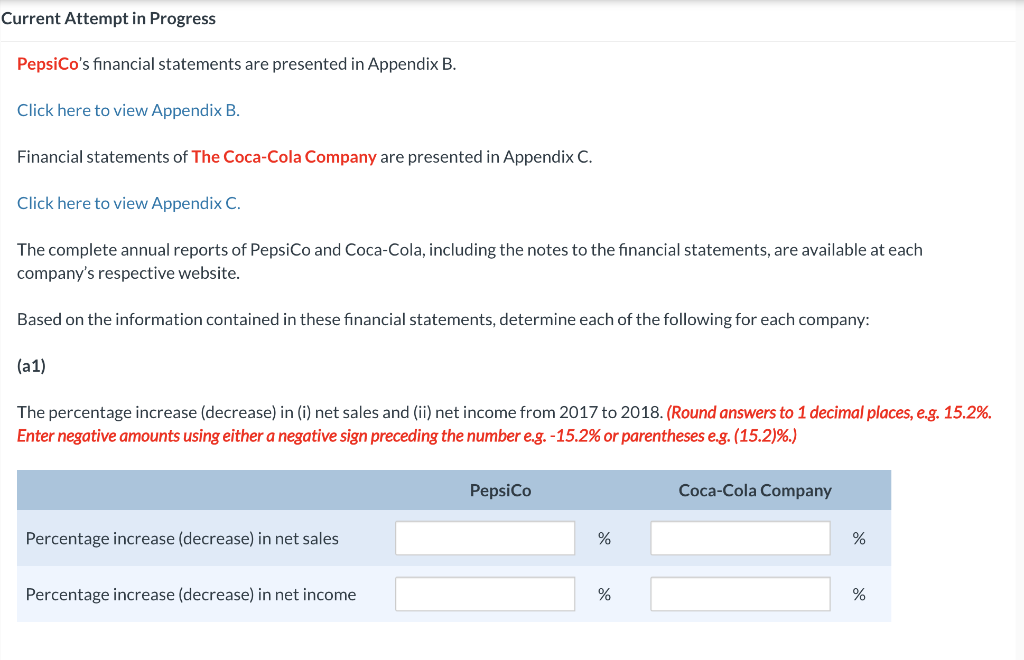

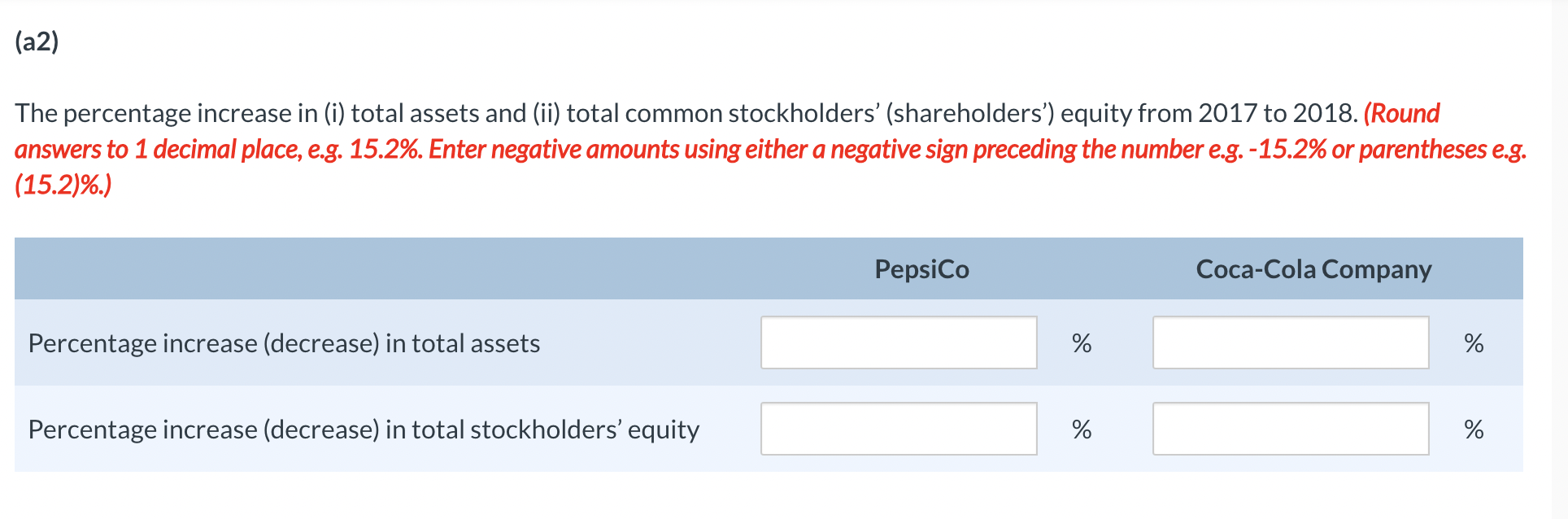

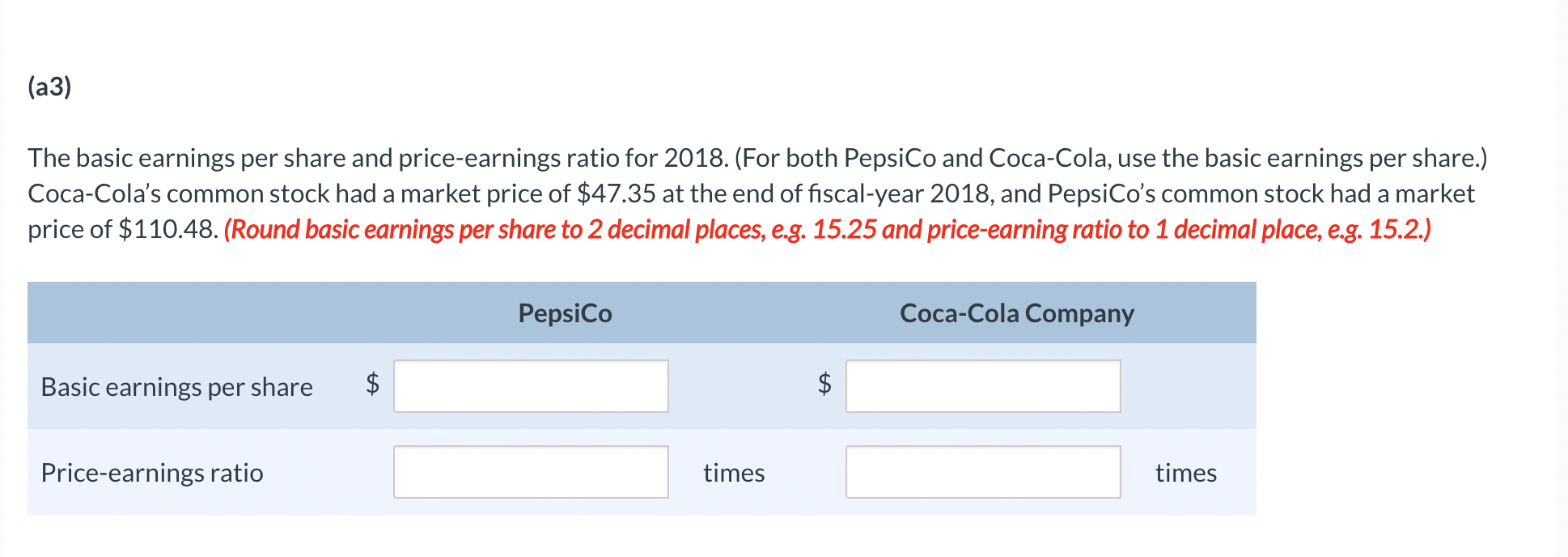

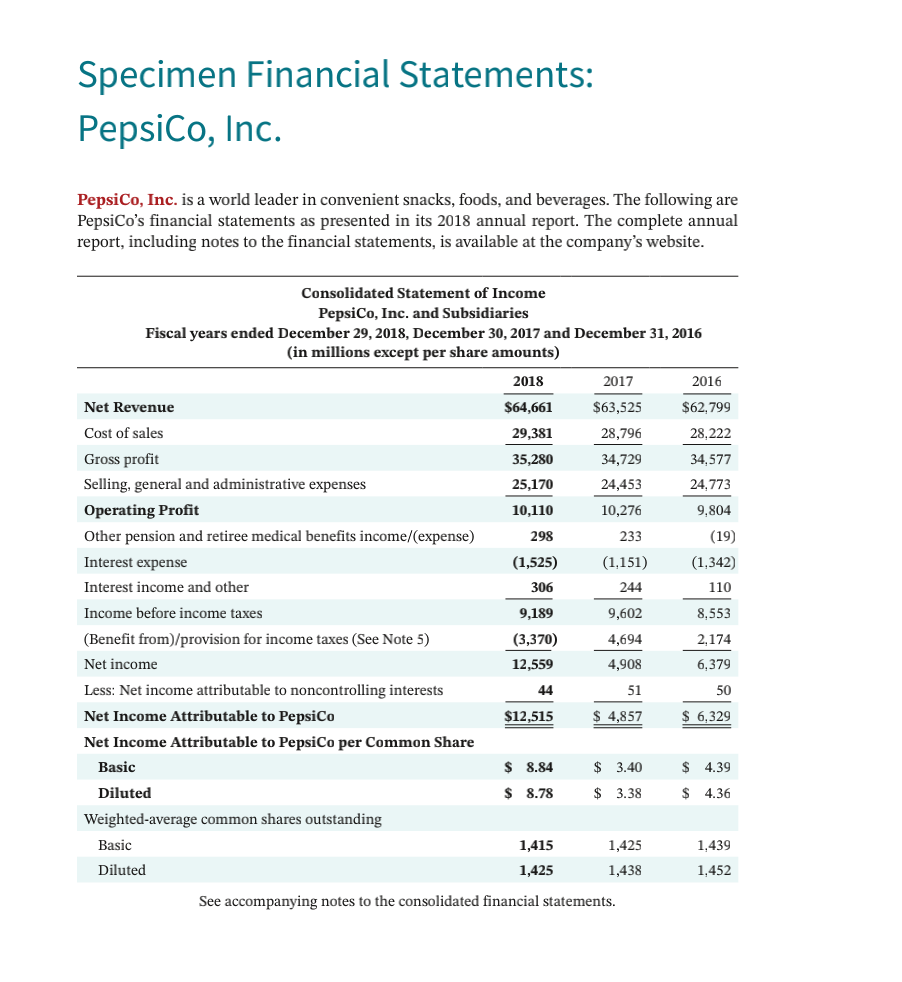

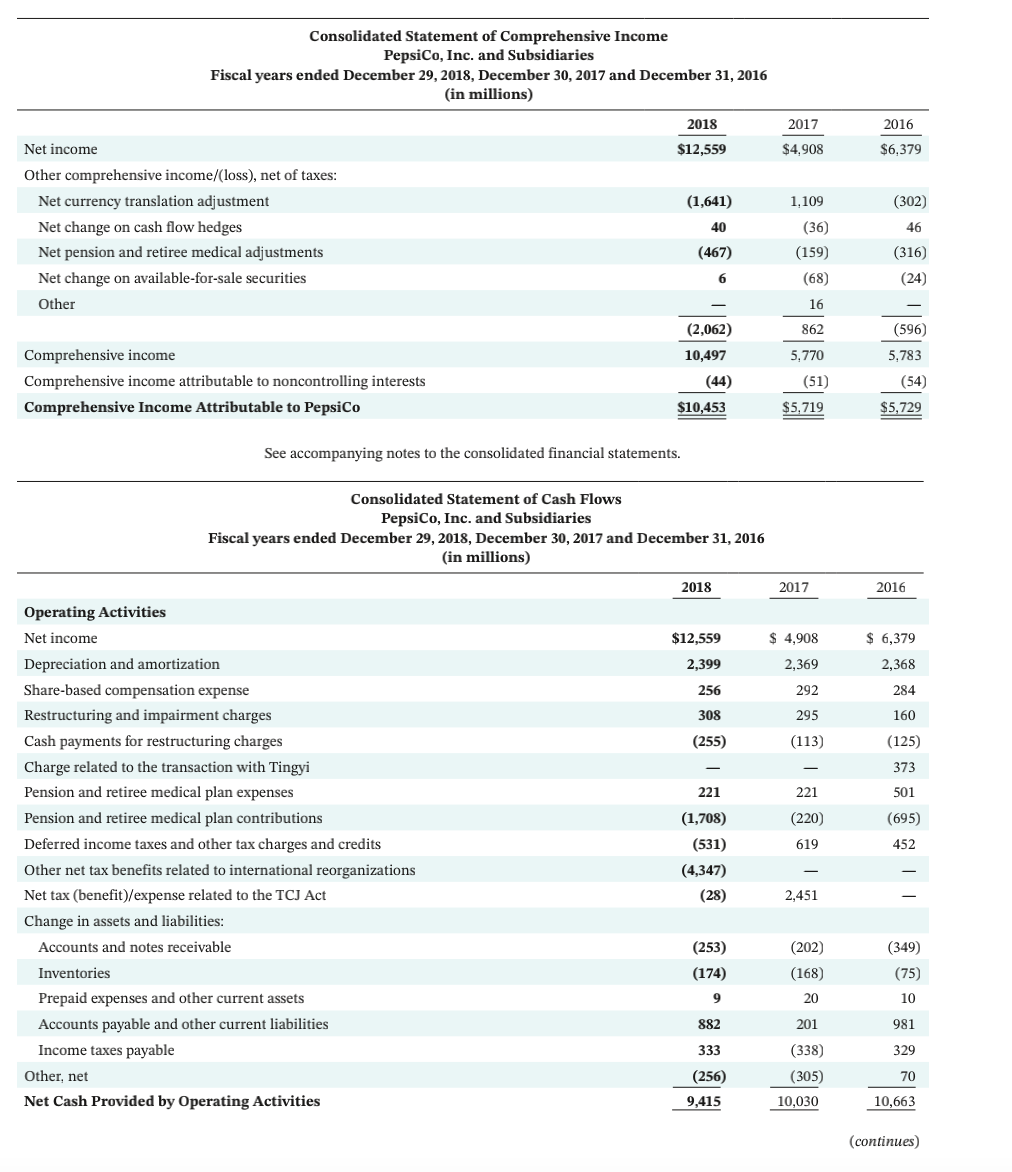

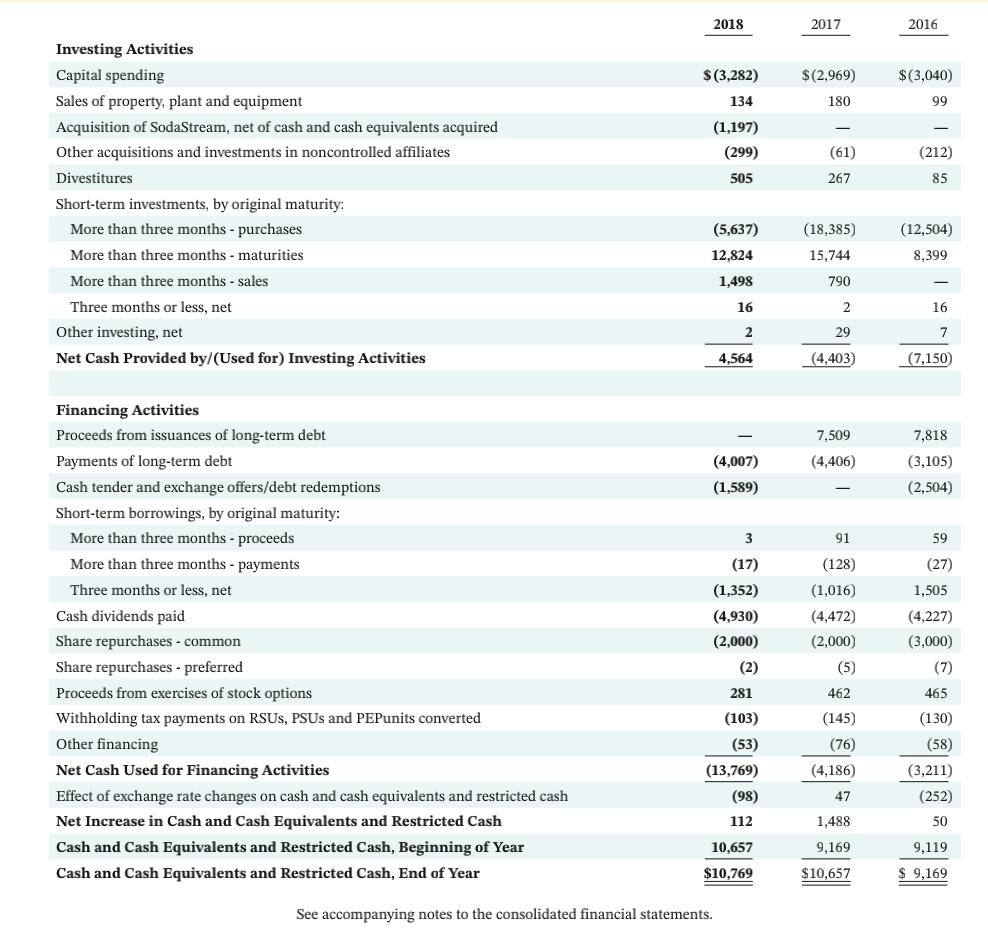

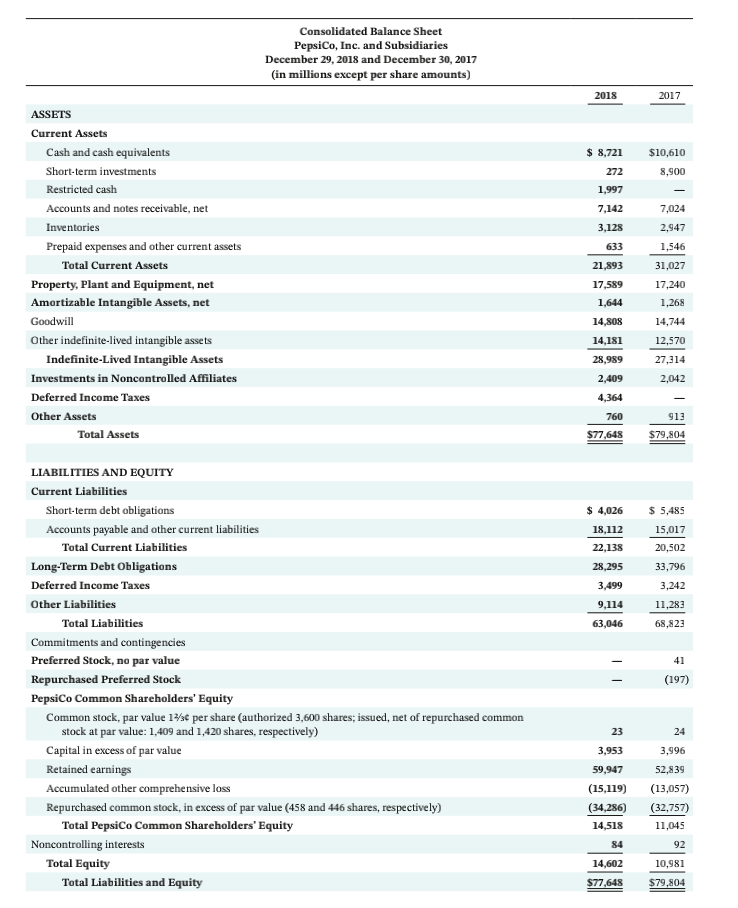

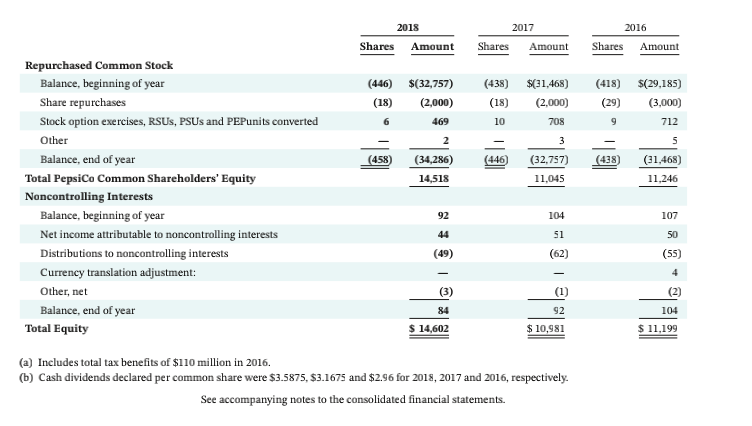

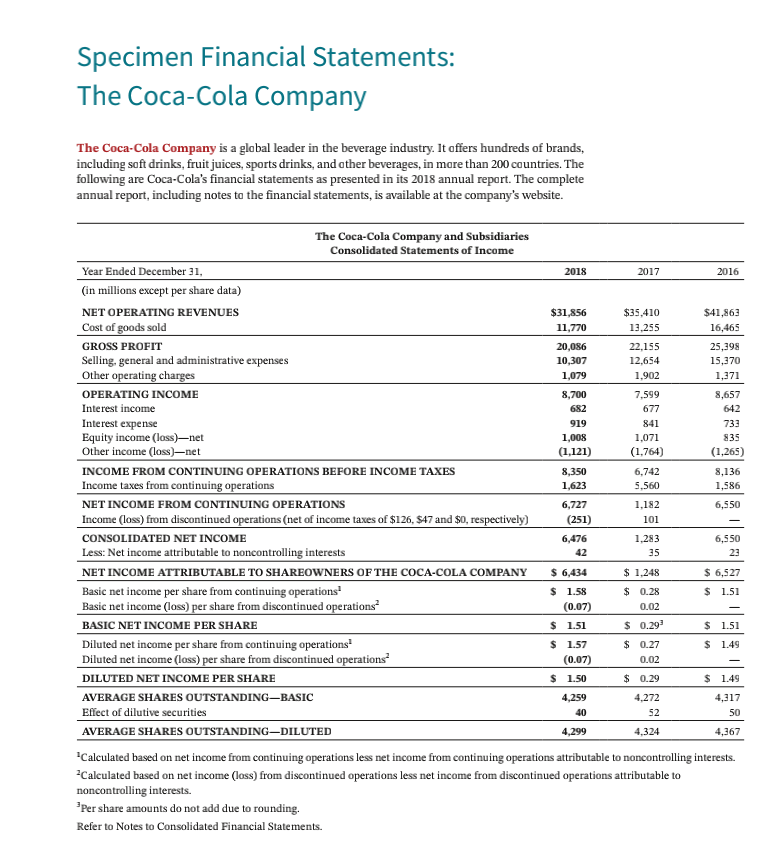

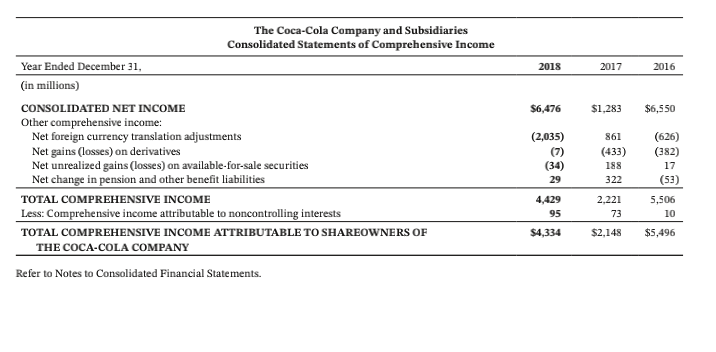

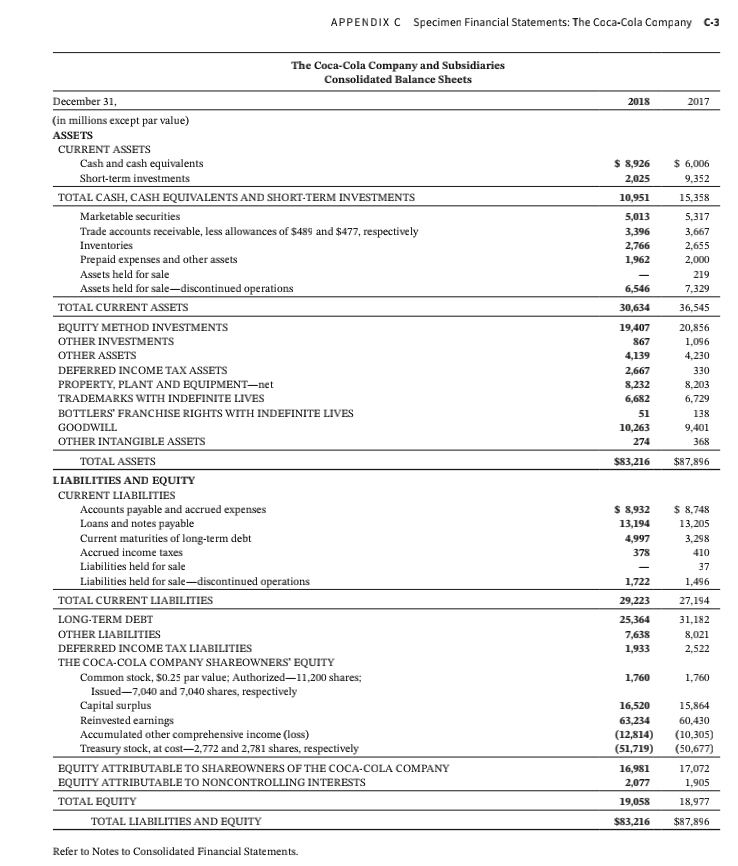

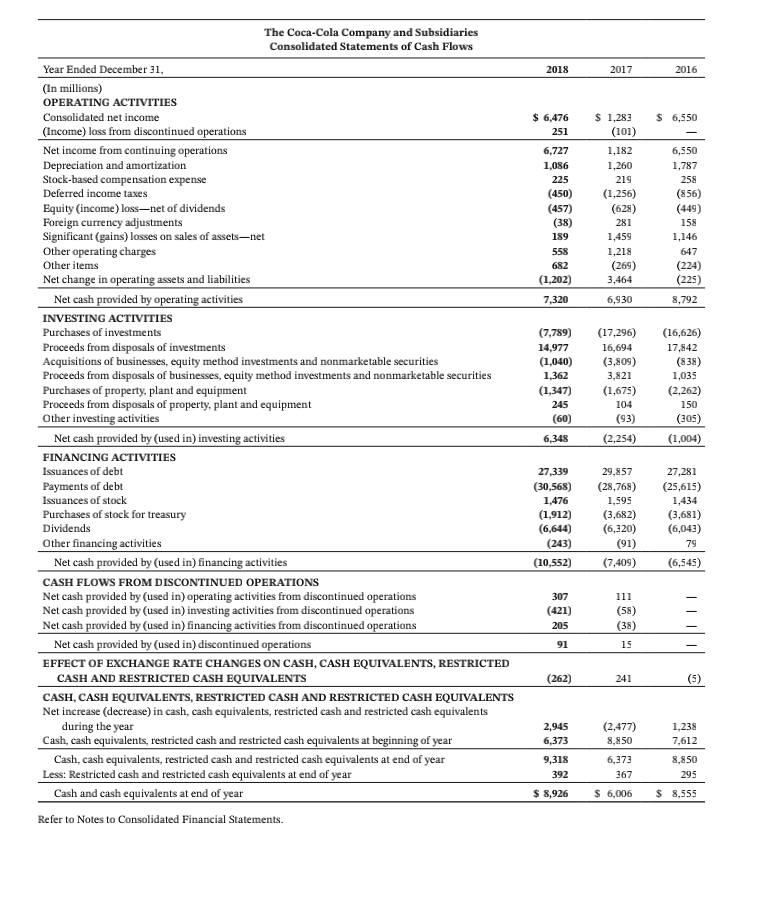

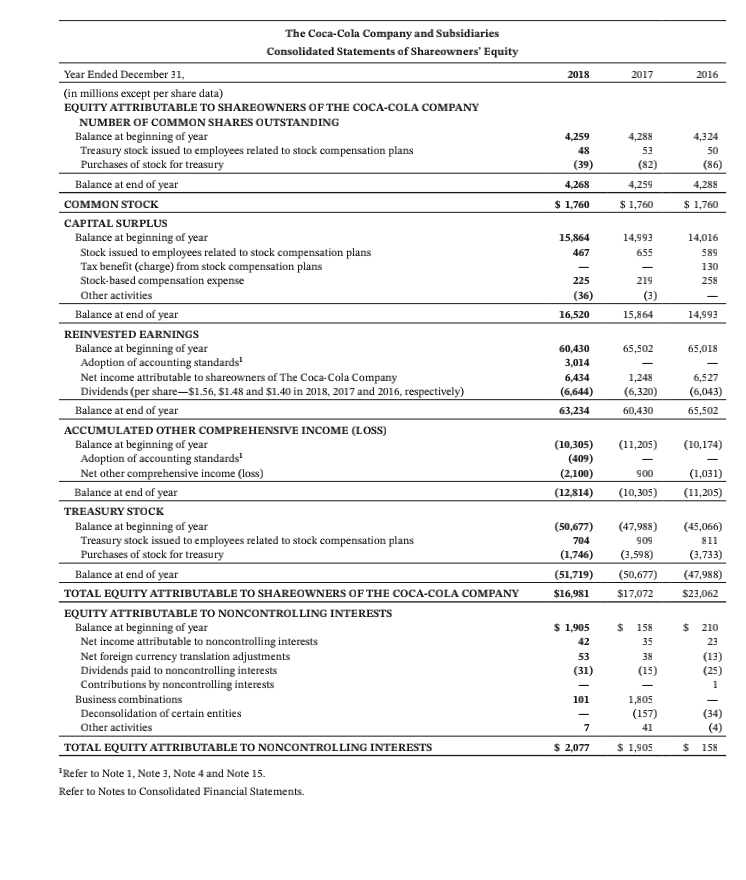

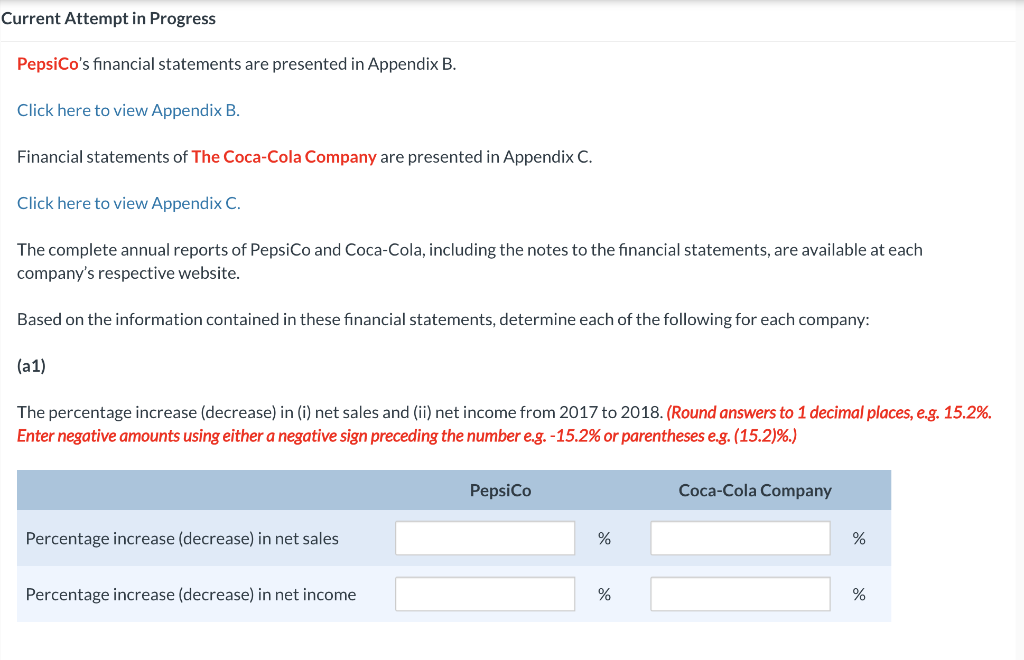

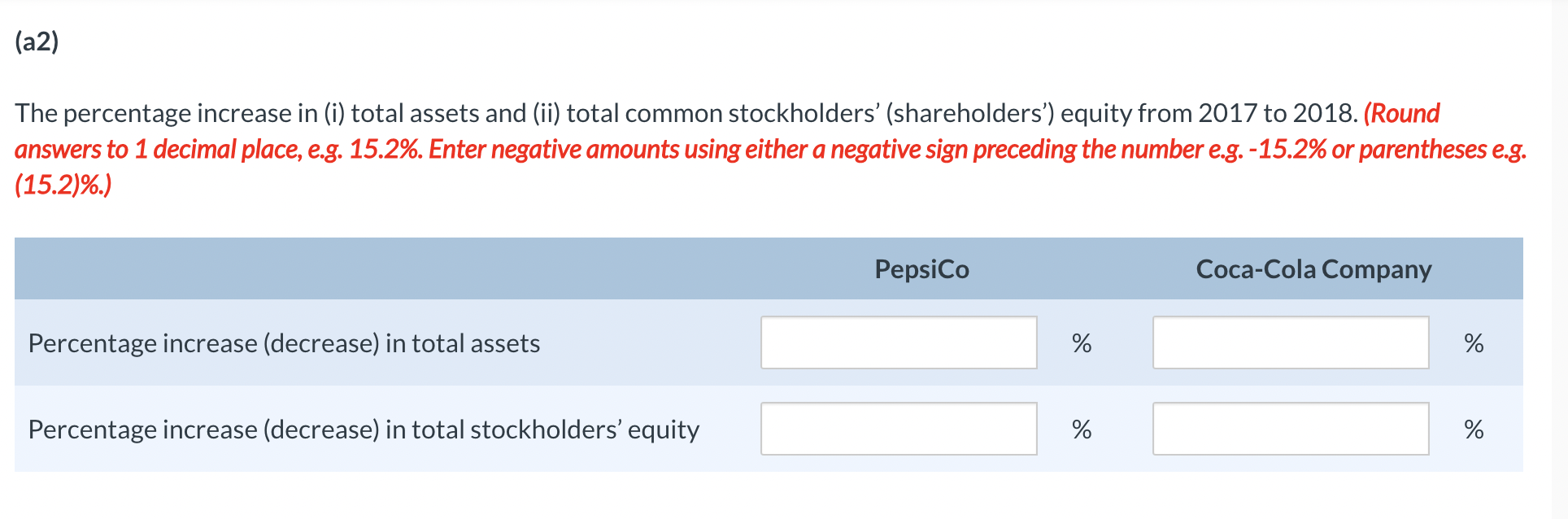

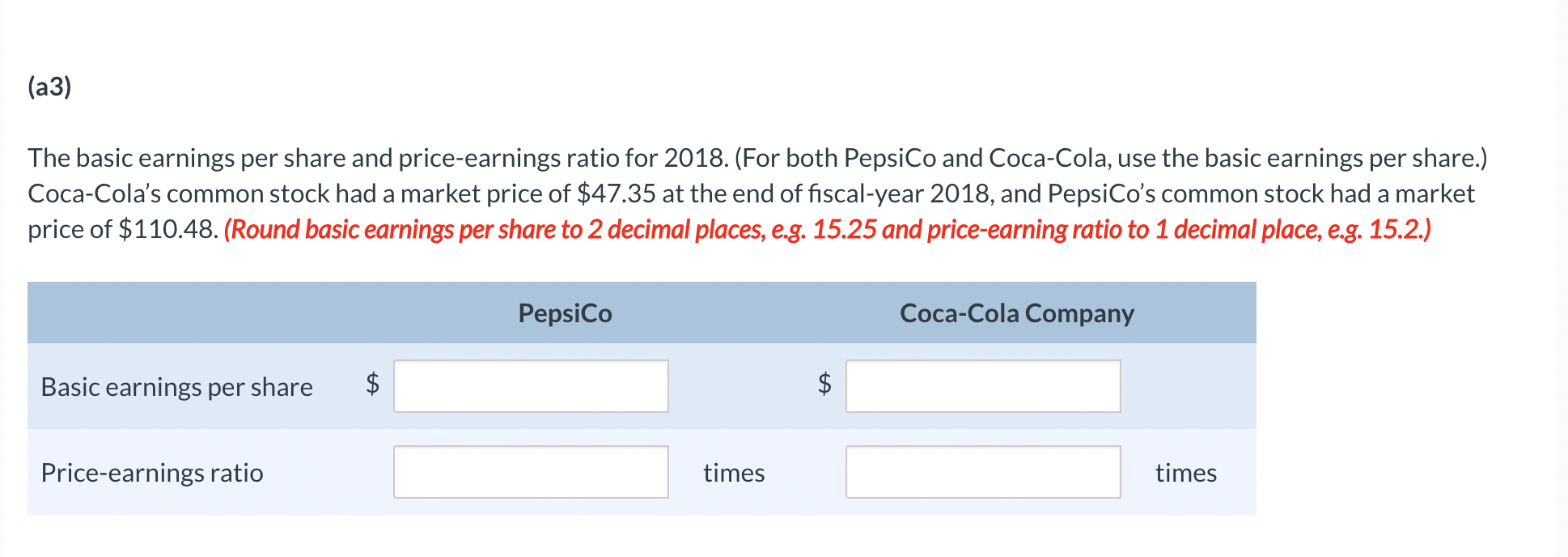

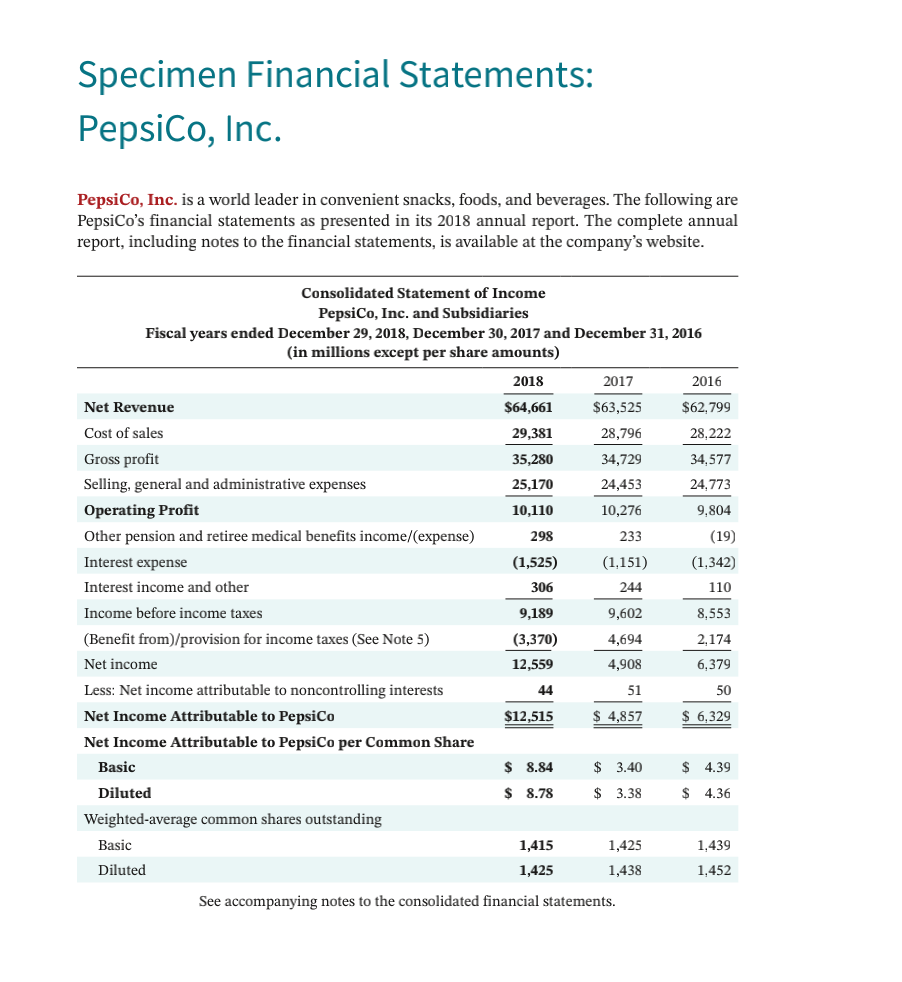

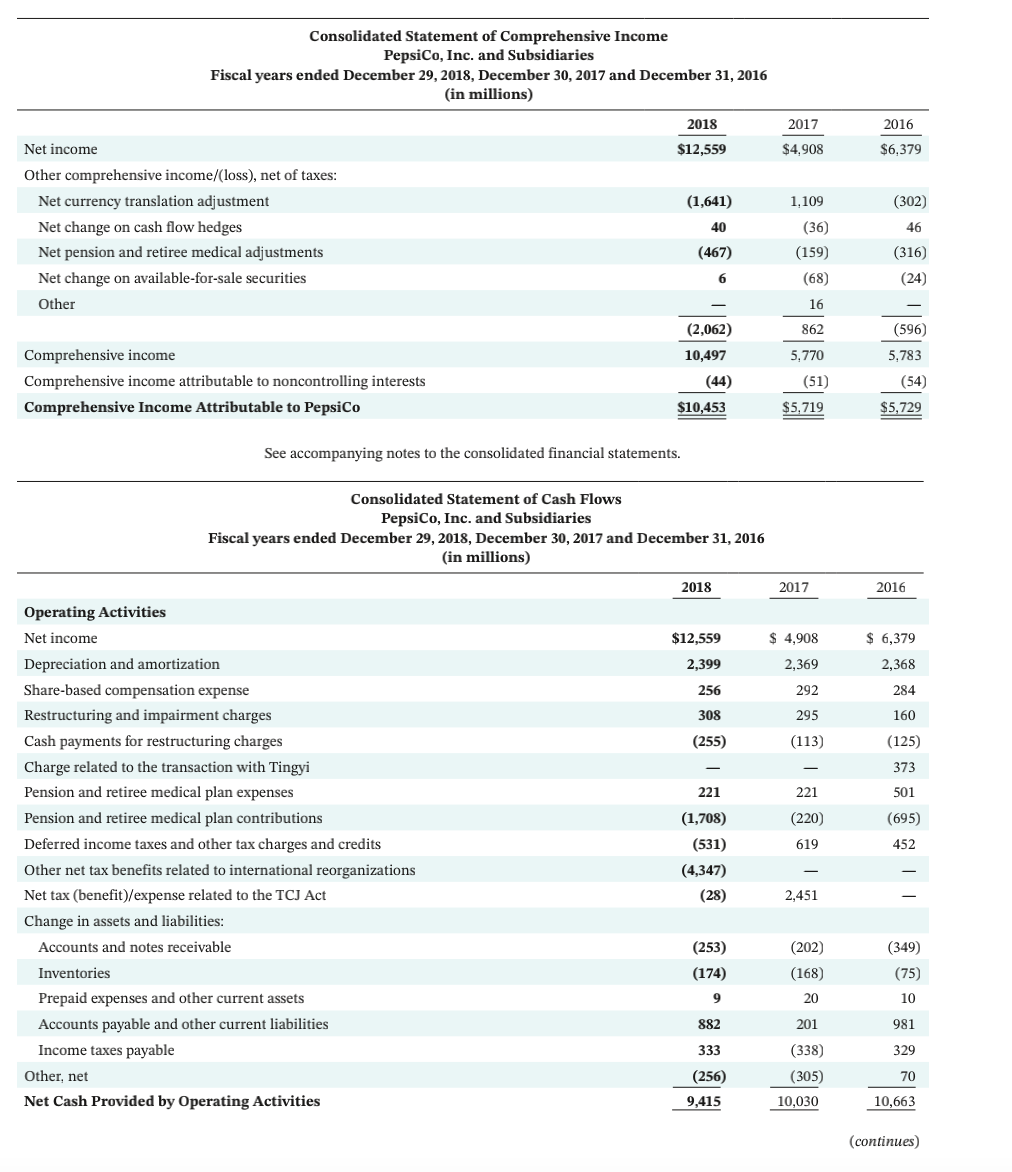

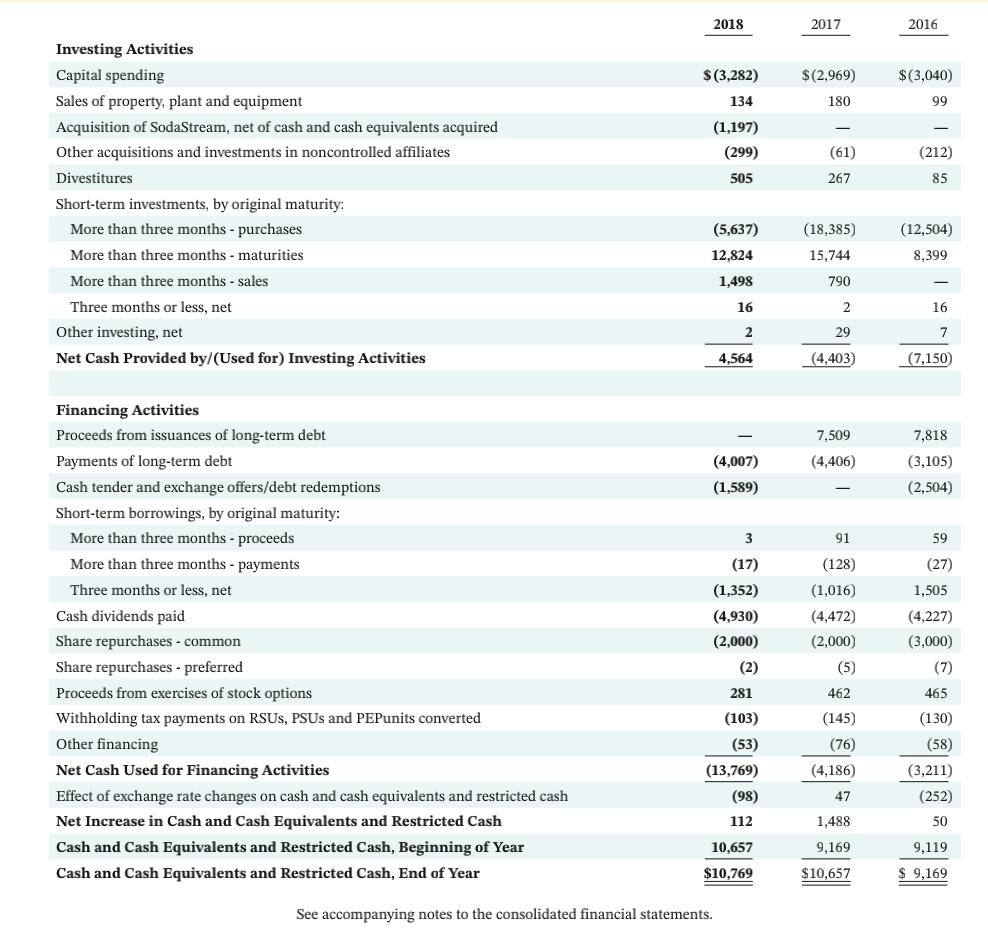

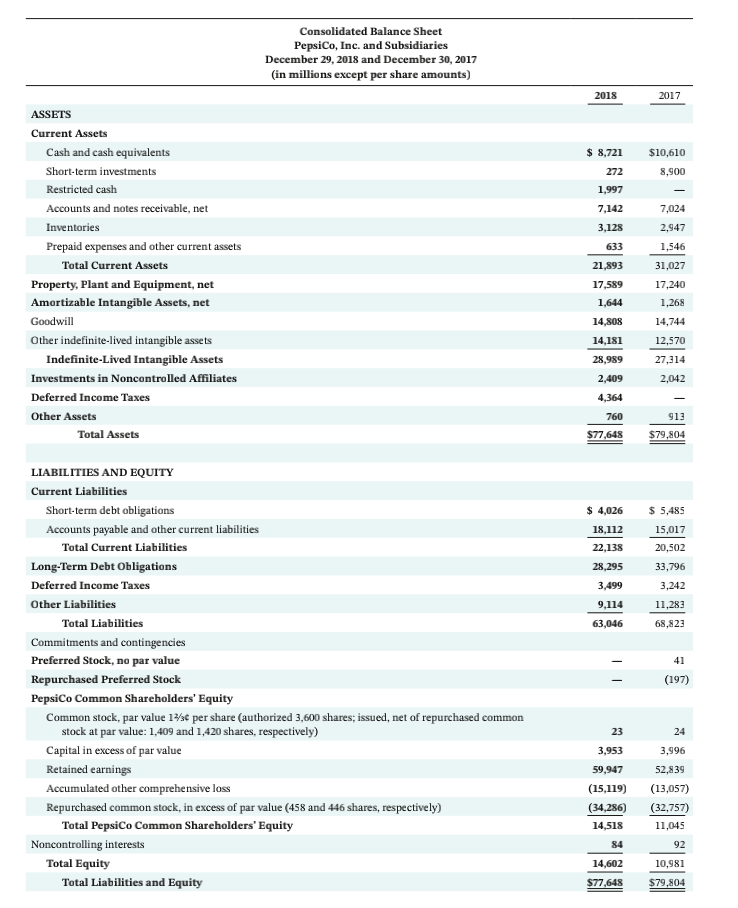

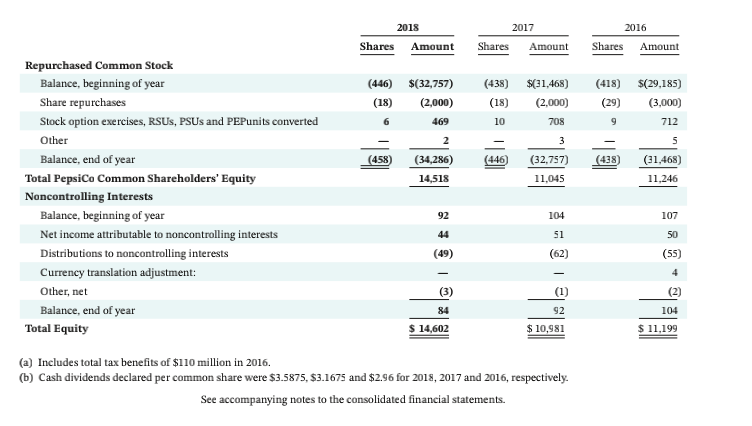

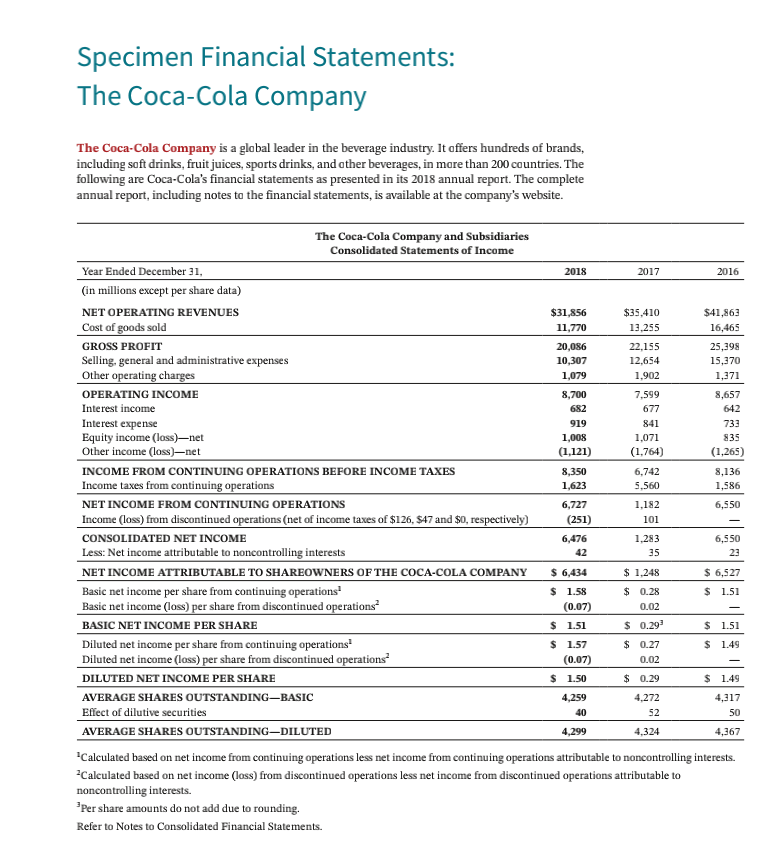

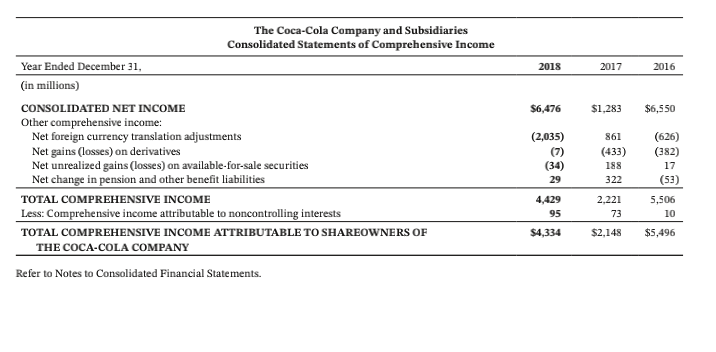

