Answered step by step

Verified Expert Solution

Question

1 Approved Answer

per canadian tax act Kruger Ltd. is a Canadian controlled private corporation with a December 31 year end that has been in operation for over

per canadian tax act

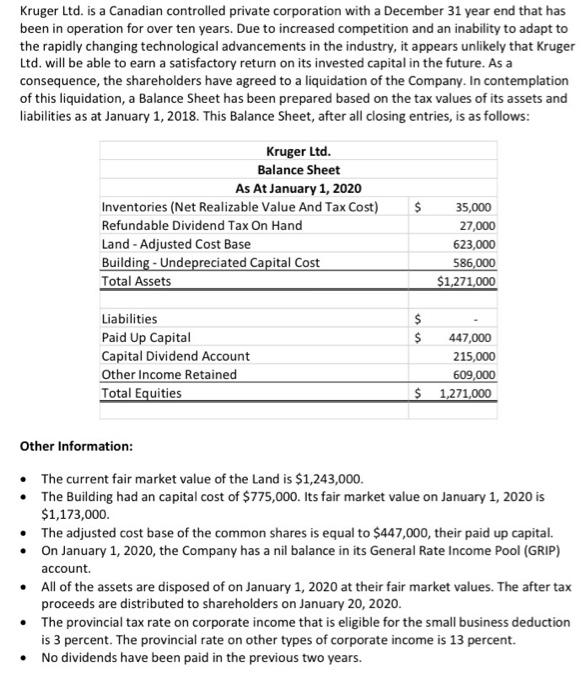

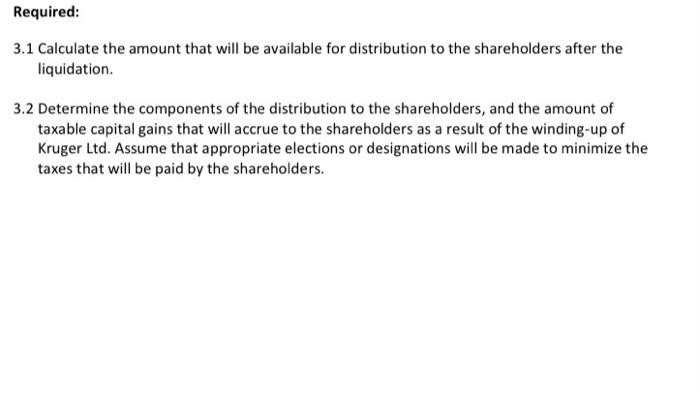

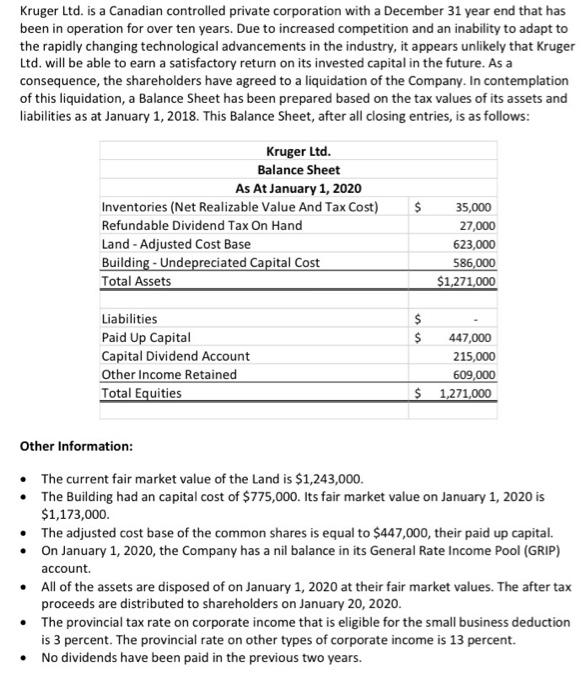

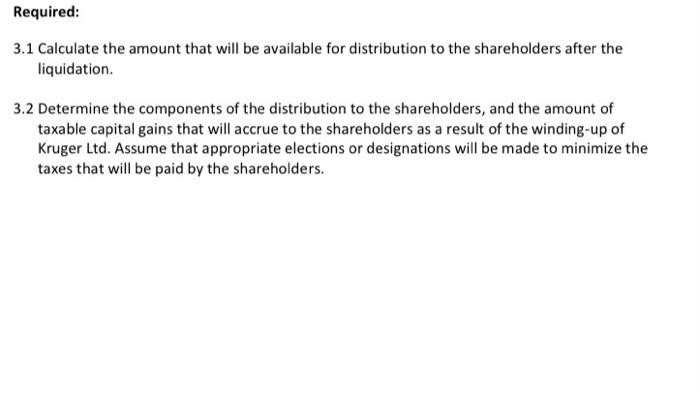

Kruger Ltd. is a Canadian controlled private corporation with a December 31 year end that has been in operation for over ten years. Due to increased competition and an inability to adapt to the rapidly changing technological advancements in the industry, it appears unlikely that Kruger Ltd. will be able to earn a satisfactory return on its invested capital in the future. As a consequence, the shareholders have agreed to a liquidation of the Company. In contemplation of this liquidation, a Balance Sheet has been prepared based on the tax values of its assets and liabilities as at January 1, 2018. This Balance Sheet, after all closing entries, is as follows: $ Kruger Ltd. Balance Sheet As At January 1, 2020 Inventories (Net Realizable Value And Tax Cost) Refundable Dividend Tax On Hand Land - Adjusted Cost Base Building - Undepreciated Capital Cost Total Assets 35,000 27,000 623,000 586,000 $1,271,000 Liabilities Paid Up Capital Capital Dividend Account Other Income Retained Total Equities $ $ 447,000 215,000 609,000 $ 1,271,000 Other Information: The current fair market value of the Land is $1,243,000. The Building had an capital cost of $775,000. Its fair market value on January 1, 2020 is $1,173,000. The adjusted cost base of the common shares is equal to $447,000, their paid up capital. On January 1, 2020, the Company has a nil balance in its General Rate Income Pool (GRIP) account. All of the assets are disposed of on January 1, 2020 at their fair market values. The after tax proceeds are distributed to shareholders on January 20, 2020. The provincial tax rate on corporate income that is eligible for the small business deduction is 3 percent. The provincial rate on other types of corporate income is 13 percent. No dividends have been paid in the previous two years. Required: 3.1 Calculate the amount that will be available for distribution to the shareholders after the liquidation. 3.2 Determine the components of the distribution to the shareholders, and the amount of taxable capital gains that will accrue to the shareholders as a result of the winding-up of Kruger Ltd. Assume that appropriate elections or designations will be made to minimize the taxes that will be paid by the shareholders

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started