Question

Penny Cassidy has decided to start her business, Penny's Pool Service & Supply, Incorporated (PPSS). There is much to do when starting a new business.

Penny Cassidy has decided to start her business, Penny's Pool Service & Supply, Incorporated (PPSS). There is much to do when starting a new business. Here are some transactions that have occurred in Pess in March

a. Received $43,000 cash and a large delivery van with a value of $54,000 from Penny, who was given 5,800 shares of $0.05 par value common stock in exchange.

Purchased land with a small office and warehouse by paying $19,000 cash and signing a 10-year note payable to the local bank for $89,000. The land has a value of $27,000 and the building's value is $81,000. Use separate accounts for land and buildings

Purchased new computer equipment from Dell for $4.300 cash, and purchased other office equipment for $5.800. signing a note pavable due in six months to the office equipment manufacturer.

d. Hired a receptionist for the office at a salary of $3,300 per month; the receptionist will begin working for PPSS starting in April.

raid $2,800 on the note payable to the bank in b above at the end of March ignore interest.

- Purchased short-term investments in the stock of other companies for $6.800 cash.

- Ordered $28,000 in inventory from Pool Corporation, Incorporated, a pool supply wholesaler, to be received in April.

required:

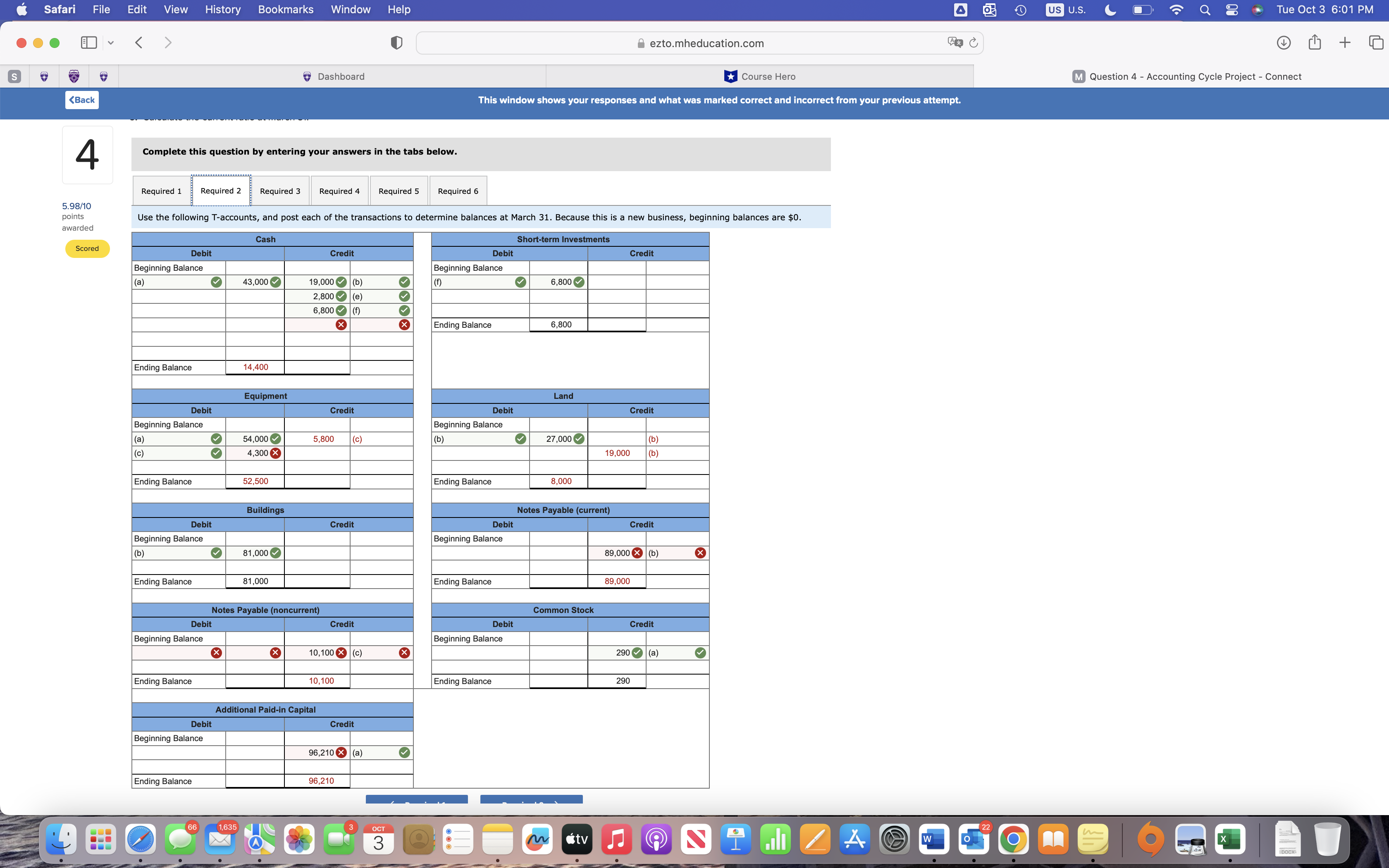

- Use the tollowing -accounts. and post each of the transactions to determine balances at March 31. Because this is a new business beginning balances are $0.