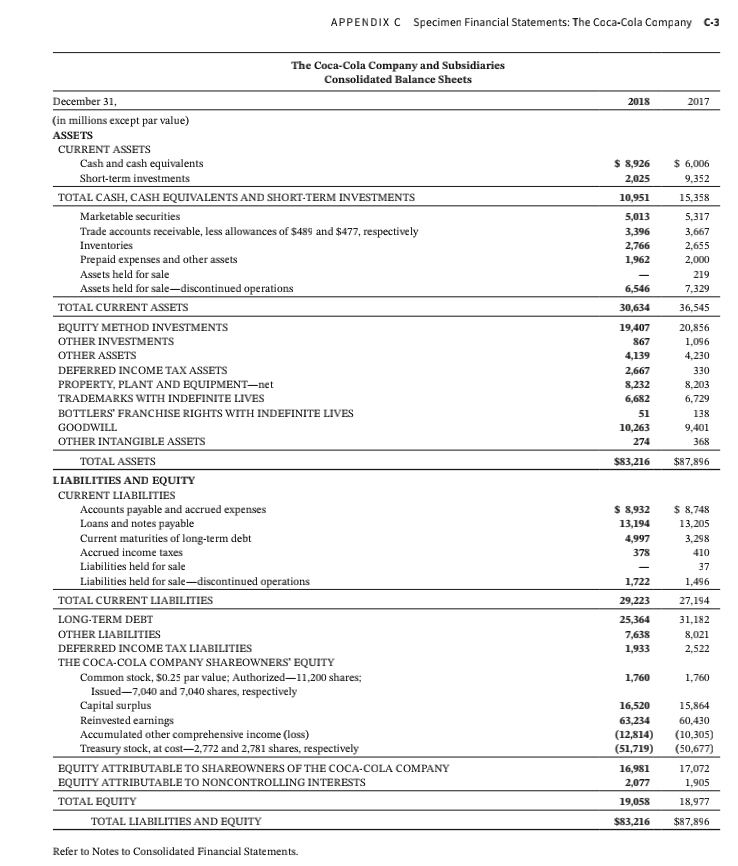

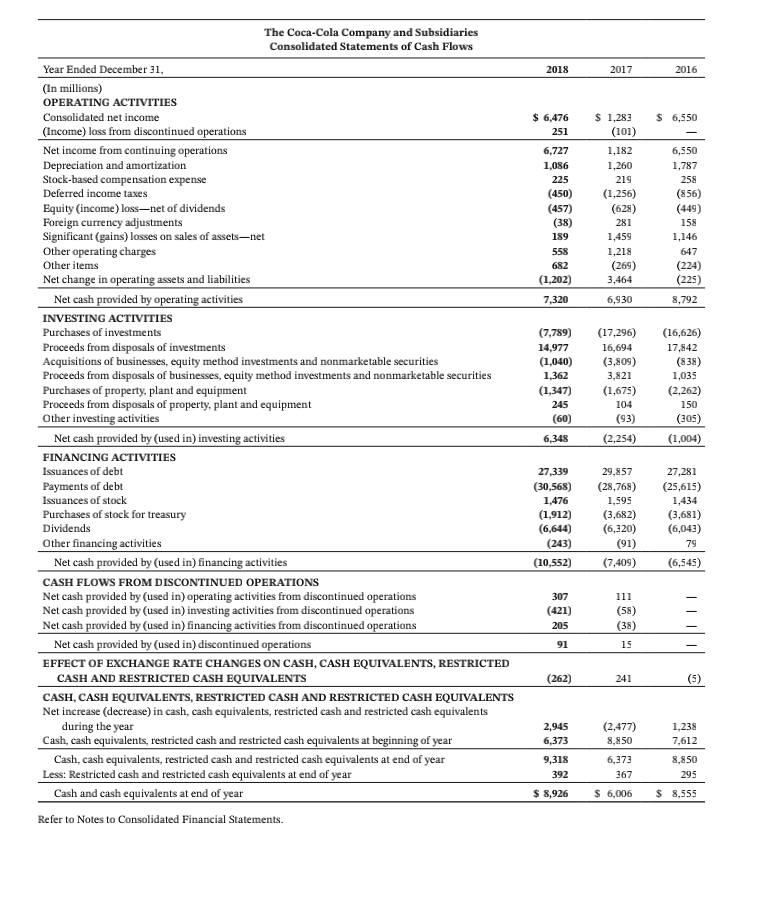

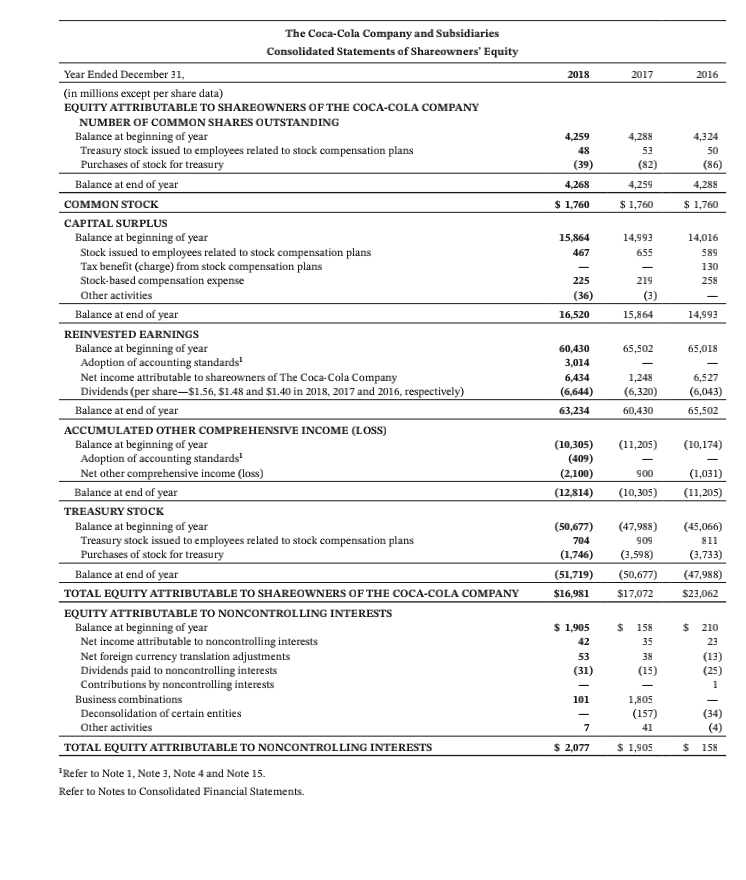

PepsiCo's financial statements are presented in Appendix B. Click here to view Appendix B. Financial statements of The Coca-Cola Company are presented in Appendix C. Click here to view Appendix C. The complete annual reports of PepsiCo and Coca-Cola, including the notes to the financial statements, are available at each company's respective website. Based on the information contained in these financial statements, determine each of the following for each company: (a1) The percentage increase (decrease) in (i) net sales and (ii) net income from 2017 to 2018. (Round answers to 1 decimal places, e.g. 15. Enter negative amounts using either a negative sign preceding the number e.g. -15.2\% or parentheses e.g. (15.2)\%.) The percentage increase in (i) total assets and (ii) total common stockholders' (shareholders') equity