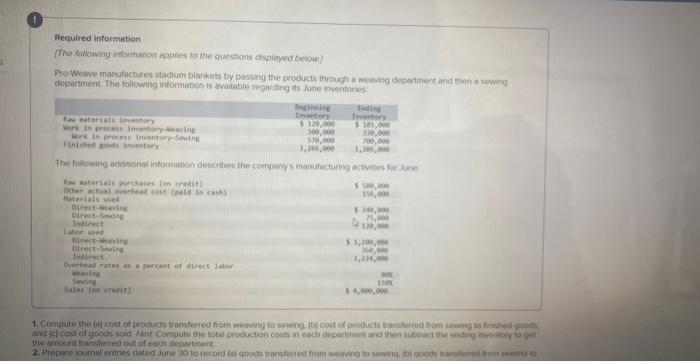

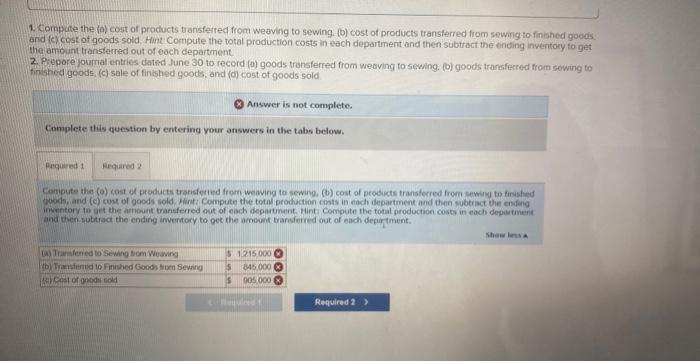

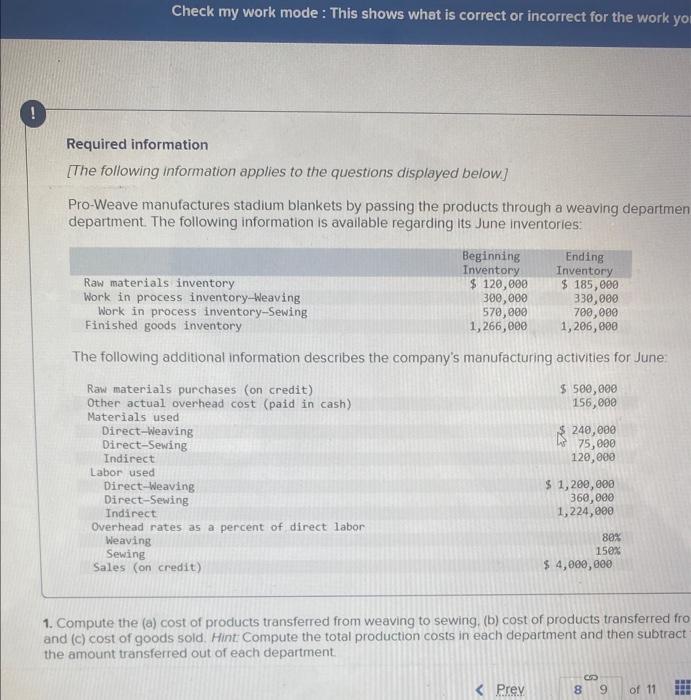

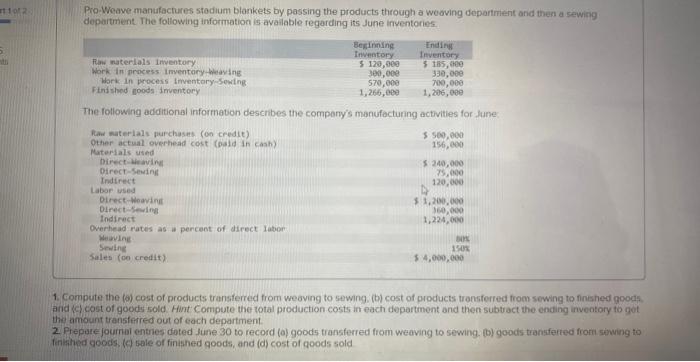

Pequired information The following informabova applies to the quostions displayed below/ Pro Weawe manufhctures stadium blarkets by passing the products through a weavelg dopartment and then a sewng copartment the following informabon is avaitable regnecting its lune inventories: 1. Compute the (a) cost of products transfefred from weaving to sewing. (b) cost of products transferred from sowing to finished goods and (c) cost of goods sold. Hint Compute the total production costs in each department and then subtract the encing inventary fo get the amocint transferred out of each department. 2. P. ipare journal entries dated fune 30 to record (a) goods transferred from weaving to sewing: (D) goods transferred from sewing to finished goods. (c) sale of finthhed goods, and (c) cost of goods sold Answer is not complete. Complete this question by entering your answers in the tabs below. poote, and (c) cose of goods sold. Plint: Compute the totid production costs in eich department and then subtract the endened inventory to get the arnouit transferred put of each depirtinent. Hint Compute the total prodoction costo in each depertmert. and tien subtract the ending imentory to gee the amoint transferred out of anch deportment. Required information [The following information applies to the questions displayed below] Pro-Weave manufactures stadium blankets by passing the products through a weaving departmei department. The following information is available regarding its June inventories: The following additional information describes the company's manufacturing activities for June: 1. Compute the (a) cost of products transferred from weaving to sewing, (b) cost of products transferred fr and (c) cost of goods sold. Hint: Compute the total production costs in each department and then subtrac the amount transferred out of each department. Pro-Woave manufactures stodium blankets by passing the products through a weoving departiment and then a sewing department. The following information is avaliable regarding its June inventories. The following additional informaton describes the compary's manufacturing activities for fune: 1. Compute the (o) cost of products transtered from weaving to sewing, (b) cost of products transferred from sewing to finished poods. arid k cost of goods sold. Himt Compute the total production costs in each department and then subtract the ending inventory to got the amount transferred out of each department. 2. Preporejournar entries doted June 30 to record (o) goods transferred from weaving to sewing. (b) goods transferted from sitwing to Intished coods, (c) sale of finithed goods, and (d) cost of qoods sold