- create a trial balance on March 31 to check that debits equal credits after the transactions are posted to the T-accounts

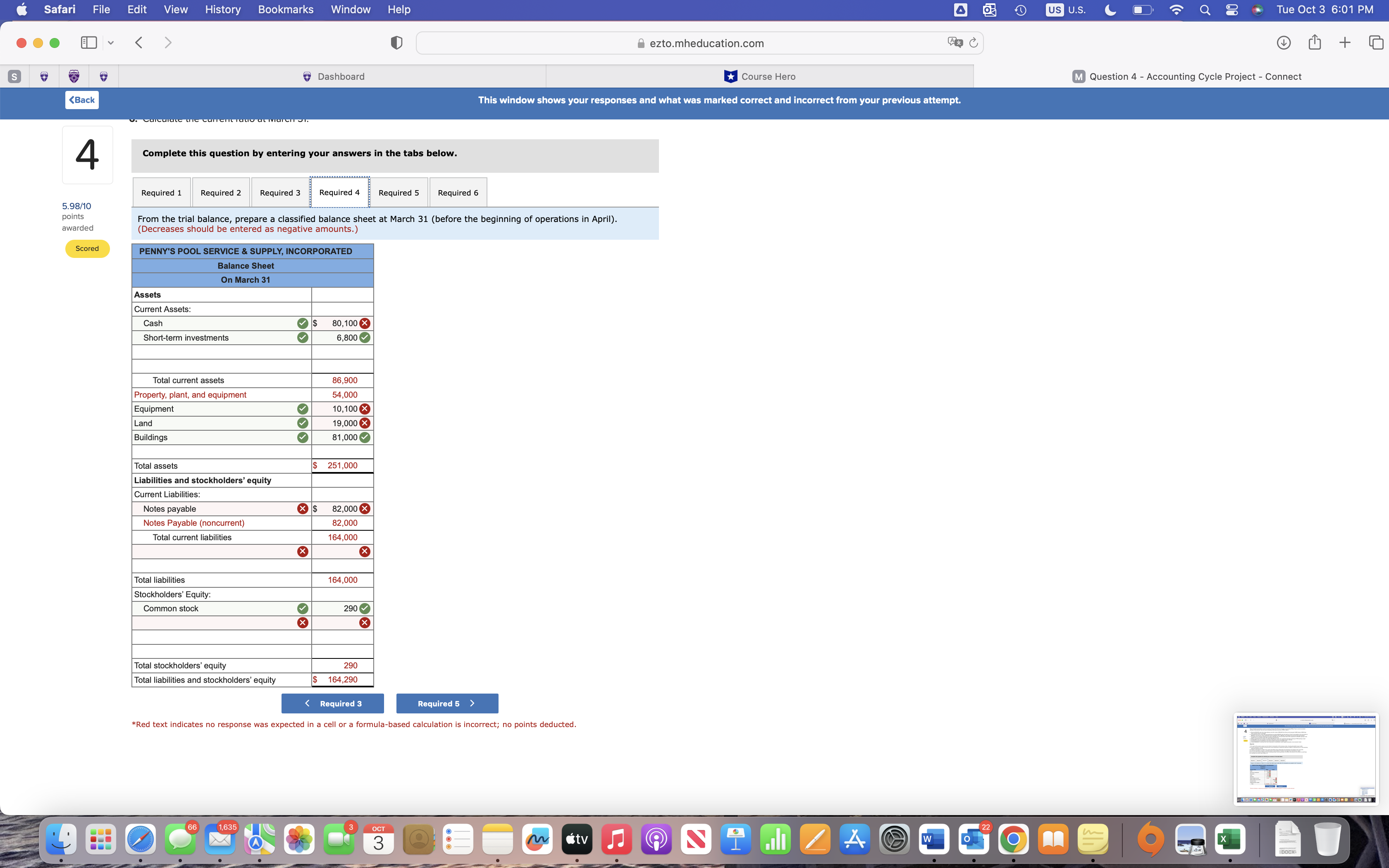

- From the trial balance. prepare a classified balance sheet at March 31 (before the beginnina of operations in Abril

