Answered step by step

Verified Expert Solution

Question

1 Approved Answer

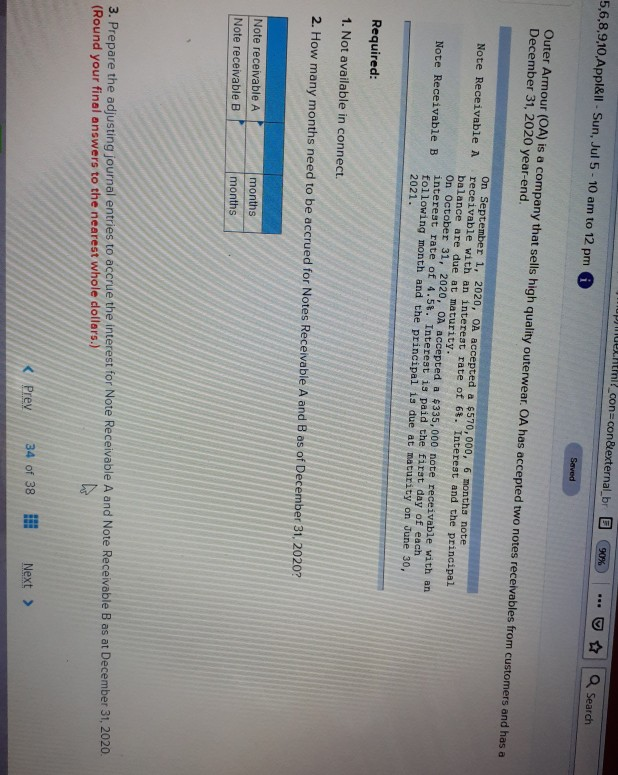

pentin_con=con&external_br 5,6,8,9,10,Appl&ll - Sun, Jul 5 - 10 am to 12 pm 90% : Search Saved Outer Armour (OA) is a company that sells high

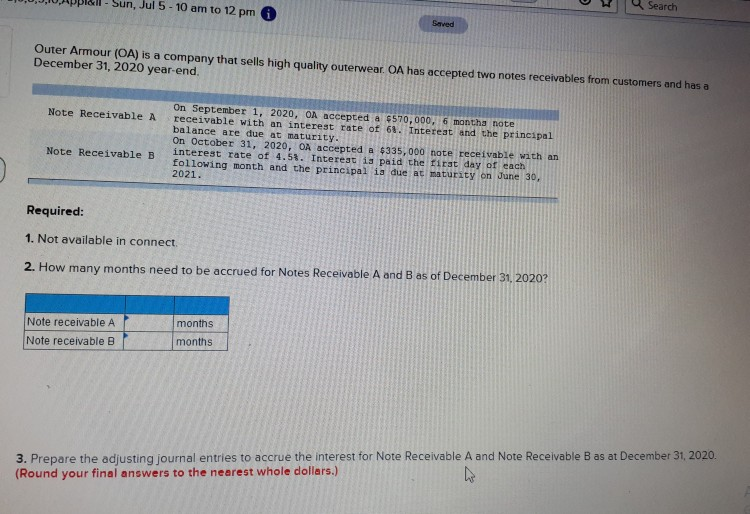

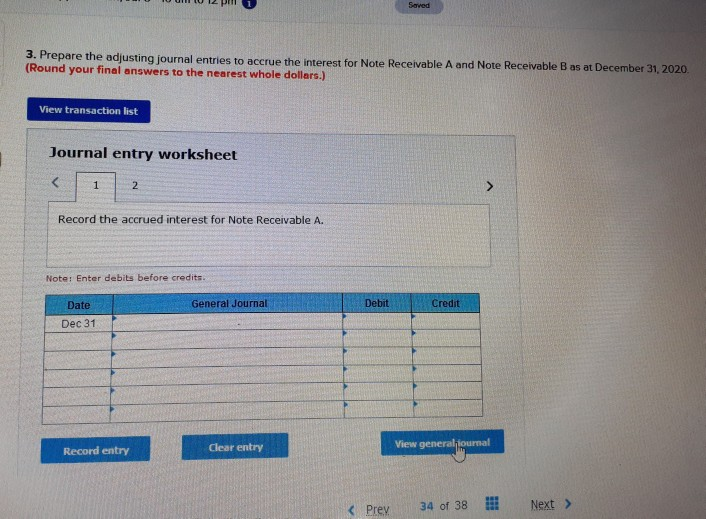

pentin_con=con&external_br 5,6,8,9,10,Appl&ll - Sun, Jul 5 - 10 am to 12 pm 90% : Search Saved Outer Armour (OA) is a company that sells high quality outerwear. OA has accepted two notes receivables from customers and has a December 31, 2020 year-end. Note Receivable A On September 1, 2020, OA accepted a 6570,000, 6 months note receivable with an interest rate of 63. Interest and the principal balance are due at maturity. On October 31, 2020, OA accepted a $335,000 note receivable with an interest rate of 4.53. Interest is paid the first day of each following month and the principal is due at maturity on June 30, 2021. Note Receivable B Required: 1. Not available in connect. 2. How many months need to be accrued for Notes Receivable A and B as of December 31, 2020? Note receivable A Note receivable B months months 3. Prepare the adjusting journal entries to accrue the interest for Note Receivable A and Note Receivable B as at December 31, 2020 (Round your final answers to the nearest whole dollars.) Sun, Jul 5 - 10 am to 12 pm a Search Saved Outer Armour (OA) is a company that sells high quality outerwear. OA has accepted two notes receivables from customers and has a December 31, 2020 year-end. Note Receivable A On September 1, 2020, OA accepted a 4570,000, 6 months note receivable with an interest rate of 6. Interest and the principal balance are due at maturity. On October 31, 2020, OA accepted a $335,000 note receivable with an interest rate of 4.51. Interest is paid the first day of each following month and the principal is due at maturity on June 30, 2021. Note Receivable B Required: 1. Not available in connect 2. How many months need to be accrued for Notes Receivable A and B as of December 31, 2020? Note receivable A Note receivable B months months 3. Prepare the adjusting journal entries to accrue the interest for Note Receivable A and Note Receivable B as at December 31, 2020. (Round your final answers to the nearest whole dollars.) Saved 3. Prepare the adjusting journal entries to accrue the interest for Note Receivable A and Note Receivable B as at December 31, 2020 (Round your final answers to the nearest whole dollars.) View transaction list Journal entry worksheet 1 2 Record the accrued interest for Note Receivable A. Note: Enter debits before credits General Journal Debit Credit Date Dec 31 Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started