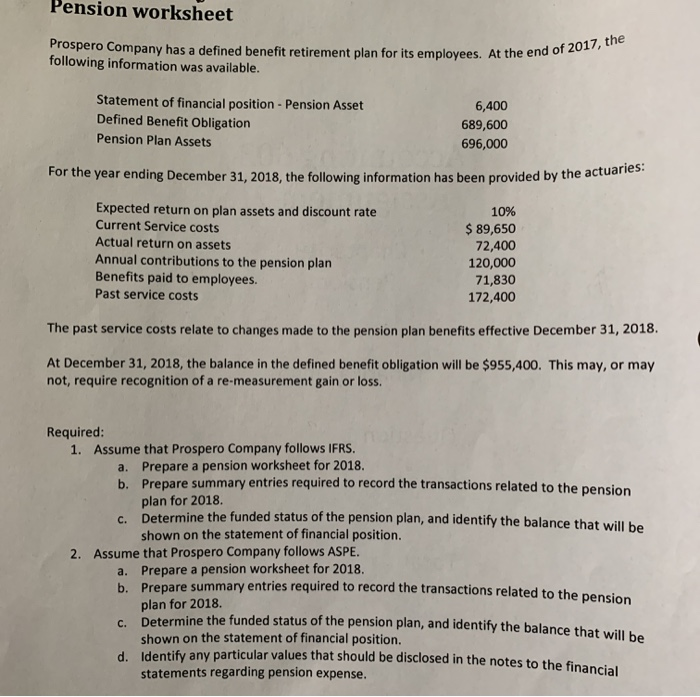

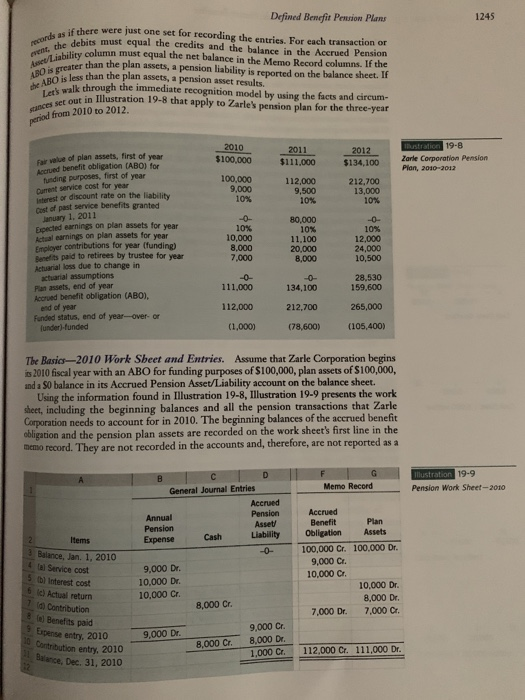

Pension worksheet Prospero Company has a defined benefit retirement plan for its employees. At the end of 2017, the following information was available. Statement of financial position - Pension Asset Defined Benefit Obligation 6,400 689,600 Pension Plan Assets 696,000 For the year ending December 31, 2018, the following information has been provided by the actuaries: Expected return on Current Service costs plan assets and discount rate 10% $89,650 72,400 120,000 Actual return on assets Annual contributions to the pension plan Benefits paid to employees. Past service costs 71,830 172,400 The past service costs relate to changes made to the pension plan benefits effective December 31, 2018. At December 31, 2018, the balance in the defined benefit obligation willl be $955,400. This may, or may not, require recognition of a re-measurement gain or loss. Required: 1. Assume that Prospero Company follows IFRS. Prepare a pension worksheet for 2018. Prepare summary entries required to record the transactions related to the pension a. b. plan for 2018. Determine the funded status of the pension plan, and identify the balance that will be C. shown on the statement of financial position. 2. Assume that Prospero Company follows ASPE a. Prepare a pension worksheet for 2018. b. Prepare summary entries required to record the transactions related to the pension plan for 2018. C. Determine the funded status of the pension plan, and identify the balance that will be shown on the statement of financial position. d Identify any particular values that should be disclosed in the notes to the financial statements regarding pension expense. Defined Benefit Pension Plans 1245 records as if there were just one set for recording the entries. For each transaction or event, the debits must equal the credits and the balance in the Accrued Pension Asset/Liability column must equal the net balance in the Memo Record columns. If the ABO is greater than the plan assets, a pension liability is reported on the balance sheet. If the ABO is less than the plan assets, a pension asset results. Let's walk through the immediate recognition model by using the facts and circum- Snces set out in Illustration 19-8 that apply to Zarle's pension plan for the three-year period from 2010 to 2012. ustration 19-8 2010 2011 2012 ar value of plan assets, first of vear Accrued benefit obligation (ABO) for tunding purposes, first of year Darent service cost for year isterest or discount rate on the liability cost of past service benefits granted Zarle Corporation Pension Plan, 2010-2012 $100,000 $111,000 $134,100 100,000 9,000 10 % 112,000 9,500 10% 212.700 13,000 10 % January 1, 2011 Expected earnings on plan assets for year Actual earnings on plan assets for year Employer contributions for year (funding) Benefits paid to retirees by trustee for year Actuarial loss due to change in actuarial assumptions Plan assets, end of year Accrued benefit obligation (ABO), -0- 10 % 10,000 8,000 7,000 -0- 80,000 10% 11,100 20,000 8,000 10% 12,000 24,000 10,500 -0- 28,530 159.600 -0- 111,000 134,100 end of year Funded status, end of year-over- or (under)-funded 112,000 265,000 212,700 (1,000) (78,600) (105,400) The Basics-2010 Work Sheet and Entries. Assume that Zarle Corporation begins is 2010 fiscal year with an ABO for funding purposes of $100,000, plan assets of $100,000, and a S0 balance in its Accrued Pension Asset/Liability account on the balance sheet. Using the information found in Illustration 19-8, Illustration 19-9 presents the work sheet, including the beginning balances and all the pension transactions that Zarle Corporation needs to account for in 2010. The beginning balances of the accrued benefit obligation and the pension plan meno record. They are not recorded in the accounts and, therefore, are not reported as a assets are recorded on the work sheet's first line in the lustration 19-9 G Memo Record Pension Work Sheet-2010 General Journal Entries Acued Pension Asset Liability Accrued Benefit Annual Pension Expense Plan Assets Obligation Cash Items 100,000 Cr. 100,000 Dr. -0- 3 Balance, Jan. 1, 2010 fal Service cost 5 e) Interest cost 6 ic) Actual return 10 Contribution Benefits paid Expense entry, 2010 Contribution entry, 2010 Balance, Dec. 31, 2010 9,000 Cr 9,000 Dr. 10,000 Cr. 10,000 Dr. 10,000 Dr. 10,000 Cr. 8,000 Dr. 8.000 Cr. 7,000 Cr. 7,000 Dr. 9,000 Cr 8,000 Dr. 1,000 