Question

Penn Corporations October 31, 2006, journal entries to record the operations of its 80%-owned subsidiary, Soper Company, during the first year following the business combination,

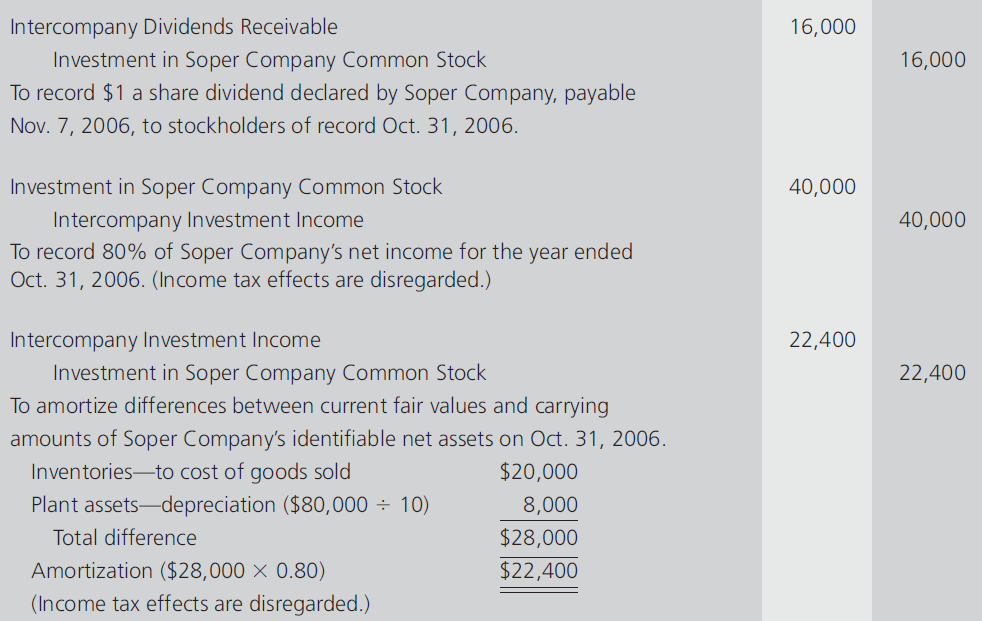

Penn Corporations October 31, 2006, journal entries to record the operations of its 80%-owned subsidiary, Soper Company, during the first year following the business combination, were as follows:

Additional Information 1. Penn had acquired 16,000 shares of Sopers $1 par common stock on October 31, 2005, at a total cost, including out-of-pocket costs, of $240,000. The minority interest in net assets of subsidiary on that date was $50,000. 2. On October 31, 2006, the balances of Sopers Common Stock, Paid-in Capital in Excess of Par, and Retained Earnings ledger accounts were in the ratio of 1 : 3 : 5, respectively. 3. Soper allocates depreciation expense 75% to cost of goods sold and 25% to operating expenses. 4. Consolidated goodwill of $40,000 was unimpaired as of October 31, 2006.

Instructions Prepare working paper eliminations (in journal entry format) for Penn Corporation and subsidiary on October 31, 2006. (Suggestion: Use T accounts to determine balances of ledger accounts of the parent company and subsidiary.) (Disregard income taxes.)

Intercompany Dividends Receivable Investment in Soper Company Common Stock To record $1 a share dividend declared by Soper Company, payable Nov. 7, 2006, to stockholders of record Oct. 31, 2006. Investment in Soper Company Common Stock Intercompany Investment Income To record 80% of Soper Company's net income for the year ended Oct. 31, 2006. (Income tax effects are disregarded.) Intercompany Investment Income Investment in Soper Company Common Stock To amortize differences between current fair values and carrying amounts of Soper Company's identifiable net assets on Oct. 31, 2006. Intercompany Dividends Receivable Investment in Soper Company Common Stock To record $1 a share dividend declared by Soper Company, payable Nov. 7, 2006, to stockholders of record Oct. 31, 2006. Investment in Soper Company Common Stock Intercompany Investment Income To record 80% of Soper Company's net income for the year ended Oct. 31, 2006. (Income tax effects are disregarded.) Intercompany Investment Income Investment in Soper Company Common Stock To amortize differences between current fair values and carrying amounts of Soper Company's identifiable net assets on Oct. 31, 2006

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started