Answered step by step

Verified Expert Solution

Question

1 Approved Answer

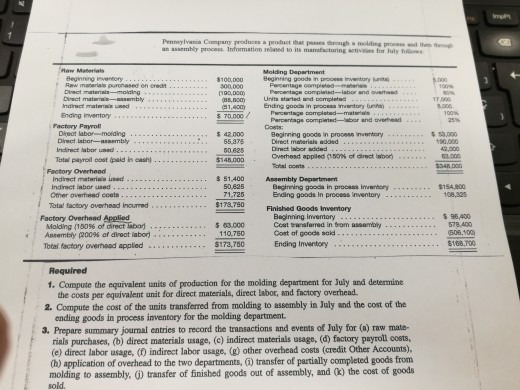

Pennsylvania Company produces a product that peses through a molding process and the an assembly process Information relaned to its marvafacturing activiis for fuly olls

Pennsylvania Company produces a product that peses through a molding process and the an assembly process Information relaned to its marvafacturing activiis for fuly olls Beginning invereory $100,000 Beginning goods in procsss Inventory lunits Diect materials-molding n90,0o0) and overnead 1,400E Ending goods in process inventory uns Ending inventory s 70.000 Pencentage Parcentage completed-bor and averhead Beginning goode in process invenbory... Direct Inbor added Toral oonts Factory Payrol Diyuot labo-molding $ 42.000 3,000 80,000 42,000 Direct labor-assembly. 65.375 Tatal payroil eost (paid in cash.... $348000 Factory Overhead 51,400 Assembly Department indirect materiis sed Indirect iabor used..-.-.. Other overhead costs $154,800 Begineing goocds in procsss inverory Ending goods in process inventory Total factory overhead Incurred 173,750 Finished Goods Inventory s 96,400 Baginning invemtory Coat taraferred in fram assembty Cost of goeds soid Factory Overhead Applied $ 63,000 10,760 Malding (150% 0, direct labaj 506,400 $68,70o Total factory overhead applied 173,750 Required 1. Compute the equivalent units of production for the molding department for July and determine the costs per equivalent unit for direct materials, direct labor, and factory overhead. 2. Compute the cost of the units transferred from molding to assembly in July and the cost of the ending goods in process inventory for the molding department 3. Prepare summary journal entries to record the transactions and events of July for (a) raw mate- rials purchases, (b) direct materials usage, (c) indirect materials usage, (d) factory payroll costs, (e) direct labor usage, (f) indirect labor usage, (g) other overhead costs (credit Other Accounts), (h) application of overhead to the two departments,) transfer of partially completed goods from molding to assembly, ) transfer of finished goods out of assembly, and (k) the cost of goods sold

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started