Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pep LTD has a total assets 6.4 million of which current assets. 0.4 million of the total assets is current assets. Revenue is N$20 million

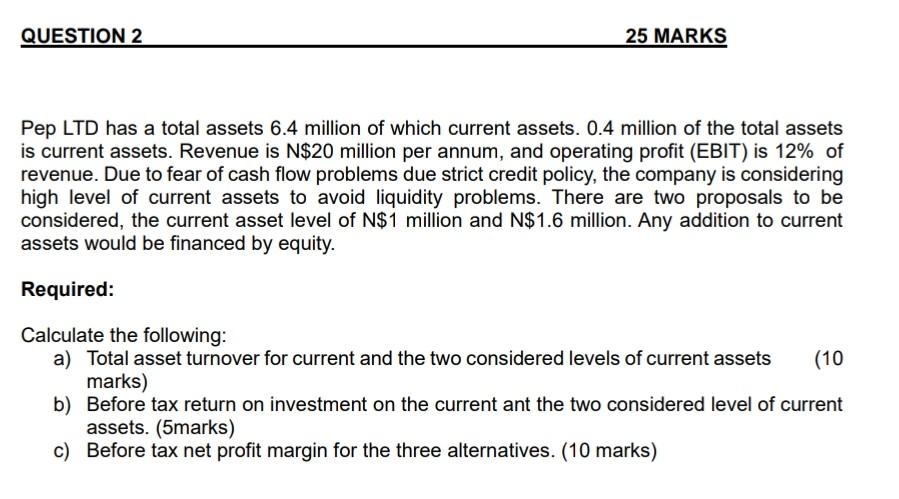

Pep LTD has a total assets 6.4 million of which current assets. 0.4 million of the total assets is current assets. Revenue is N$20 million per annum, and operating profit (EBIT) is 12% of revenue. Due to fear of cash flow problems due strict credit policy, the company is considering high level of current assets to avoid liquidity problems. There are two proposals to be considered, the current asset level of N$1 million and N$1.6 million. Any addition to current assets would be financed by equity. Required: Calculate the following: a) Total asset turnover for current and the two considered levels of current assets (10 marks) b) Before tax return on investment on the current ant the two considered level of current assets. (5marks) c) Before tax net profit margin for the three alternatives. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started