Question

Penny Manufacturing Company acquired 75 percent of Saul Corporation stock at underlying book value. At the date of acquisition, the fair value of the noncontrolling

Penny Manufacturing Company acquired 75 percent of Saul Corporation stock at underlying book value. At the date of acquisition, the fair value of the noncontrolling interest was equal to 25 percent of Sauls book value. The balance sheets of the two companies for January 1, 20X1, are as follows:

| PENNY MANUFACTURING CORPORATION Balance Sheet January 1, 20X1 | ||||||||

| Cash | $ | 241,500 | Accounts Payable | $ | 130,500 | |||

| Accounts Receivable | 70,000 | Bonds Payable | 393,000 | |||||

| Inventory | 116,000 | Common Stock | 197,000 | |||||

| Buildings & Equipment | 620,000 | Additional Paid-In Capital | 47,000 | |||||

| Less: Accumulated Depreciation | (142,000 | ) | Retained Earnings | 393,000 | ||||

| Investment in Saul Corporation | 255,000 | |||||||

| Total Assets | $ | 1,160,500 | Total Liabilities & Equities | $ | 1,160,500 | |||

| SAUL CORPORATION Balance Sheet January 1, 20X1 | ||||||||

| Cash | $ | 67,000 | Accounts Payable | $ | 126,000 | |||

| Accounts Receivable | 110,000 | Bonds Payable | 293,000 | |||||

| Inventory | 196,000 | Common Stock ($10 par) | 100,000 | |||||

| Buildings & Equipment | 620,000 | Additional Paid-In Capital | 47,000 | |||||

| Less: Accumulated Depreciation | (234,000 | ) | Retained Earnings | 193,000 | ||||

| Total Assets | $ | 759,000 | Total Liabilities & Equities | $ | 759,000 | |||

On January 2, 20X1, Penny purchased an additional 2,500 shares of common stock directly from Saul for $150,000. Required: a. Prepare the consolidation entry needed to complete a consolidated balance sheet worksheet immediately following the issuance of additional shares to Penny. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

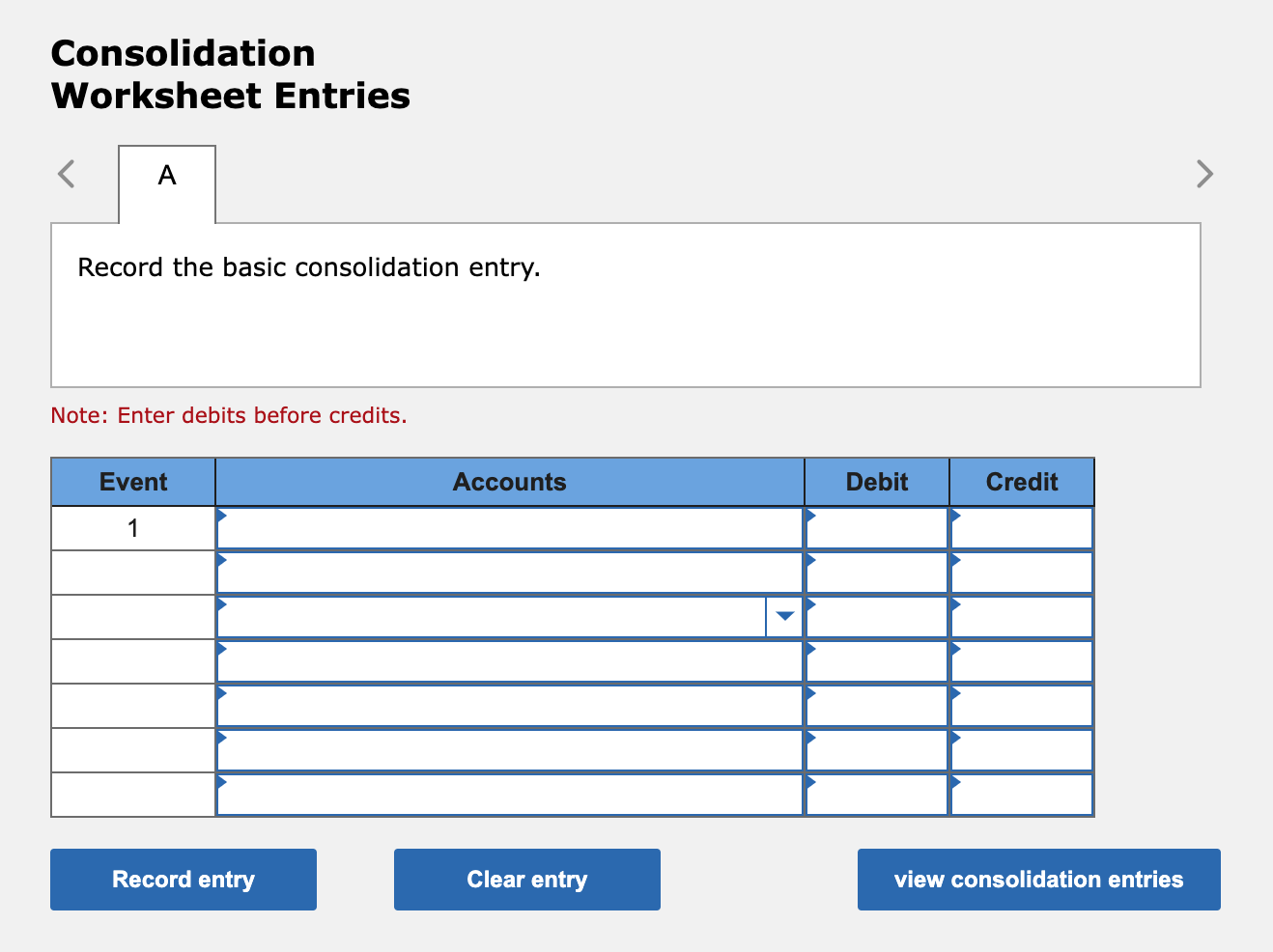

Consolidation Worksheet Entries

- Record the basic consolidation entry.