Cr 9,000 Dr. 0 Cr. 112,000 Cr. 111,000 Dr. Pension worksheet Prospero Company has a defined benefit retirement plan for its employees. At the end of 2017, the following information was available. Statement of financial position - Pension Asset Defined Benefit Obligation 6,400 689,600 Pension Plan Assets 696,000 For the year ending December 31, 2018, the following information has been provided by the actuaries: Expected return on Current Service costs plan assets and discount rate 10% $89,650 72,400 120,000 Actual return on assets Annual contributions to the pension plan Benefits paid to employees. Past service costs 71,830 172,400 The past service costs relate to changes made to the pension plan benefits effective December 31, 2018. At December 31, 2018, the balance in the defined benefit obligation willl be $955,400. This may, or may not, require recognition of a re-measurement gain or loss. Required: 1. Assume that Prospero Company follows IFRS. Prepare a pension worksheet for 2018. Prepare summary entries required to record the transactions related to the pension a. b. plan for 2018. Determine the funded status of the pension plan, and identify the balance that will be C. shown on the statement of financial position. 2. Assume that Prospero Company follows ASPE a. Prepare a pension worksheet for 2018. b. Prepare summary entries required to record the transactions related to the pension plan for 2018. C. Determine the funded status of the pension plan, and identify the balance that will be shown on the statement of financial position. d Identify any particular values that should be disclosed in the notes to the financial statements regarding pension expense. Defined Benefit Pension Plans 1245 records as if there were just one set for recording the entries. For each transaction or event, the debits must equal the credits and the balance in the Accrued Pension Asset/Liability column must equal the net balance in the Memo Record columns. If the ABO is greater than the plan assets, a pension liability is reported on the balance sheet. If the ABO is less than the plan assets, a pension asset results. Let's walk through the immediate recognition model by using the facts and circum- Snces set out in Illustration 19-8 that apply to Zarle's pension plan for the three-year period from 2010 to 2012. ustration 19-8 2010 2011 2012 ar value of plan assets, first of vear Accrued benefit obligation (ABO) for tunding purposes, first of year Darent service cost for year isterest or discount rate on the liability cost of past service benefits granted Zarle Corporation Pension Plan, 2010-2012 $100,000 $111,000 $134,100 100,000 9,000 10 % 112,000 9,500 10% 212.700 13,000 10 % January 1, 2011 Expected earnings on plan assets for year Actual earnings on plan assets for year Employer contributions for year (funding) Benefits paid to retirees by trustee for year Actuarial loss due to change in actuarial assumptions Plan assets, end of year Accrued benefit obligation (ABO), -0- 10 % 10,000 8,000 7,000 -0- 80,000 10% 11,100 20,000 8,000 10% 12,000 24,000 10,500 -0- 28,530 159.600 -0- 111,000 134,100 end of year Funded status, end of year-over- or (under)-funded 112,000 265,000 212,700 (1,000) (78,600) (105,400) The Basics-2010 Work Sheet and Entries. Assume that Zarle Corporation begins is 2010 fiscal year with an ABO for funding purposes of $100,000, plan assets of $100,000, and a S0 balance in its Accrued Pension Asset/Liability account on the balance sheet. Using the information found in Illustration 19-8, Illustration 19-9 presents the work sheet, including the beginning balances and all the pension transactions that Zarle Corporation needs to account for in 2010. The beginning balances of the accrued benefit obligation and the pension plan meno record. They are not recorded in the accounts and, therefore, are not reported as a assets are recorded on the work sheet's first line in the lustration 19-9 G Memo Record Pension Work Sheet-2010 General Journal Entries Acued Pension Asset Liability Accrued Benefit Annual Pension Expense Plan Assets Obligation Cash Items 100,000 Cr. 100,000 Dr. -0- 3 Balance, Jan. 1, 2010 fal Service cost 5 e) Interest cost 6 ic) Actual return 10 Contribution Benefits paid Expense entry, 2010 Contribution entry, 2010 Balance, Dec. 31, 2010 9,000 Cr 9,000 Dr. 10,000 Cr. 10,000 Dr. 10,000 Dr. 10,000 Cr. 8,000 Dr. 8.000 Cr. 7,000 Cr. 7,000 Dr. 9,000 Cr 8,000 Dr. 1,000 Cr 9,000 Dr. 0 Cr. 112,000 Cr. 111,000 Dr