Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2- Pelga Company routinely receives goods from its 80%-owned subsidiary, Swede Corporation. In 2014, Swede sold merchandise that cost $80,000 to Pelga for $100,000.

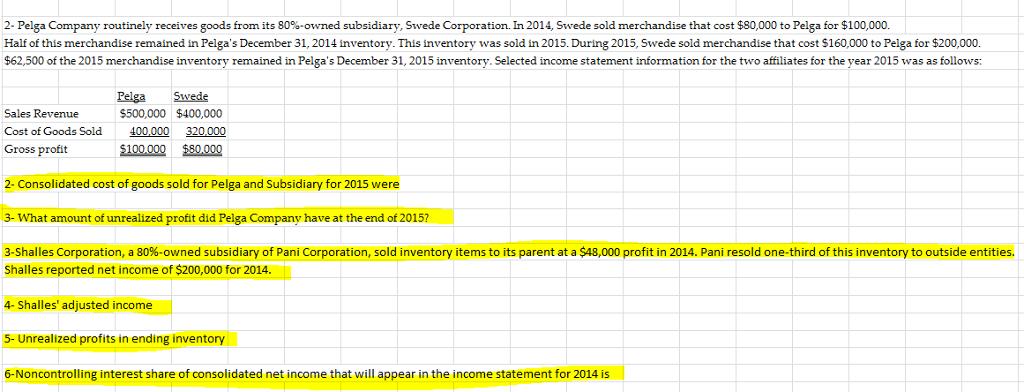

2- Pelga Company routinely receives goods from its 80%-owned subsidiary, Swede Corporation. In 2014, Swede sold merchandise that cost $80,000 to Pelga for $100,000. Half of this merchandise remained in Pelga's December 31, 2014 inventory. This inventory was sold in 2015. During 2015, Swede sold merchandise that cost $160,000 to Pelga for $200,000. $62,500 of the 2015 merchandise inventory remained in Pelga's December 31, 2015 inventory. Selected income statement information for the two affiliates for the year 2015 was as follows: Pelga Swede Sales Revenue $500,000 $400,000 Cost of Goods Sold 400,000 320.000 Gross profit $100.000 $80.000 2- Consolidated cost of goods sold for Pelga and Subsidiary for 2015 were 3- What amount of unrealized profit did Pelga Company have at the end of 2015? 3-Shalles Corporation, a 80%-owned subsidiary of Pani Corporation, sold inventory items to its parent at a $48,000 profit in 2014. Pani resold one-third of this inventory to outside entities. Shalles reported net income of $200,000 for 2014. 4- Shalles' adjusted income 5- Unrealized profits in ending inventory 6-Noncontrolling interest share of consolidated net income that will appear in the income statement for 2014 is

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Total Cost of Goods Sold 720000 400000320000 Inter company Sales 200000 Beginning Un...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started