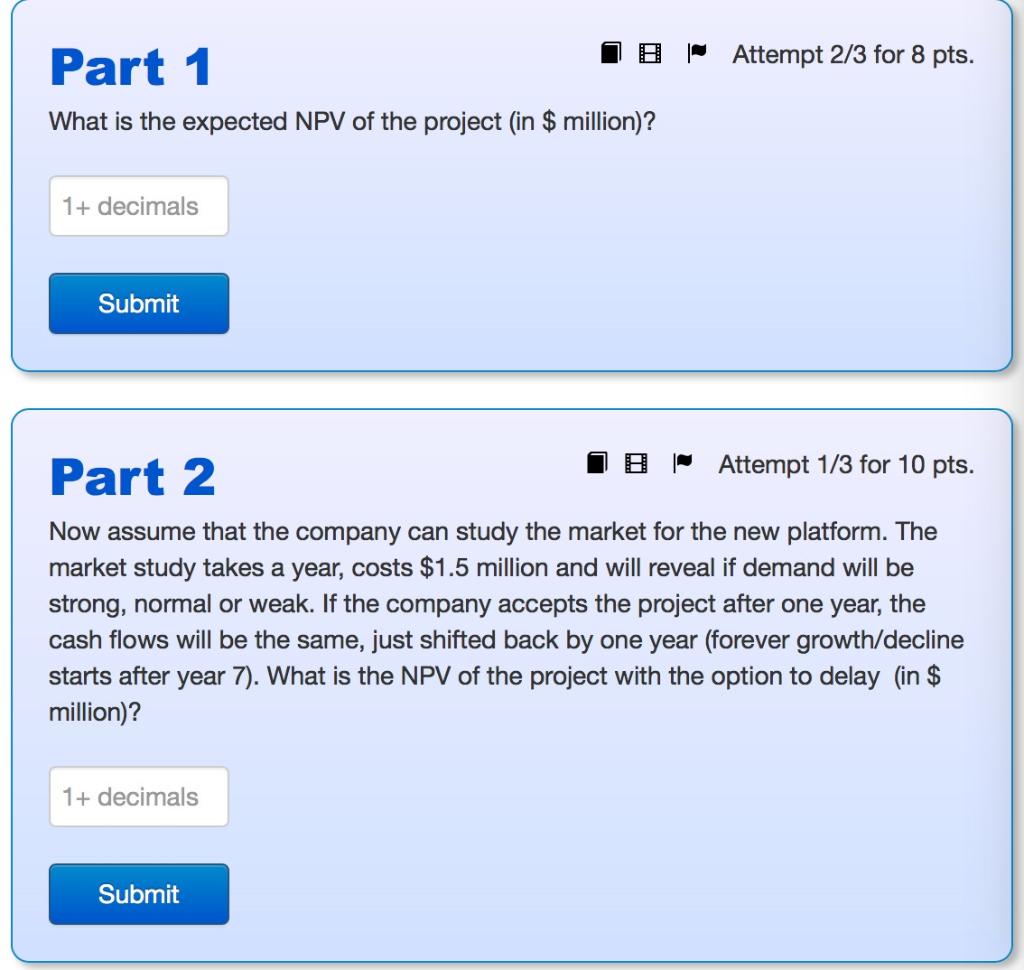

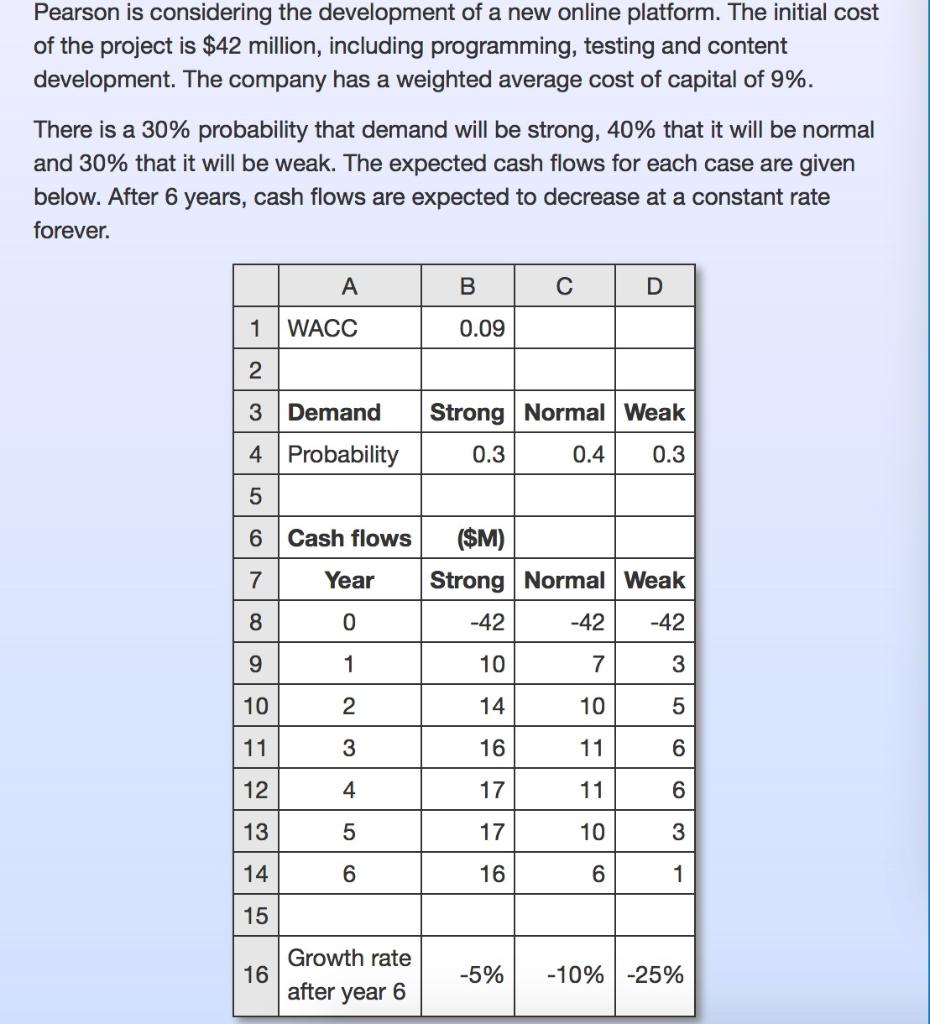

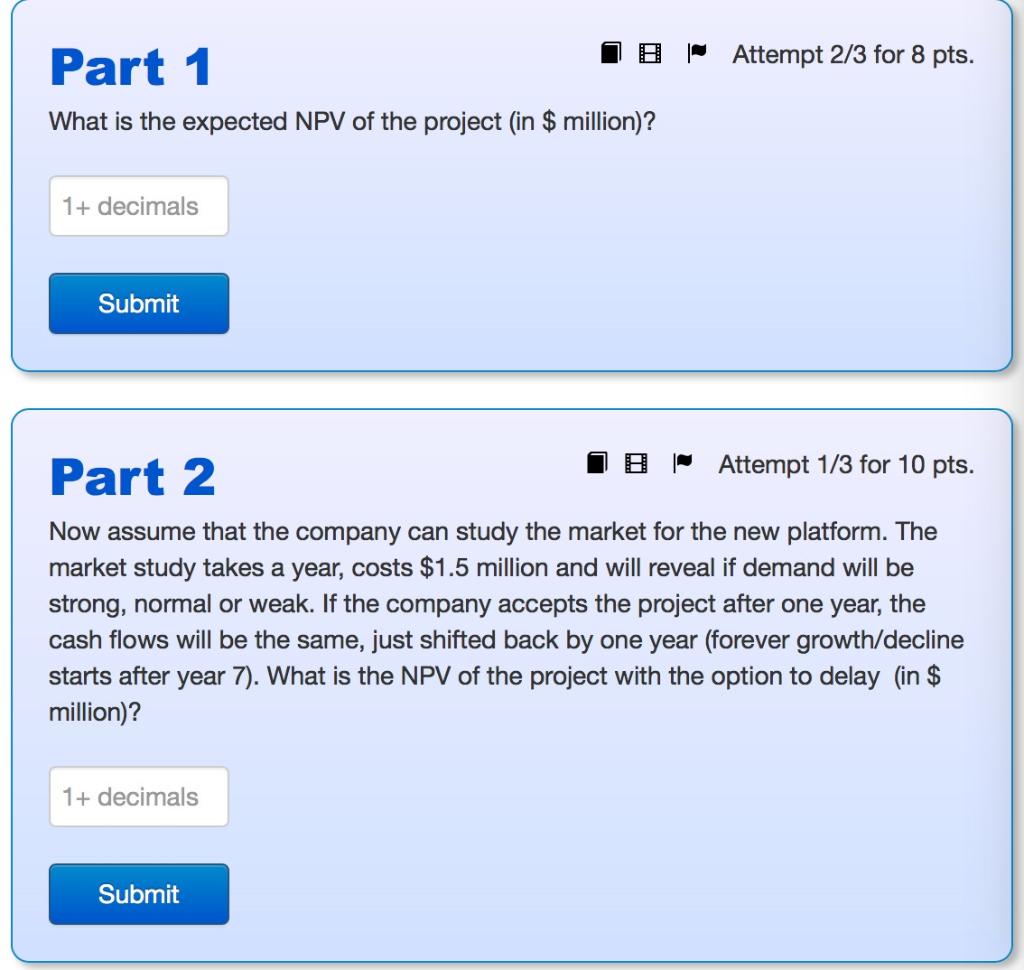

Pearson is considering the development of a new online platform. The initial cost of the project is $42 million, including programming, testing and content development. The company has a weighted average cost of capital of 9%. There is a 30% probability that demand will be strong, 40% that it will be normal and 30% that it will be weak. The expected cash flows for each case are given below. After 6 years, cash flows are expected to decrease at a constant rate forever. A B D 1 WACC 0.09 2 Strong Normal Weak 3 Demand 4 Probability 0.3 0.4 0.3 5 6 Cash flows 7 Year ($M) Strong Normal Weak -42 -42 -42 8 0 9 1 10 7 3 10 2 14 10 5 11 3 16 11 6 12 4 17 11 6 13 5 17 10 3 14 6 16 6 1 15 16 Growth rate after year 6 -5% -10%-25% | Attempt 2/3 for 8 pts. Part 1 What is the expected NPV of the project (in $ million)? 