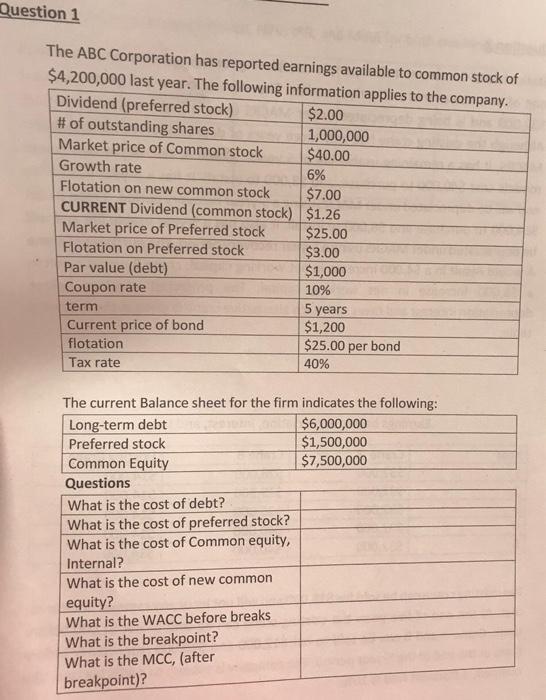

Question 1 The ABC Corporation has reported earnings available to common stock of $4,200,000 last year. The following information applies to the company. Dividend

Question 1 The ABC Corporation has reported earnings available to common stock of $4,200,000 last year. The following information applies to the company. Dividend (preferred stock) # of outstanding shares Market price of Common stock $2.00 1,000,000 $40.00 Growth rate 6% Flotation on new common stock $7.00 CURRENT Dividend (common stock) $1.26 Market price of Preferred stock Flotation on Preferred stock Par value (debt) Coupon rate $25.00 $3.00 $1,000 10% 5 years $1,200 $25.00 per bond term Current price of bond flotation Tax rate 40% The current Balance sheet for the firm indicates the following: Long-term debt Preferred stock $6,000,000 $1,500,000 $7,500,000 Common Equity Questions What is the cost of debt? What is the cost of preferred stock? What is the cost of Common equity, Internal? What is the cost of new common equity? What is the WACC before breaks What is the breakpoint? What is the MCC, (after breakpoint)? Question 1 The ABC Corporation has reported earnings available to common stock of $4,200,000 last year. The following information applies to the company. Dividend (preferred stock) # of outstanding shares Market price of Common stock $2.00 1,000,000 $40.00 Growth rate 6% Flotation on new common stock $7.00 CURRENT Dividend (common stock) $1.26 Market price of Preferred stock Flotation on Preferred stock Par value (debt) Coupon rate $25.00 $3.00 $1,000 10% 5 years $1,200 $25.00 per bond term Current price of bond flotation Tax rate 40% The current Balance sheet for the firm indicates the following: Long-term debt Preferred stock $6,000,000 $1,500,000 $7,500,000 Common Equity Questions What is the cost of debt? What is the cost of preferred stock? What is the cost of Common equity, Internal? What is the cost of new common equity? What is the WACC before breaks What is the breakpoint? What is the MCC, (after breakpoint)?

Step by Step Solution

3.33 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

BREAK POINT AMOUNT OF CAPITAL AT WHICH SOURCE OF CAPITAL CHANGES NEW MCC TO FIN...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started