Pepper Ltd have received the March bank statement from the bank. Chris, the owner is confused because the balance on the bank statement is

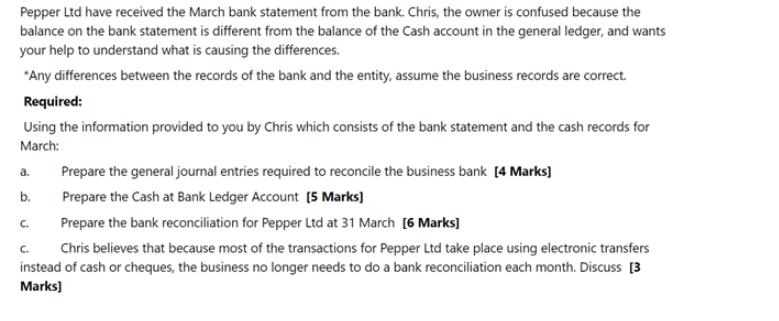

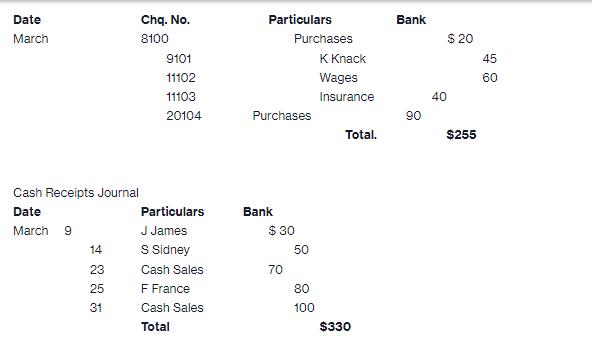

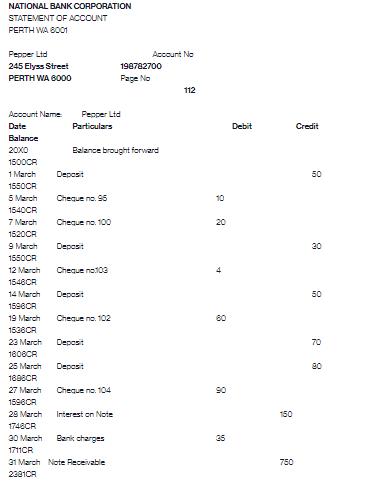

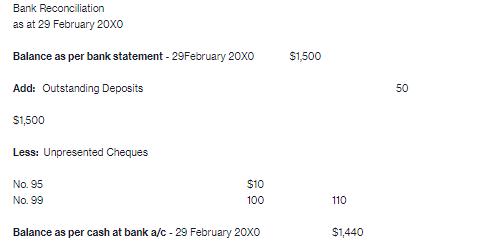

Pepper Ltd have received the March bank statement from the bank. Chris, the owner is confused because the balance on the bank statement is different from the balance of the Cash account in the general ledger, and wants your help to understand what is causing the differences. *Any differences between the records of the bank and the entity, assume the business records are correct. Required: Using the information provided to you by Chris which consists of the bank statement and the cash records for March: Prepare the general journal entries required to reconcile the business bank [4 Marks] Prepare the Cash at Bank Ledger Account [5 Marks] Prepare the bank reconciliation for Pepper Ltd at 31 March [6 Marks] Chris believes that because most of the transactions for Pepper Ltd take place using electronic transfers instead of cash or cheques, the business no longer needs to do a bank reconciliation each month. Discuss [3 Marks] a. b. C. Date March Cash Receipts Journal Date March 9 14 23 25 31 Chq. No. 8100 9101 11102 11103 20104 Particulars J James S Sidney Cash Sales F France Cash Sales Total Particulars Purchases Purchases Bank $30 70 50 80 100 K Knack Wages Insurance Total. $330 Bank 90 40 $ 20 $255 45 60 NATIONAL BANK CORPORATION STATEMENT OF ACCOUNT PERTH WA 8001 Pepper Ltd 245 Elyss Street PERTH WA 6000 Account Name Date Balance 2000 1500CR 1 March 1550CR 5 March 1540CR 7 March 1520CR 9 March 1550CR 12 March 1548CR 14 March 1596CR 19 March 1536CR 23 March 1808CR 25 March 1808CR 27 March 1596CR Pepper Ltd Particulars Deposit Balance brought forward Cheque no. 96 Cheque no. 100 Deposit Cheque no:103 Deposit Cheque no. 102 Deposit Deposit Cheque no. 104 29 March 1748CR 30 March Bank charges 1711CR 31 March Note Receivable 2381CR Interest on Note Account No 198782700 Page No 112 10 20 4 60 8 90 35 Debit 150 750 Credit 50 30 50 70 80 Bank Reconciliation as at 29 February 20X0 Balance as per bank statement - 29 February 20X0 Add: Outstanding Deposits $1,500 Less: Unpresented Cheques No. 95 No. 99 $10 100 Balance as per cash at bank a/c - 29 February 20X0 $1,500 110 $1,440 50

Step by Step Solution

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a General Journal Entries 1 To record the outstanding deposit Date March 31 Particulars Bank Debit 50 Particulars Accounts Receivable or Sales or Cash ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started