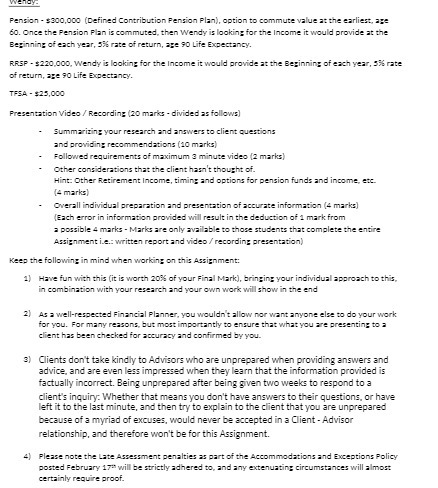

Pension - $300,000 (Defined Contribution Pension Plan), option to commute value at the earliest, ape 60. Once the Pension Plan is commuted, then Wendy is looking for the Income it would provide at the Beginning of each year, 5% rate of return, age 90 Life Expectancy. RRSP - $220.000. Wendy is looking for the Income it would provide at the Beginning of each year, 5%% rate of return, age 90 Life Expectancy. TFSA - $25,000 Fresentation Video / Recording (20 marks - divided as follows] Summarizing your research and answers to client questions and providing recommendations (10 marks) Followed requirements of maximum 3 minute video (2 marks) Other considerations that the client hasn't thought of. Hint: Other Retirement Income, timing and options for pension funds and income, etc. (4 marks) Overall individual preparation and presentation of accurate information (4 marks] [Each error in information provided will result in the deduction of 1 mark from possible 4 marks - Marks are only available to those students that complete the entire Assignment i.e.: written report and video / recording presentation) Keep the following in mind when working on this Assignment: 1) Have fun with this (it is worth 2016 of your Final Mark), bringing your individual approach to this, in combination with your research and your own work will show in the end As = well-respected Financial Planner, you wouldn't allow nor want anyone else to do your work for you. For many reasons, but most importantly to ensure that what you are presenting to a client has been checked for accuracy and confirmed by you. 3) Clients don't take kindly to Advisors who are unprepared when providing answers and advice, and are even less impressed when they learn that the information provided is factually incorrect. Being unprepared after being given two weeks to respond to a client's inquiry: Whether that means you don't have answers to their questions, or have left it to the last minute, and then try to explain to the client that you are unprepared because of a myriad of excuses, would never be accepted in a Client - Advisor relationship, and therefore won't be for this Assignment. 4) Please note the Late Assessment penalties as part of the Accommodations and Exceptions Policy posted February 17" will be strictly adhered to, and any extenuating circumstances will almost certainly require proof