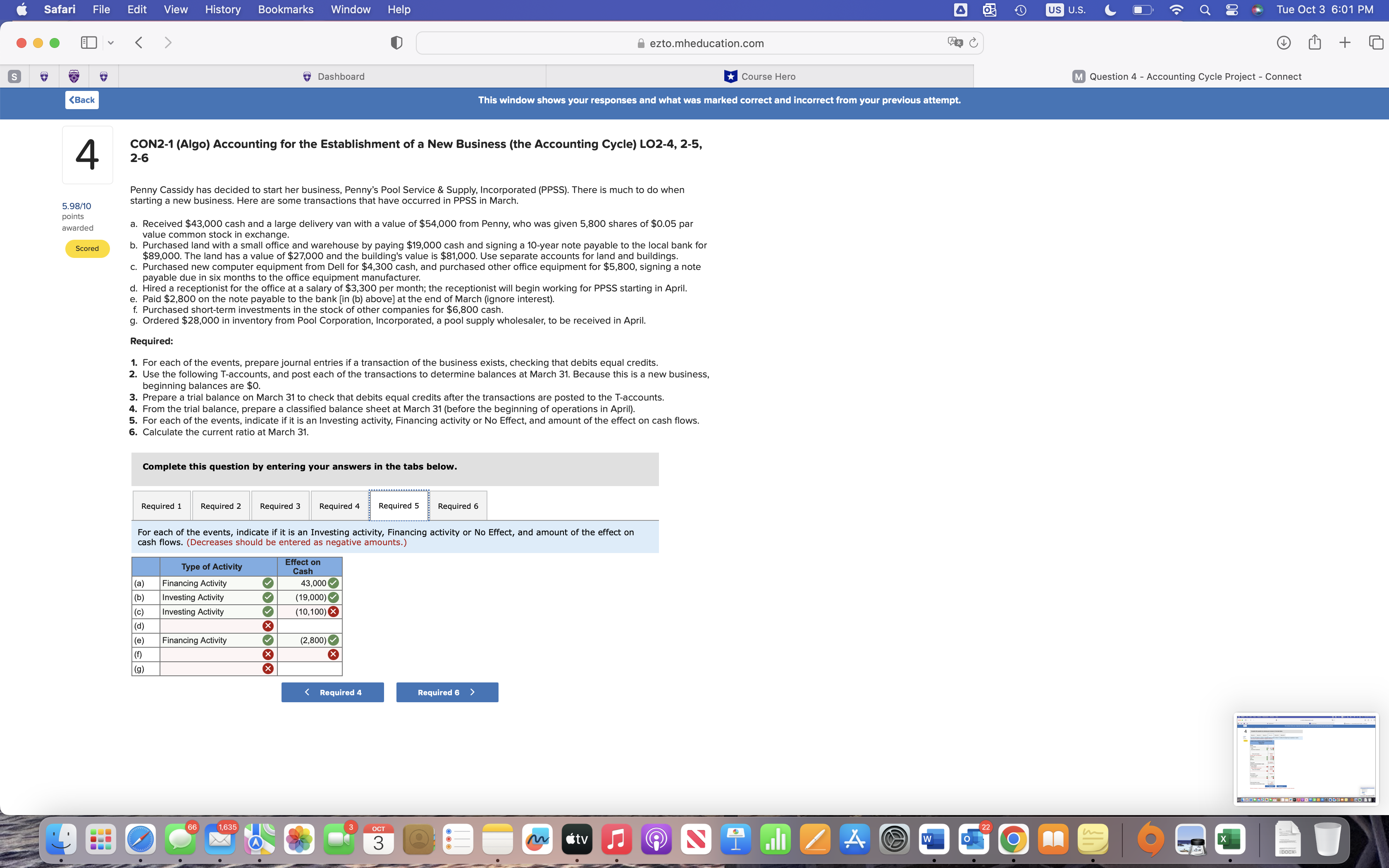

- For each of the events. indicate if it is an Investing activitv. rinancing activity or No Eifect. and amount of the effect on cash flows.

