Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pep Corporation pays $88,000 for 80 percent of the outstanding voting stock of Sap Corporation on January 1, 2011, when Sap Corporation's stockholders' equity

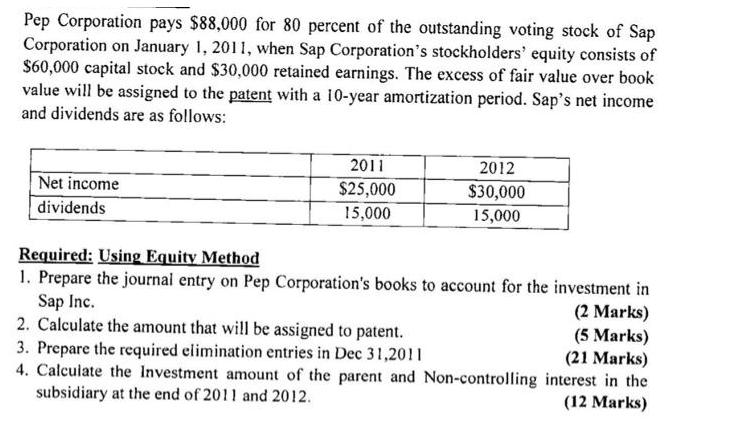

Pep Corporation pays $88,000 for 80 percent of the outstanding voting stock of Sap Corporation on January 1, 2011, when Sap Corporation's stockholders' equity consists of $60,000 capital stock and $30,000 retained earnings. The excess of fair value over book value will be assigned to the patent with a 10-year amortization period. Sap's net income and dividends are as follows: Net income dividends 2011 $25,000 15,000 2012 $30,000 15,000 Required: Using Equity Method 1. Prepare the journal entry on Pep Corporation's books to account for the investment in Sap Inc. 2. Calculate the amount that will be assigned to patent. 3. Prepare the required elimination entries in Dec 31,2011 4. Calculate the Investment amount of the parent and Non-controlling subsidiary at the end of 2011 and 2012. (2 Marks) (5 Marks) (21 Marks) interest in the (12 Marks)

Step by Step Solution

★★★★★

3.54 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 Pep Corporation Investment in Sap Inc 60000 Common Stock 60000 2 The amount that will be assigned to patent is 18000 3 Pep Corporation Sap In...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started