Answered step by step

Verified Expert Solution

Question

1 Approved Answer

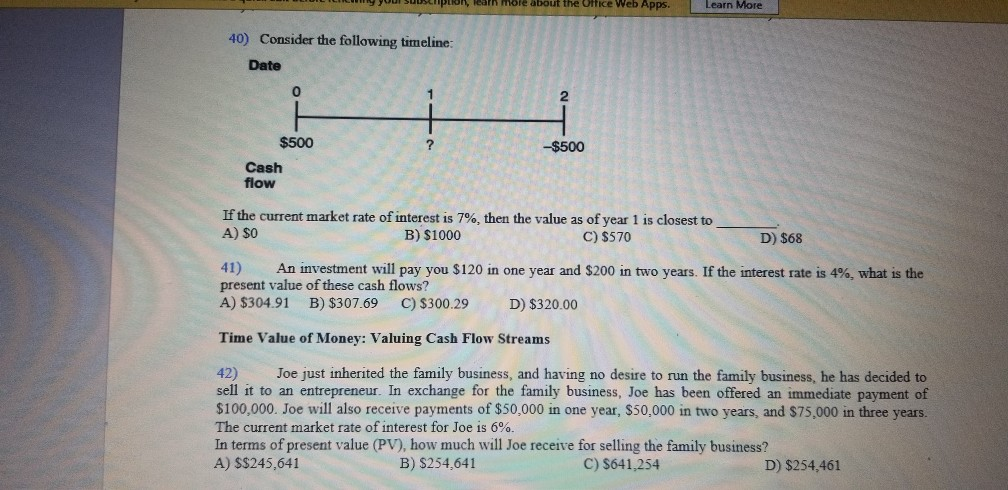

penyre more about the Ulrice Web Apps. Learn More 40) Consider the following timeline: Date -$500 $500 Cash flow If the current market rate of

penyre more about the Ulrice Web Apps. Learn More 40) Consider the following timeline: Date -$500 $500 Cash flow If the current market rate of interest is 7%, then the value as of year 1 is closest to A) $0 B) $1000 C) $570 D) $68 41) An investment will pay you $120 in one year and $200 in two years. If the interest rate is 4%, what is the present value of these cash flows? A) $304.91 B) $307.69 C) $300.29 D ) $320.00 Time Value of Money: Valuing Cash Flow Streams 42) Joe just inherited the family business, and having no desire to run the family business, he has decided to sell it to an entrepreneur. In exchange for the family business, Joe has been offered an immediate payment of $100,000. Joe will also receive payments of $50,000 in one year, $50,000 in two years, and $75,000 in three years. The current market rate of interest for Joe is 6%. In terms of present value (PV), how much will Joe receive for selling the family business? A) S$245,641 B) $254.641 C) $641,254 D) $254,461

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started