Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2017, Oval Company purchased 10% of the outstanding ordinary shares of Tin Corporation for P800,000, when the fair value of Tin's

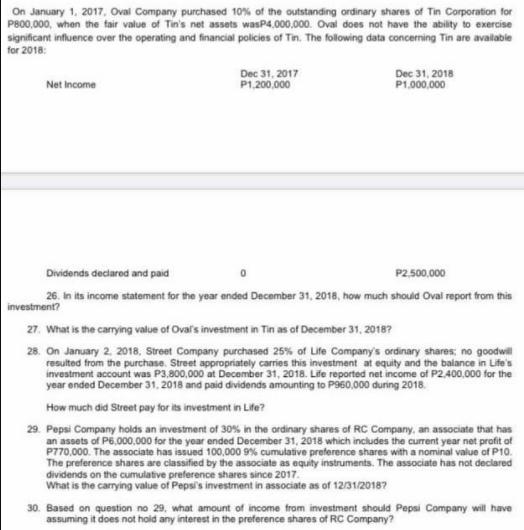

On January 1, 2017, Oval Company purchased 10% of the outstanding ordinary shares of Tin Corporation for P800,000, when the fair value of Tin's net assets wasP4.000,000. Oval does not have the ability to exercise significant influence over the operating and financial policies of Tin. The folowing data concerning Tin are avalable for 2018: Dec 31, 2017 P1,200,000 Dec 31, 2018 P1.000.000 Net income Dividends declared and paid P2.500,000 26. In its income statement for the year ended December 31, 2018, how much should Oval report from this investment? 27. What is the carrying value of Ovals investment in Tin as of December 31, 2018? 28. On January 2. 2018, Street Company purchased 25% of Life Company's ordinary shares, no goodwill resulted from the purchase. Street appropriately carries this investment at equity and the balance in Life's investment account was P3,800,000 at December 31, 2018. Life reported net income of P2.400,000 for the year ended December 31, 2018 and paid dividends amounting to P960,000 during 2018. How much did Street pay for its investment in Life? 29. Pepsi Company holds an investment of 30% in the ordinary shares of RC Company, an associate that has an assets of P6,000,000 for the year ended December 31, 2018 which includes the current year net profit of P770,000. The associate has issued 100,000 9% cumulative preference shares with a nominal value of P10. The preference shares are classified by the associate as equity instruments. The associate has not declared dividends on the cumulative preference shares since 2017. What is the carrying value of Pepsis investment in associate as of 12/31/20187 30. Based on question no 29, what amount of income from investment should Pepsi Company will have assuming it does not hoid any interest in the preference shares of RC Company?

Step by Step Solution

★★★★★

3.34 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Page No Date Questioon 26 and 27 Far Oval Company the income ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started