Question

Pele Solar Company is a small, rapidly growing wholesaler of solar panels. Bobby Moore, Peles general manager of marketing, predicts sales of 100,000 units in

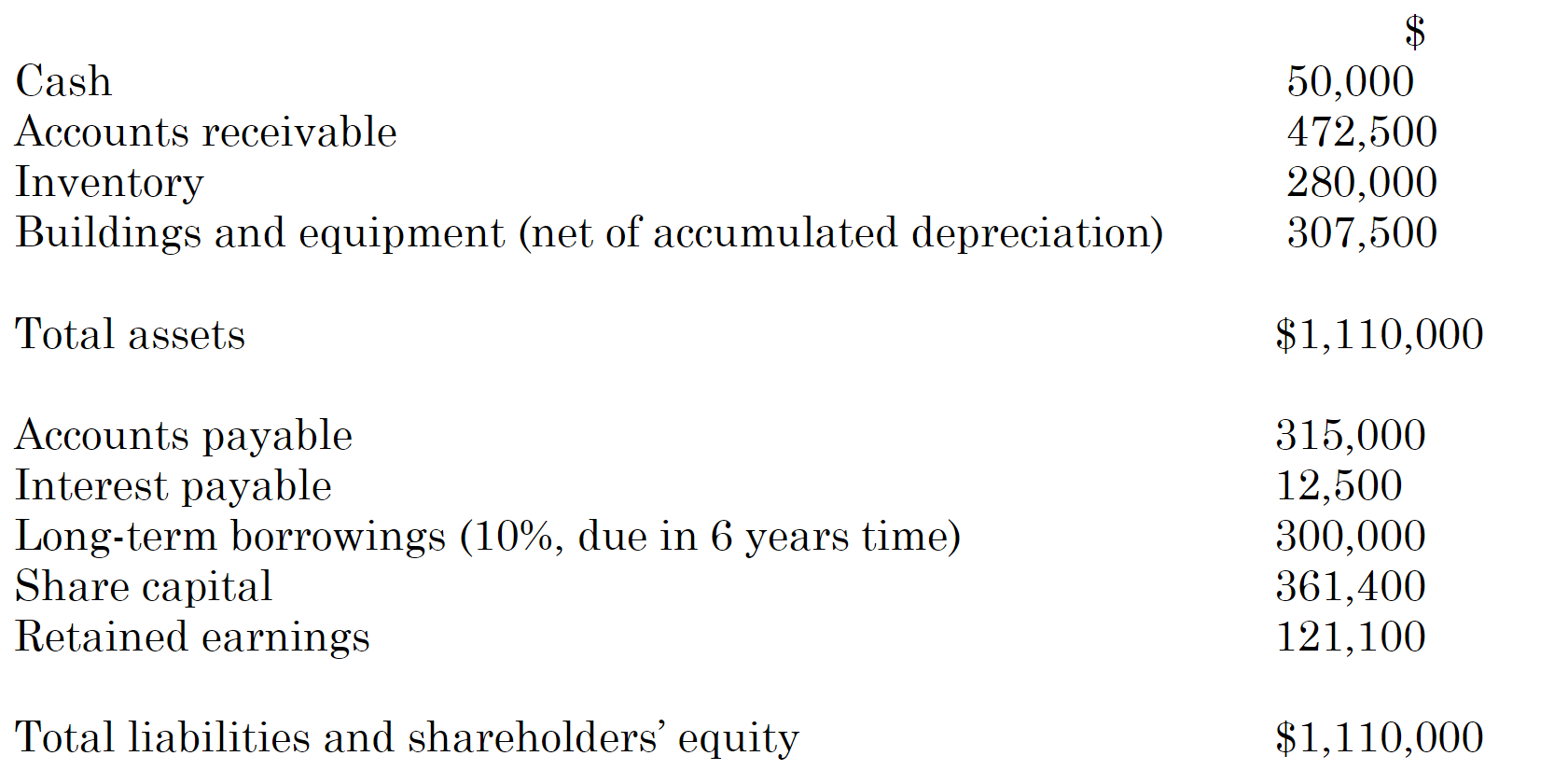

Pele Solar Company is a small, rapidly growing wholesaler of solar panels. Bobby Moore, Peles general manager of marketing, predicts sales of 100,000 units in January 2023, increasing by 15% each month during 2023. Sales revenue in January 2023 is forecast to be $800,000. The sales price will remain constant in 2023. Peles projected balance sheet as at 31 December 2022 is provided as follows:  Cristiano Ronaldo (the assistant accountant) is now preparing a monthly budget for the first quarter of 2023, and he needs your help. So far, the following information has been accumulated:

