Answered step by step

Verified Expert Solution

Question

1 Approved Answer

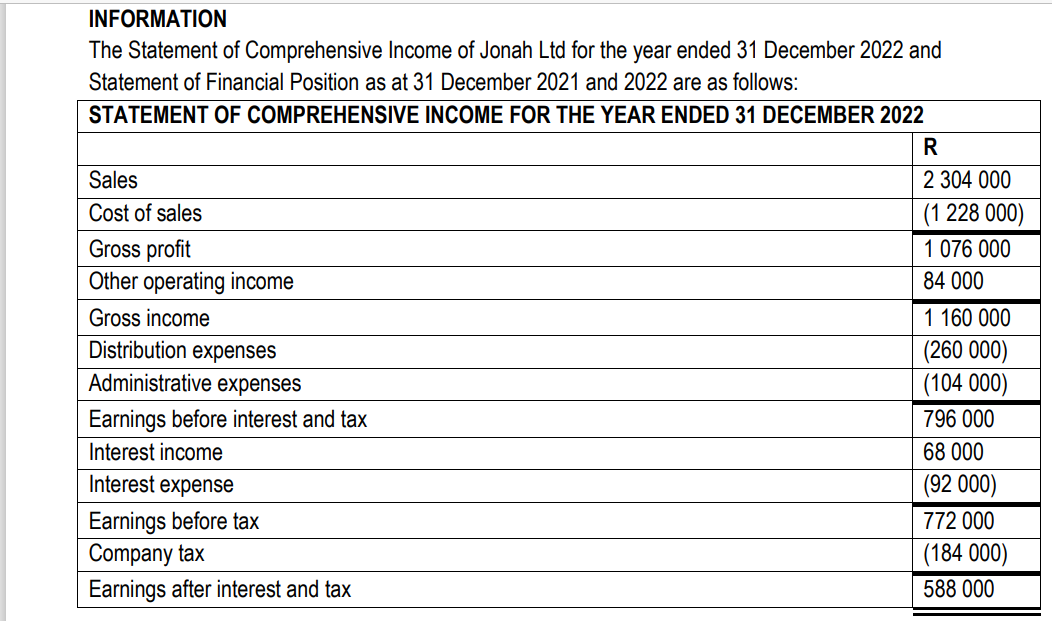

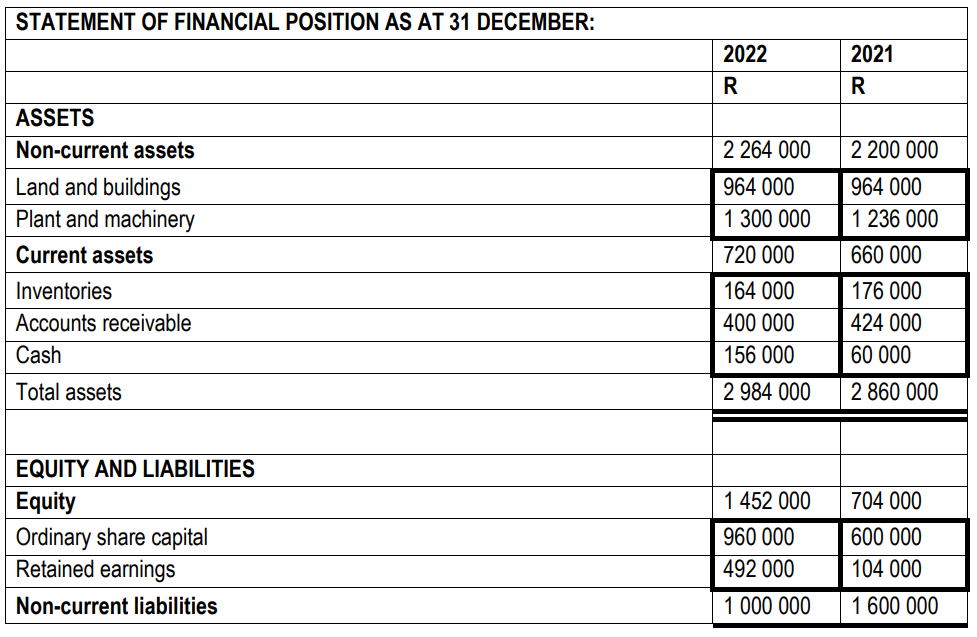

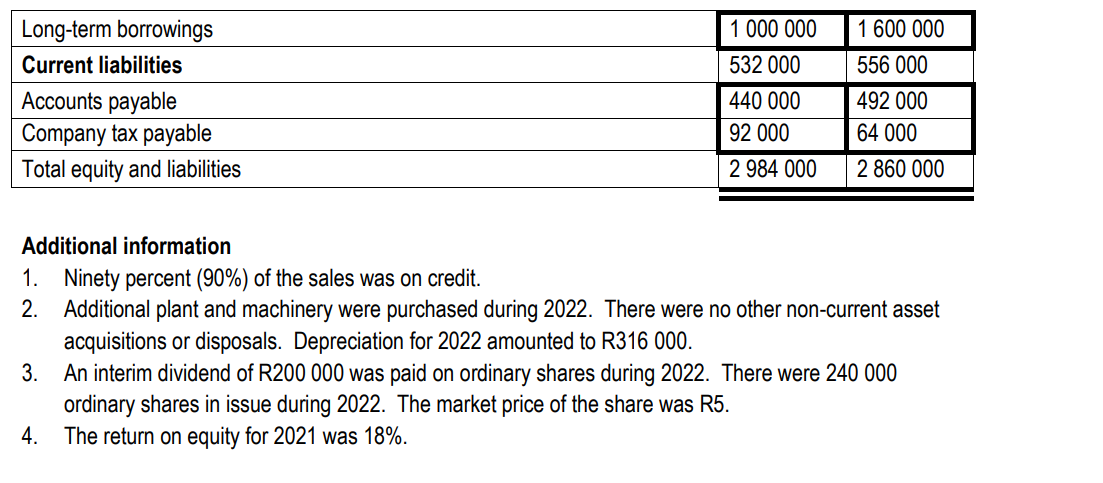

Pelase answer Question 2 based on the information from Question 1 which I provided. INFORMATION The Statement of Comprehensive Income of Jonah Ltd for the

Pelase answer Question 2 based on the information from Question 1 which I provided.

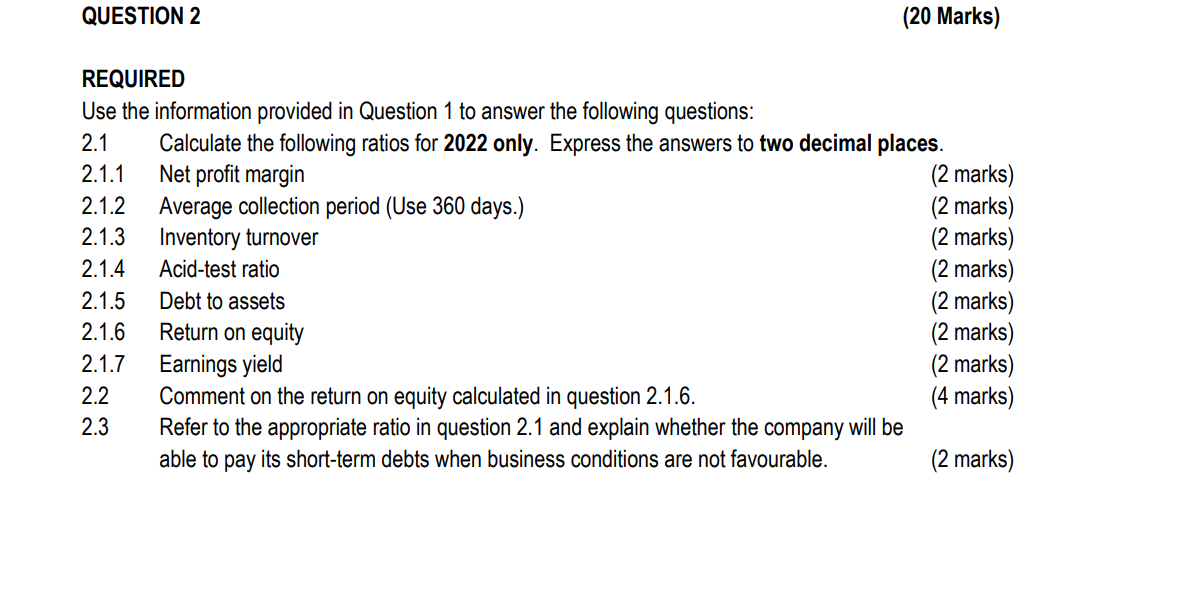

INFORMATION The Statement of Comprehensive Income of Jonah Ltd for the year ended 31 December 2022 and Statement of Financial Position as at 31 December 2021 and 2022 are as follows: Additional information 1. Ninety percent (90%) of the sales was on credit. 2. Additional plant and machinery were purchased during 2022. There were no other non-current asset acquisitions or disposals. Depreciation for 2022 amounted to R316 000. 3. An interim dividend of R200 000 was paid on ordinary shares during 2022 . There were 240000 ordinary shares in issue during 2022. The market price of the share was R5. 4. The return on equity for 2021 was 18%. QUESTION 2 (20 Marks) REQUIRED Use the information provided in Question 1 to answer the following questions: 2.1 Calculate the following ratios for 2022 only. Express the answers to two decimal places. 2.1.1 Net profit margin 2.1.2 Average collection period (Use 360 days.) ( 2 marks) 2.1.3 Inventory turnover ( 2 marks) 2.1.4 Acid-test ratio ( 2 marks) 2.1.5 Debt to assets ( 2 marks) ( 2 marks) 2.1.6 Return on equity ( 2 marks) 2.1.7 Earnings yield ( 2 marks) 2.2 Comment on the return on equity calculated in question 2.1.6. (4 marks) 2.3 Refer to the appropriate ratio in question 2.1 and explain whether the company will be able to pay its short-term debts when business conditions are not favourable. ( 2 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started