from 2017 to 2018. (Round answers to 1 decimal place, e.g. 15.2\%. Enter negative amounts using either a negative sign preceding the number e.g. - 15.2% or parentheses e.g. (15.2)\%.) The basic earnings per share and price-earnings ratio for 2018. (For both PepsiCo and Coca-Cola, use the basic earnings per share.) Coca-Cola's common stock had a market price of $47.35 at the end of fiscal-year 2018, and PepsiCo's common stock had a market price of $110.48. (Round basic earnings per share to 2 decimal places, e.g. 15.25 and price-earning ratio to 1 decimal place, e.g. 15.2.) Specimen Financial Statements: Pepsico, Inc. PepsiCo, Inc. is a world leader in convenient snacks, foods, and beverages. The following are - . * Consolidated Statement of Comprehensive Income PepsiCo, Inc. and Subsidiaries Fiscal years ended December 29, 2018, December 30, 2017 and December 31,2016 (in millions) \begin{tabular}{llllll} \hline Net income & $12,5592018 & $4,9082017 & $6,379 \end{tabular} Other comprehensive income/(loss), net of taxes: See accompanying notes to the consolidated financial statements. Consolidated Statement of Cash Flows PepsiCo, Inc. and Subsidiaries Fiscal years ended December 29, 2018, December 30, 2017 and December 31,2016 (in millions) (continues) Investing Activities Short-term investments, by original maturity: See accompanying notes to the consolidated financial statements. Consolidated Balance Sheet PepsiCo, Inc. and Subsidiaries December 29, 2018 and December 30, 2017 (in millions except per share amounts) ASSETS Current Assets LIABILITIES AND EQUITY Current Liabilities Short-term debt obligations Accounts payable and other current liabilities Total Current Liabilities Long-Term Debt Obligations Deferred Income Taxes Other Liabilities Total Liabilities Commitments and contingencies Preferred Stock, no par value Repurchased Preferred Stock PepsiCo