Question

Peng Corporation is considering the purchase of new equipment costing $30,000. The projected annual after-tax net income from the equipment is $1,200, after deducting $10,000

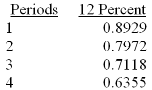

Peng Corporation is considering the purchase of new equipment costing $30,000. The projected annual after-tax net income from the equipment is $1,200, after deducting $10,000 for depreciation. The revenue is to be received at the end of each year. The machine has a useful life of 4 years and no salvage value. Peng requires a 12% return on its investments. The factors for the present value of $1 for different periods follow:

Calculate the break-even time for this equipment.

-Break-even time is between 1 and 2 years.

-Break-even time is longer than 4 years.

-Break-even time is between 2 and 3 years.

-Break-even time is between 3 and 4 years.

-This project will never break-even.

I tried to calculate it but my answer didn't seem right! Can anyone explain this?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started