Cristiano Ronaldo (the assistant accountant) is now preparing a monthly budget for the first quarter of 2023, and he needs your help. So far, the following information has been accumulated:

Projected sales for December 2022 are $700,000. Credit sales typically are 75 per cent of total sales, with the remainder being cash sales. Peles credit experience indicates that 10 per cent of the credit sales are collected during the month of sale, and the remainder are collected during the following month.

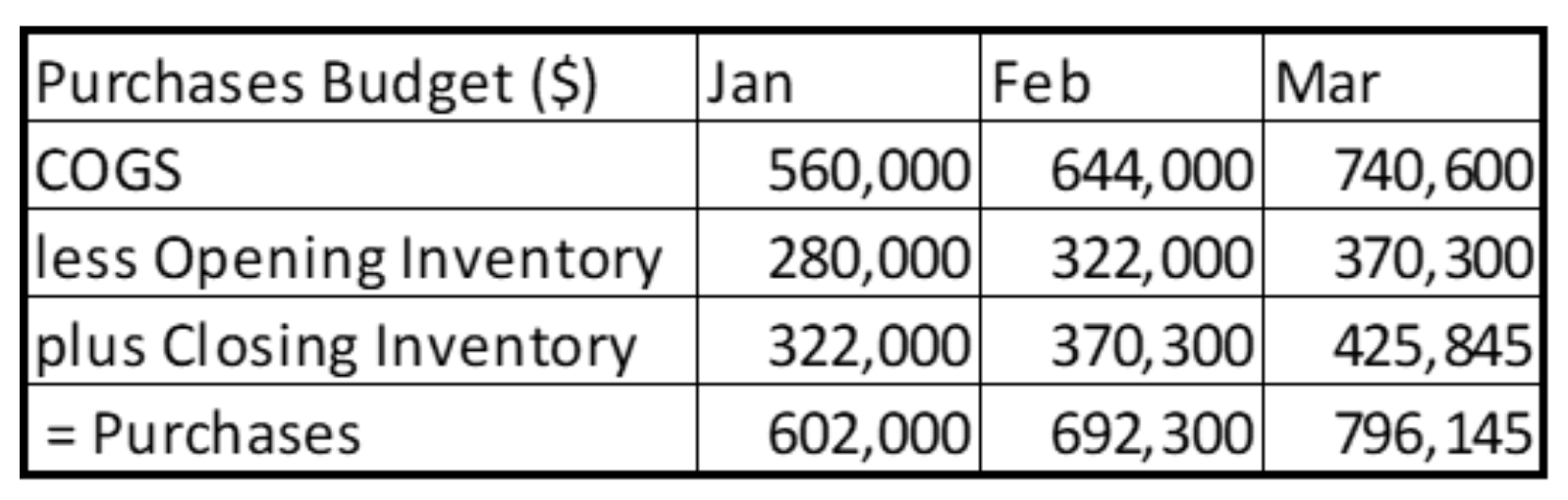

Peles cost of goods sold generally runs at 70 per cent of sales. Inventory is purchased on credit, and 40 per cent of each months purchases are paid during the month of purchase. The remainder is paid during the following month. In order to have adequate stocks of inventory on hand, the firm attempts to have inventory at the end of each month equal to one-half of the next months projected cost of goods sold.