1+ decimals Submit Part 2 - Attempt 1/3 for 10 pts. Now assume that the company can study the market for the new platform. The market study takes a year, costs $1.5 million and will reveal if demand will be strong, normal or weak. If the company accepts the project after one year, the cash flows will be the same, just shifted back by one year (forever growth/decline starts after year 7). What is the NPV of the project with the option to delay (in $ million)? 1+ decimals Submit - Attempt 1/3 for 10 pts. Part 3 What is the value of the option to delay (in $ million)? 2+ decimals Submit Pearson is considering the development of a new online platform. The initial cost of the project is $42 million, including programming, testing and content development. The company has a weighted average cost of capital of 9%. There is a 30% probability that demand will be strong, 40% that it will be normal and 30% that it will be weak. The expected cash flows for each case are given below. After 6 years, cash flows are expected to decrease at a constant rate forever. A B D 1 WACC 0.09 2 Strong Normal Weak 3 Demand 4 Probability 0.3 0.4 0.3 5 6 Cash flows 7 Year ($M) Strong Normal Weak -42 -42 -42 8 0 9 1 10 7 3 10 2 14 10 5 11 3 16 11 6 12 4 17 11 6 13 5 17 10 3 14 6 16 6 1 15 16 Growth rate after year 6 -5% -10%-25% | Attempt 2/3 for 8 pts. Part 1 What is the expected NPV of the project (in $ million)? 1+ decimals Submit Part 2 - Attempt 1/3 for 10 pts. Now assume that the company can study the market for the new platform. The market study takes a year, costs $1.5 million and will reveal if demand will be strong, normal or weak. If the company accepts the project after one year, the cash flows will be the same, just shifted back by one year (forever growth/decline starts after year 7). What is the NPV of the project with the option to delay (in $ million)? 1+ decimals Submit - Attempt 1/3 for 10 pts. Part 3 What is the value of the option to delay (in $ million)? 2+ decimals Submit