Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(Pension Income Splitting - No OAS) Harry Cheung is 67 years of age. He was a long term employee of a Canadian public company

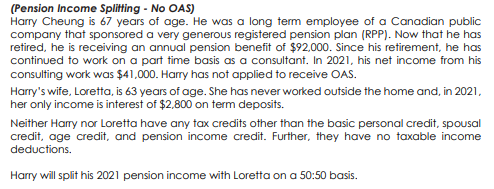

(Pension Income Splitting - No OAS) Harry Cheung is 67 years of age. He was a long term employee of a Canadian public company that sponsored a very generous registered pension plan (RPP). Now that he has retired, he is receiving an annual pension benefit of $92,000. Since his retirement, he has continued to work on a part time basis as a consultant. In 2021, his net income from his consulting work was $41,000. Harry has not applied to receive OAS. Harry's wife, Loretta, is 63 years of age. She has never worked outside the home and, in 2021, her only income is interest of $2,800 on term deposits. Neither Harry nor Loretta have any tax credits other than the basic personal credit, spousal credit, age credit, and pension income credit. Further, they have no taxable income deductions. Harry will split his 2021 pension income with Loretta on a 50:50 basis. Required: Calculate the amount of 2021 federal income tax savings that would result from pension income splitting.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate Harry and Lorettas combined taxable income for the year 2021 we need to tak...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started