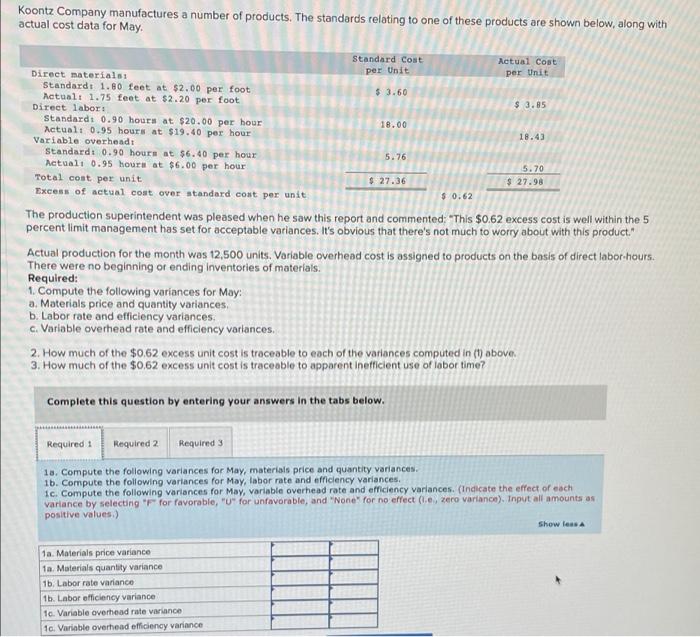

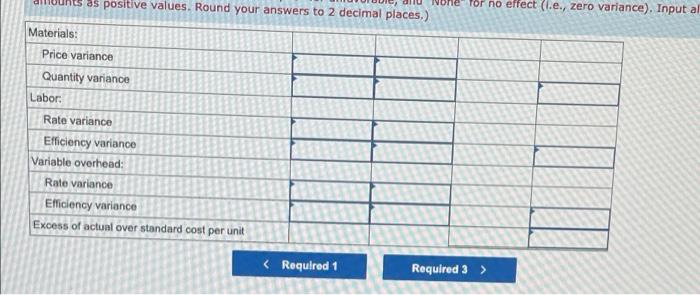

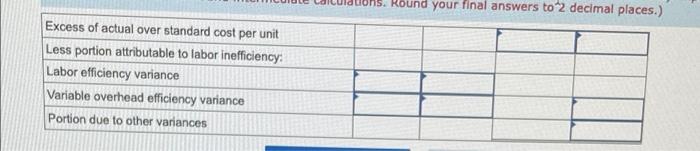

per Unit Koontz Company manufactures a number of products. The standards relating to one of these products are shown below, along with actual cost data for May. Standard Cost Actual Cost per Unit Direct materials Standardt 1.80 feet at $2.00 per foot $ 3.60 Actual: 1.75 feet at $2.20 per foot $ 3.85 Direct labor Standard: 0.90 hours at $20.00 per hour 18.00 Actualt 0.95 hours at $19.40 per hour 18.43 Variable overheads Standard: 0.90 hours at $6.40 per hour 5.76 Actualt 0.95 hours at $6.00 per hour 5.70 Total cost per unit $ 27.36 $ 27.98 Excess of actual cost over standard cost per unit $ 0.62 The production superintendent was pleased when he saw this report and commented: "This $0.62 excess cost is well within the 5 percent limit management has set for acceptable variances. It's obvious that there's not much to worry about with this product." Actual production for the month was 12,500 units. Variable overhead cost is assigned to products on the basis of direct labor-hours. There were no beginning or ending Inventories of materials. Required: 1. Compute the following variances for May: a. Materials price and quantity variances, b. Labor rate and efficiency variances. c. Variable overhead rate and efficiency variances, 2. How much of the $0,62 excess unit cost is troceable to each of the variances computed in (1) above. 3. How much of the $0.62 excess unit cost is traceable to apparent inefficient use of labor time? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 18. Compute the following variances for May, materials price and quantity variances 1b. Compute the following variances for May, labor rate and efficiency variances ic. Compute the following variances for May, variable overhead rate and efficiency variances. (Indicate the effect of each variance by selecting for favorable, "U" for unfavorable, and "None for no effect (te, zero variance). Input all amounts as positive values.) Show less 1a. Materials price variance ia. Materials quantity variance 1b. Labor rate variance 1b. Labor efficiency variance 1. Variable overhead rate variance 10. Variable overhead efficiency variance 85 positive values. Round your answers to 2 decimal places.) he For no effect (.e., zero variance). Input al Materials: Price variance Quantity variance Labor: Rate variance Efficiency variance Variable overhead: Rate variance Efficiency variance Excess of actual over standard cost per unit Round your final answers to 2 decimal places.) Excess of actual over standard cost per unit Less portion attributable to labor inefficiency: Labor efficiency variance Variable overhead efficiency variance Portion due to other variances