Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Penny, a portfolio manager, is using the Capital Asset Pricing Model (CAPM) for making recommendations to her clients, Luke. Penny is considering whether to

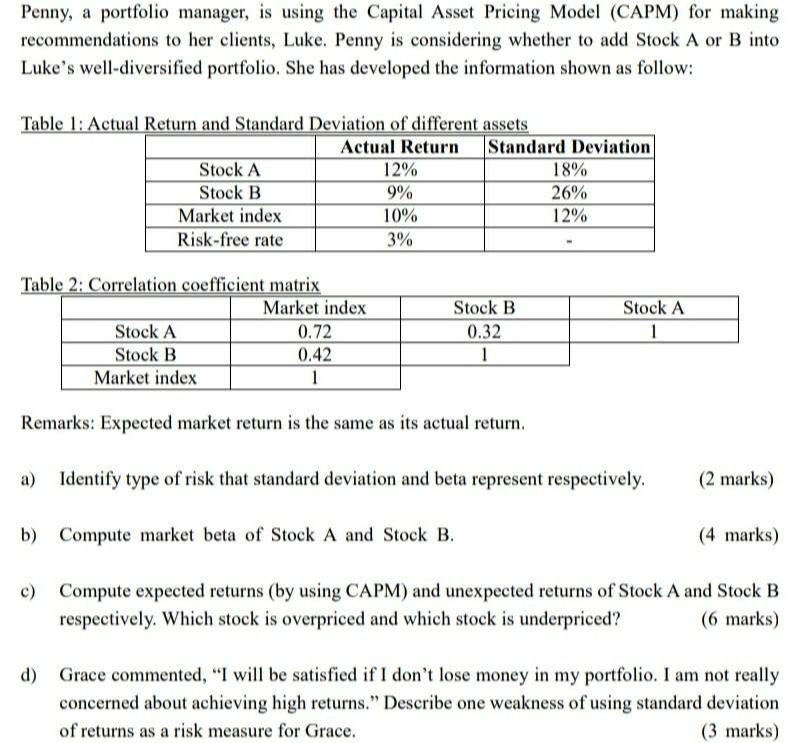

Penny, a portfolio manager, is using the Capital Asset Pricing Model (CAPM) for making recommendations to her clients, Luke. Penny is considering whether to add Stock A or B into Luke's well-diversified portfolio. She has developed the information shown as follow: Table 1: Actual Return and Standard Deviation of different assets Actual Return Standard Deviation 12% 18% Stock A Stock B 9% 26% Market index 10% 12% Risk-free rate 3% Table 2: Correlation coefficient matrix Market index Stock B Stock A Stock A 0.72 0.32 1 Stock B 0.42 1 Market index 1 Remarks: Expected market return is the same as its actual return. a) Identify type of risk that standard deviation and beta represent respectively. (2 marks) b) Compute market beta of Stock A and Stock B. (4 marks) c) Compute expected returns (by using CAPM) and unexpected returns of Stock A and Stock B respectively. Which stock is overpriced and which stock is underpriced? (6 marks) d) Grace commented, "I will be satisfied if I don't lose money in my portfolio. I am not really concerned about achieving high returns." Describe one weakness of using standard deviation of returns as a risk measure for Grace. (3 marks)

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Part a Standard deviation is a measure of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started