Note: Enter debits before credits.

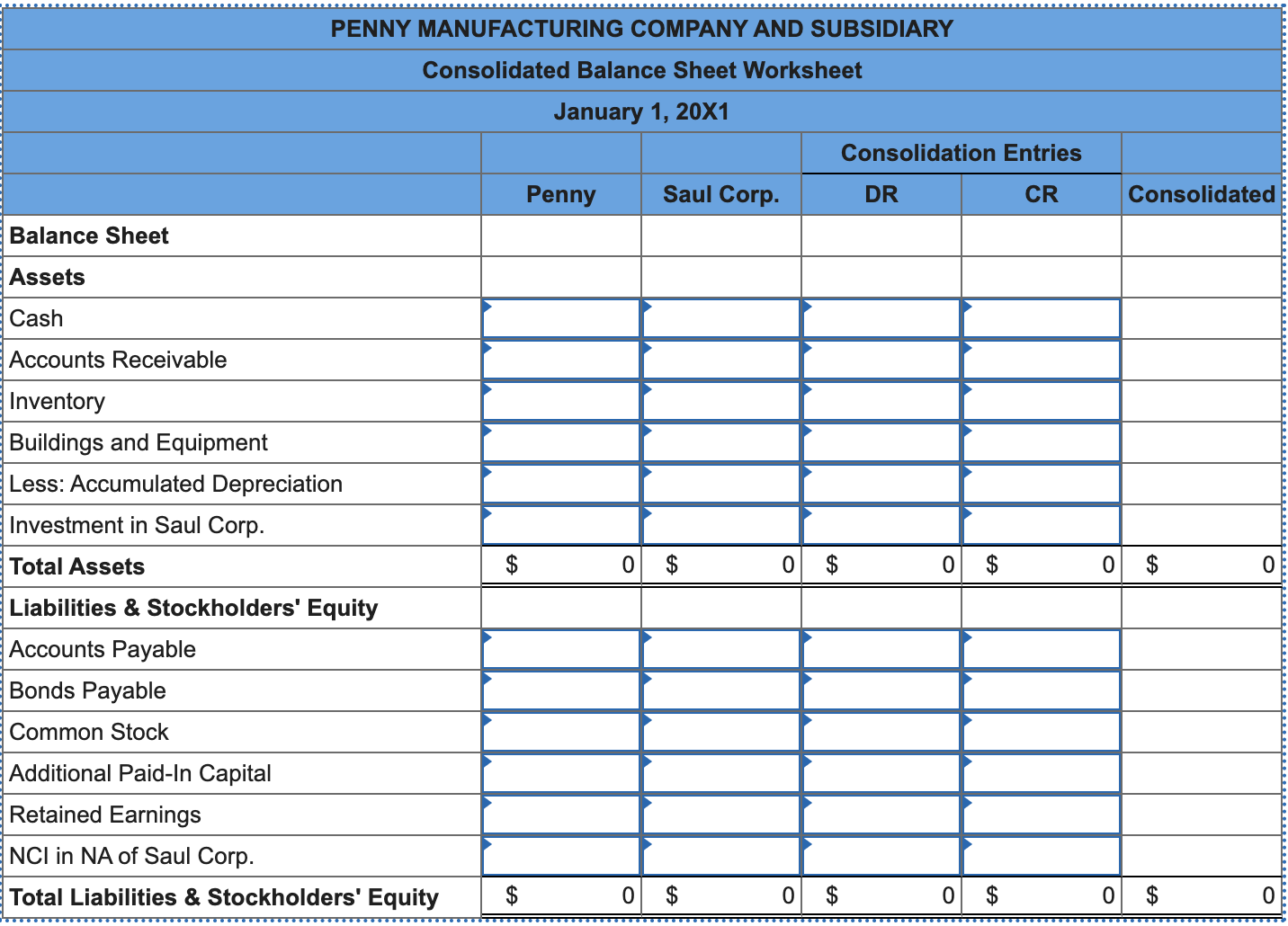

b. Prepare a consolidated balance sheet worksheet immediately following the issuance of additional shares to Penny. (Values in the first two columns (the "parent" and "subsidiary" balances) that are to be deducted should be indicated with a minus sign, while all values in the "Consolidation Entries" columns should be entered as positive values. For accounts where multiple adjusting entries are required, combine all debit entries into one amount and enter this amount in the debit column of the worksheet. Similarly, combine all credit entries into one amount and enter this amount in the credit column of the worksheet.)

Consolidation Worksheet Entries Note: Enter debits before credits

Consolidation Worksheet Entries Note: Enter debits before credits Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started