Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Per the timeline below, pretend 2018 just started. In 2012, DePaul University issued $1 million of 10-year debt at 7% to build a small

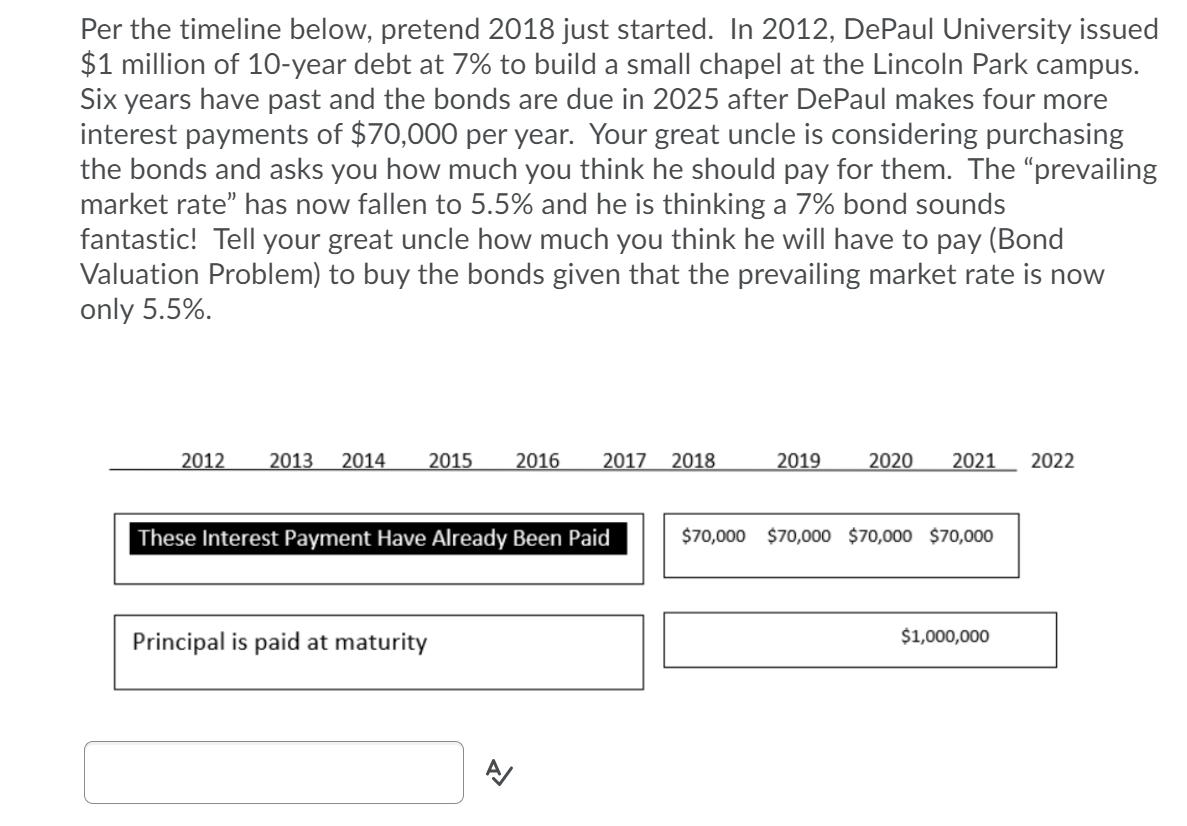

Per the timeline below, pretend 2018 just started. In 2012, DePaul University issued $1 million of 10-year debt at 7% to build a small chapel at the Lincoln Park campus. Six years have past and the bonds are due in 2025 after DePaul makes four more interest payments of $70,000 per year. Your great uncle is considering purchasing the bonds and asks you how much you think he should pay for them. The "prevailing market rate" has now fallen to 5.5% and he is thinking a 7% bond sounds fantastic! Tell your great uncle how much you think he will have to pay (Bond Valuation Problem) to buy the bonds given that the prevailing market rate is now only 5.5%. 2012 2013 2014 2015 2016 2017 2018 These Interest Payment Have Already Been Paid Principal is paid at maturity A 2019 2020 2021 2022 $70,000 $70,000 $70,000 $70,000 $1,000,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

SOLUTION To calculate the price your great uncle should pay for the bonds we can use the bond valuat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started