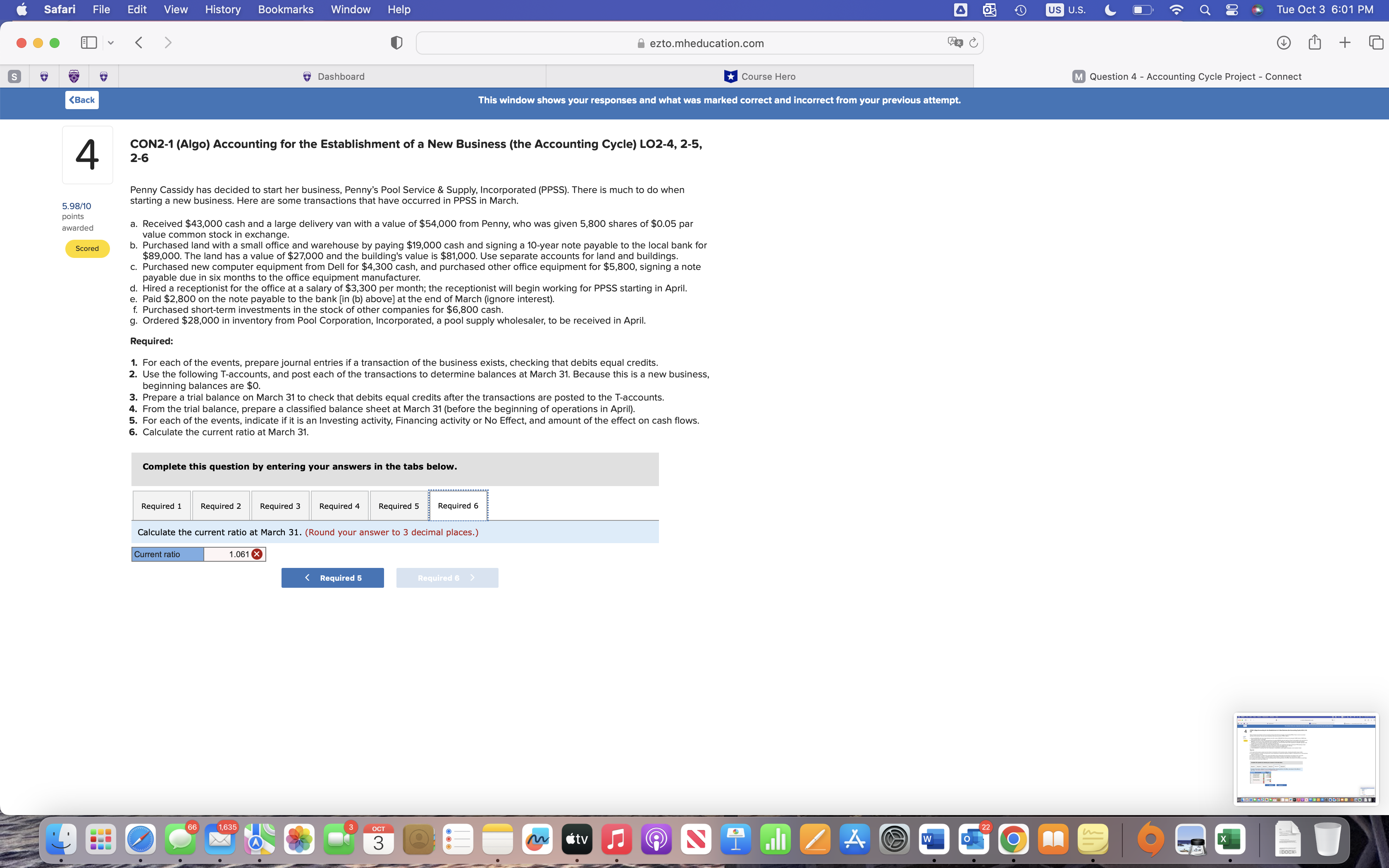

- Calculate the current ratio at March 31

Safari S Window Help Dashboard Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 ezto.mheducation.com Course Hero This window shows your responses and what was marked correct and incorrect from your previous attempt. 5.98/10 points Use the following T-accounts, and post each of the transactions to determine balances at March 31. Because this is a new business, beginning balances are $0. awarded Scored Debit Beginning Balance (a) Cash Short-term Investments Credit Debit Beginning Balance 43,000 19,000 (b) 2,800 (e) 6,800 (f) (f) 6,800 Ending Balance 6,800 Ending Balance 14,400 Credit Equipment Debit Credit Beginning Balance (a) (c) Ending Balance 52,500 Land Debit Credit 54,000 4,300 X 5,800 (c) Beginning Balance (b) 27,000 (b) 19,000 (b) Ending Balance 8,000 Buildings Debit Credit Debit Beginning Balance Beginning Balance (b) Ending Balance 81,000 81,000 Notes Payable (noncurrent) Debit Beginning Balance Ending Balance Debit Beginning Balance Ending Balance Ending Balance Notes Payable (current) Credit 89,000 (b) 89,000 Common Stock Credit Debit Credit Beginning Balance 10,100 (c) 290 (a) 10,100 Ending Balance 290 Additional Paid-in Capital 66 1,635 Credit 96,210 (a) 96,210 OCT 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started