Answered step by step

Verified Expert Solution

Question

1 Approved Answer

To help Nike, you are going to tell the marketing department how many pairs of shoes they would need to sell if they develop their

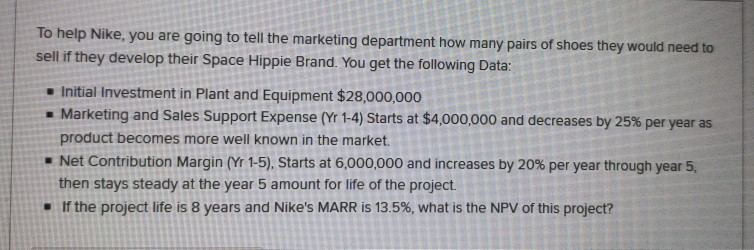

To help Nike, you are going to tell the marketing department how many pairs of shoes they would need to sell if they develop their Space Hippie Brand. You get the following Data: Initial Investment in Plant and Equipment $28,000,000 - Marketing and Sales Support Expense (Yr 1-4) Starts at $4,000,000 and decreases by 25% per year as product becomes more well known in the market. Net Contribution Margin (Yr 1-5), Starts at 6,000,000 and increases by 20% per year through year 5, then stays steady at the year 5 amount for life of the project. . If the project life is 8 years and Nike's MARR is 13.5%, what is the NPV of this project

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started