Ronaldo has already prepared the purchases budget for the quarter to save you some work:

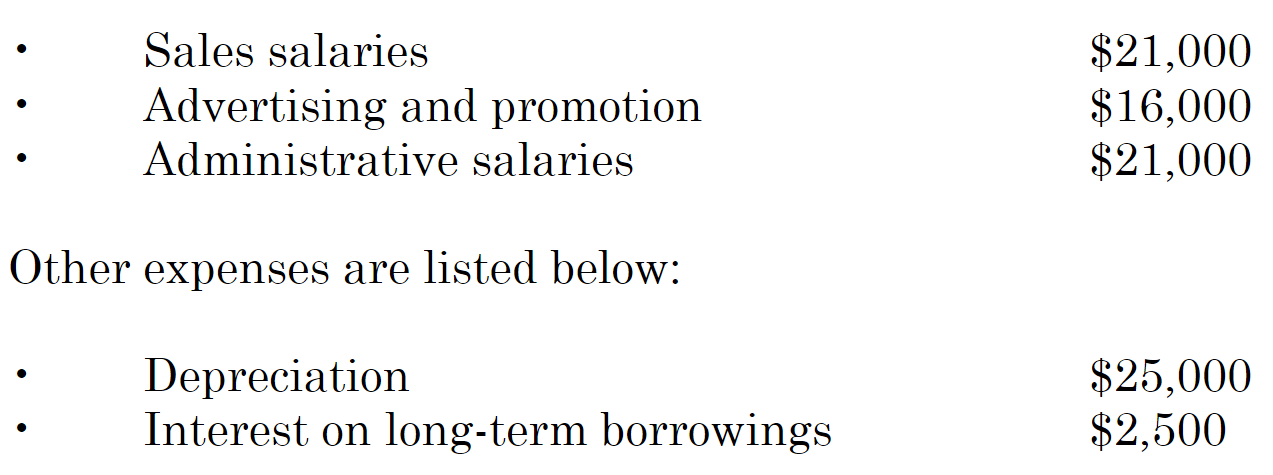

Ronaldo has estimated that Peles monthly cash expenses will be as follows:

Ronaldo has estimated that Peles monthly cash expenses will be as follows:

In addition, sales commissions run at the rate of 1 per cent of sales revenue. On January 1, a one-off payment of $175,000 is required to purchase new equipment. No depreciation is required to be calculated for this new equipment. Ronaldo believes that Pele needs to keep a minimum cash balance of $25,000. A short-term credit facility for $100,000 has been arranged with a local bank. The bank has given Pele an introductory offer of 0% interest for the first three months of 2023, although interest of 12% per annum will apply for amounts borrowed after 31 March 2023. Ronaldo has decided that Pele should re-pay any short-term loan required as soon as possible. Interest on Peles long-term borrowings is paid semi-annually, on 31 January and 31 July, for the preceding six-month period.

Required:

8. Explain why it is important to prepare a cash budget in particular and what the problems are with having too little and too much cash (3 marks) 9. How does human behaviour interact with budgeting and the budgeting process? (4 marks) 2 marks are allocated for appropriate presentation of the written analysis, including structure of sentences and paragraphs, vocabulary, spelling, presentation, referencing and tone.

CashAccountsreceivableInventoryBuildingsandequipment(netofaccumulateddepreciation)TotalassetsAccountspayableInterestpayableLong-termborrowings(10%,duein6yearstime)SharecapitalRetainedearningsTotalliabilitiesandshareholdersequity$50,000472,500280,000307,500$1,110,000315,00012,500300,000361,400121,100$1,110,000 \begin{tabular}{|l|r|l|l|} \hline Purchases Budget (\$) & \multicolumn{1}{|l|}{ Jan } & \multicolumn{1}{l|}{ Feb } & \multicolumn{1}{l|}{ Mar } \\ \hline COGS & 560,000 & 644,000 & 740,600 \\ \hline less Opening Inventory & 280,000 & 322,000 & 370,300 \\ \hline plus Closing Inventory & 322,000 & 370,300 & 425,845 \\ \hline= Purchases & 602,000 & 692,300 & 796,145 \\ \hline \end{tabular} -Salessalaries-AdvertisingandpromotionOtherexpensesarelistedbelow:-Interestonlong-termborrowings$21,000$16,000AdministrativesalariesDepreciation$2,500$21,000$25,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started