please use math/excel to answer #2. would kelly management serve the interest of its shareholderbest by obtaining debt and repurchasing some of its common stock at the january 1986 market price of $25? great rating guaranteed!

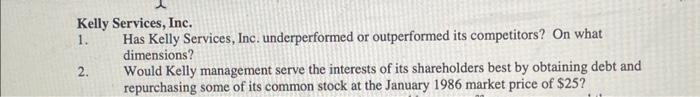

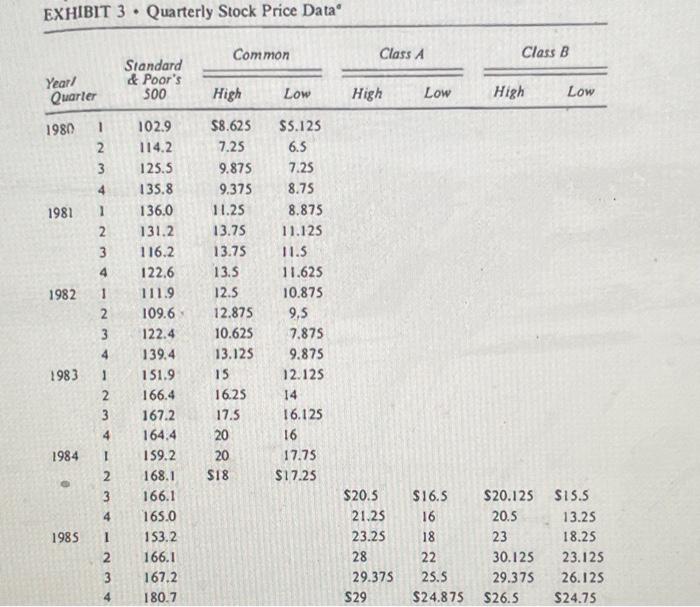

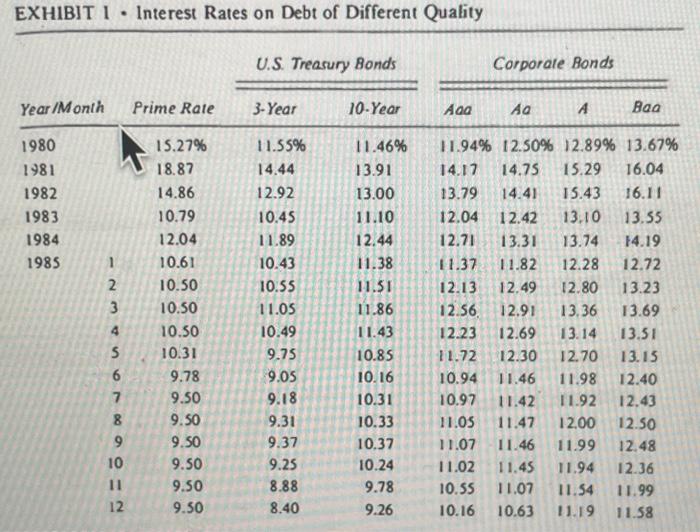

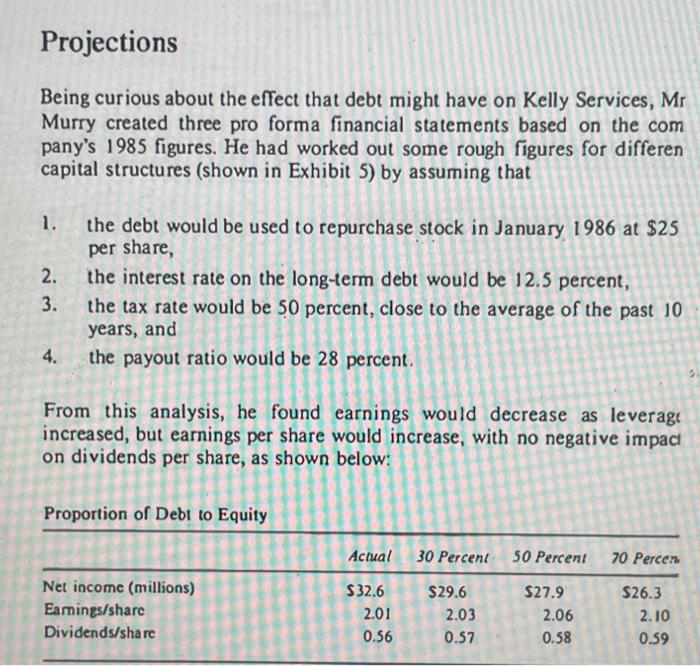

EXHIBIT 5 - Pro Forma 1986 Results for Alternative Capital EXHIBIT 3 Quarterly Stock Price Data Kelly Services, Inc. 1. Has Kelly Services, Inc. underperformed or outperformed its competitors? On what dimensions? 2. Would Kelly management serve the interests of its shareholders best by obtaining debt and repurchasing some of its common stock at the January 1986 market price of $25 ? EXHIBIT I - Interest Rates on Debt of Different Quality \begin{tabular}{|c|c|c|c|c|c|c|c|c|} \hline \multirow[b]{2}{*}{ Year/Month } & \multirow{2}{*}{\multicolumn{2}{|c|}{ Prime Rate }} & \multicolumn{2}{|c|}{ U.S. Treasury Bonds } & \multicolumn{4}{|c|}{ Corporale Bonds } \\ \hline & & & 3-Year & 10.Year & Aaa & Aa & A & Baa \\ \hline 1980 & & 15.27% & 11.55% & 11.46% & 11.94% & 12.50% & 12.89% & 13.67% \\ \hline 1981 & & 18.87 & 14.44 & 13.91 & 14.17 & 14.75 & 15.29 & 16.04 \\ \hline 1982 & & 14.86 & 12.92 & 13.00 & 13.79 & 14.41 & 15.43 & 16.11 \\ \hline 1983 & & 10.79 & 10.45 & 11.10 & 12.04 & 12.42 & 13.10 & 13.55 \\ \hline 1984 & & 12.04 & 11.89 & 12.44 & 12.71 & 13.31 & 13.74 & 14.19 \\ \hline 1985 & 1 & 10.61 & 10.43 & 11.38 & 