Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pepper Company, which is a calendar-year-reporting company, purchased 65% of the common stock of Salt Company, on December 31, 2019, for 20,000 shares of

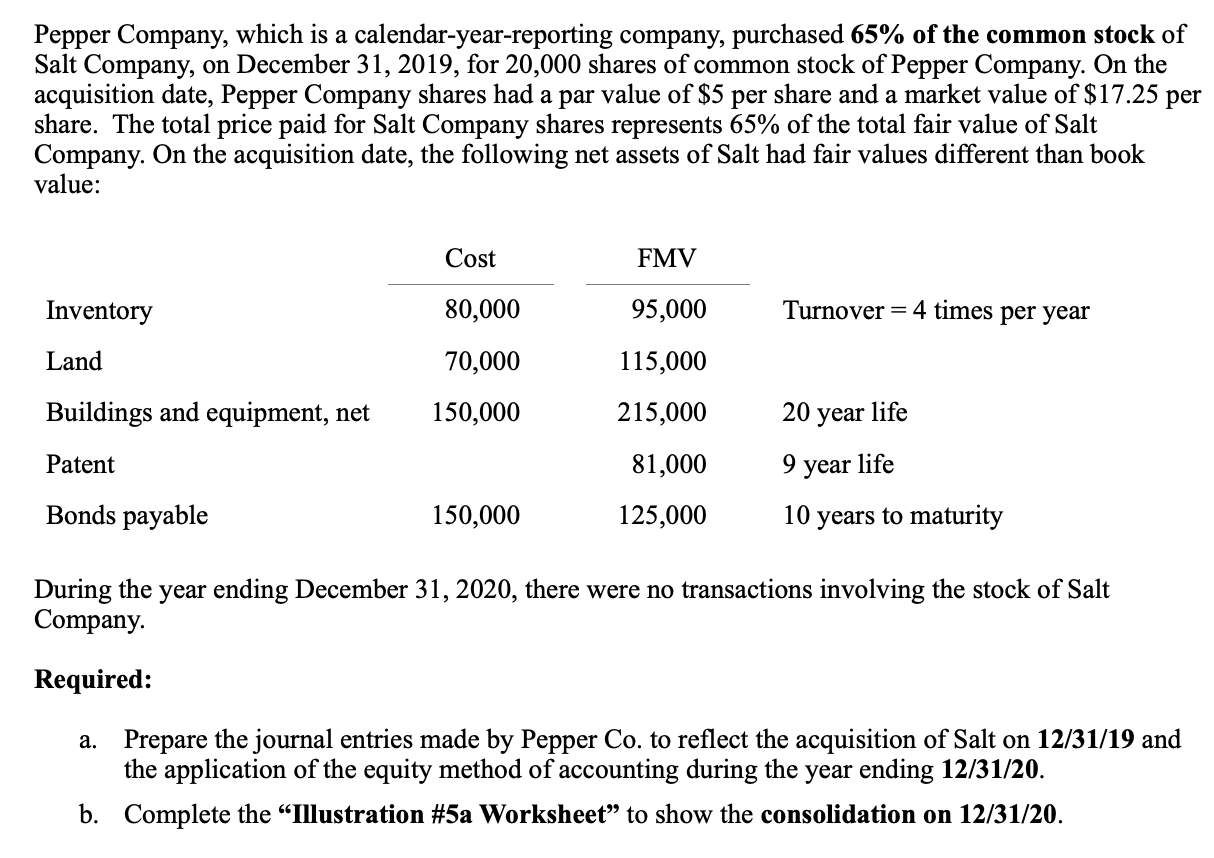

Pepper Company, which is a calendar-year-reporting company, purchased 65% of the common stock of Salt Company, on December 31, 2019, for 20,000 shares of common stock of Pepper Company. On the acquisition date, Pepper Company shares had a par value of $5 per share and a market value of $17.25 per share. The total price paid for Salt Company shares represents 65% of the total fair value of Salt Company. On the acquisition date, the following net assets of Salt had fair values different than book value: Cost FMV Inventory 80,000 95,000 Turnover 4 times per year Land 70,000 115,000 Buildings and equipment, net 150,000 215,000 20 year life Patent 81,000 9 year life Bonds payable 150,000 125,000 10 years to maturity During the year ending December 31, 2020, there were no transactions involving the stock of Salt Company. Required: a. Prepare the journal entries made by Pepper Co. to reflect the acquisition of Salt on 12/31/19 and the application of the equity method of accounting during the year ending 12/31/20. b. Complete the "Illustration #5a Worksheet" to show the consolidation on 12/31/20.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started