Common Shareholders' Equity Common stock, par value 12/st per share (authorized 3,600 shares; issued, net of repurchased common stock at par value: 1,409 and 1,420 shares, respectively) Capital in excess of par value Retained earnings Accumulated other comprehensive loss Repurchased common stock, in excess of par value (458 and 446 shares, respectively) Total PepsiCo Common Shareholders' Equity (a) Includes total tax benefits of $110 million in 2016. (b) Cash dividends declared per common share were $3.5875,$3.1675 and $2.96 for 2018,2017 and 2016 , respectively. See accompanying notes to the consolidated financial statements. Specimen Financial Statements: The Coca-Cola Company The Coca-Cola Company is a global leader in the beverage industry. It affers hundreds of brands, including saft drinks, fruit juices, sports drinks, and ather beverages, in more than 200 countries. The following are Coca-Cola's financial statements as presented in its 2018 annual report. The complete annual report. including notes to the financial statements. is available at the combanv's website. noncontrolling interests. 3 Per share amounts do not add due to rounding. Refer to Notes to Consolidated Financial Statements. The Coca-Cola Company and Subsidiaries Consolidated Statements of Comprehensive Income Refer to Notes to Consolidated Financial Statements. APPENDIX C Specimen Financial Statements: The Coca-Cola Company C.3 The Coca-Cola Company and Subsidiaries Consolidated Balance Sheets LIABILITIES AND EQUITY CURRENT LIABILITIES Accounts payable and accrued expenses Loans and notes payable Current maturities of long-term debt Accrued income taxes Liabilities held for sale Liabilities held for sale-discontinued operations TOTAL CURRENT LIABILITIES LONG-TERM DEBT OTHER LIABIL.ITIES DEFERRED INCOME TAX LIABILITIES THE COCA-COLA COMPANY SHAREOWNERS' EQUITY Common stock, $0.25 par value; Authorized 