11.37 & 11.82 & 12.28 & 12.72 \\ \hline & 2 & 10.50 & 10.55 & 11.51 & 12.13 & 12.49 & 12.80 & 13.23 \\ \hline & 3 & 10.50 & 11.05 & 11.86 & 12.56 & 12.91 & 13.36 & 13.69 \\ \hline & 4 & 10.50 & 10.49 & 11.43 & 12.23 & 12.69 & 13.14 & 13.51 \\ \hline & 5 & 10.31 & 9.75 & 10.85 & 11.72 & 12.30 & 12.70 & 13.15 \\ \hline & 6 & 9.78 & 9.05 & 10.16 & 10.94 & 11.46 & 11.98 & 12.40 \\ \hline & 7 & 9.50 & 9.18 & 10.31 & 10.97 & 11.42 & 11.92 & 12.43 \\ \hline & 8 & 9.50 & 9.31 & 10.33 & 11.05 & 11.47 & 12.00 & 12.50 \\ \hline & 9 & 9.50 & 9.37 & 10.37 & 11.07 & 11.46 & 11.99 & 12.48 \\ \hline & 10 & 9.50 & 9.25 & 10.24 & 11.02 & 11.45 & 11.94 & 12.36 \\ \hline & 11 & 9.50 & 8.88 & 9.78 & 10.55 & 11.07 & 11.54 & 11.99 \\ \hline & 12 & 9.50 & 8.40 & 9.26 & 10.16 & 10.63 & 11.19 & 11.58 \\ \hline \end{tabular} Being curious about the effect that debt might have on Kelly Services, Mr Murry created three pro forma financial statements based on the com pany's 1985 figures. He had worked out some rough figures for differen capital structures (shown in Exhibit 5) by assuming that 1. the debt would be used to repurchase stock in January 1986 at $25 per share, 2. the interest rate on the long-term debt would be 12.5 percent, 3. the tax rate would be 50 percent, close to the average of the past 10 years, and 4. the payout ratio would be 28 percent. From this analysis, he found earnings would decrease as leveragt increased, but earnings per share would increase, with no negative impact on dividends per share, as shown below