11,200 shares; Issued 7,040 and 7,040 shares, respectively Capital surplus Reinvested earnings Accumulated other comprehensive income (loss) Treasury stock, at cost-2,772 and 2,781 shares, respectively EQUITY ATTRIBUTABLE TO SHAREOWNERS OF THE COCA-COLA COMPANY EQUITY ATTRIBUTABLE TO NONCONTROL.LING INTERESTS TOTAL EQUITY TOTAL LIABILITIES AND EQUITY Refer to Notes to Consolidated Financial Statements. The Coca-Cola Company and Subsidiaries Consolidated Statements of Cash Flows CASH FLOWS FROM DISCONTINUED OPERATIONS Net cash provided by (used in) operating activities from discontinued operations Net cash provided by (used in) investing activities from discontinued operations \begin{tabular}{lrr} Net cash provided by (used in) financing activities from discontinued operations & (38) & 15 \\ \hline Net cash provided by (used in) discontinued operations & 91 & \\ \hline EFFECT OF EXCHANGE RATE CHANGES ON CASH, CASH EQUIVALENTS, RESTRICTED & \\ CASH AND RESTRICTED CASH EQUIVALENTS & (262) & 241 \\ \hline \end{tabular} CASH, CASH EQUIVALENTS, RESTRICTED CASH AND RESTRICTED CASH EQUIVALENTS Net increase (decrease) in cash, cash equivalents, restricted cash and restricted cash equivalents \begin{tabular}{lrrr} during the year & 2,945 & (2,477) & 1,238 \\ Cash, cash equivalents, restricted cash and restricted cash equivalents at beginning of year & 6,373 & 8,850 & 7,612 \\ \hline Cash, cash equivalents, restricted cash and restricted cash equivalents at end of year & 6,373 & 8,850 \\ Less: Restricted cash and restricted cash equivalents at end of year & 9,318 & 367 \\ \hline Cash and cash equivalents at end of year & 392 & 295 \\ \hline \end{tabular} Refer to Notes to Consolidated Financial Statements. The Coca-Cola Company and Subsidiaries Consolidated Statements of Shareowners' Equity 1 Refer to Note 1, Note 3, Note 4 and Note 15. Refer to Notes to Consolidated Financial Statements