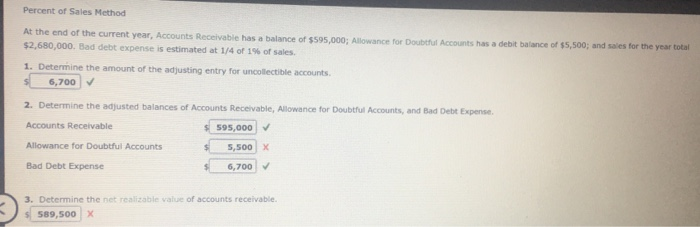

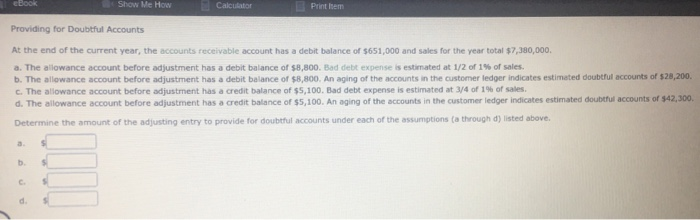

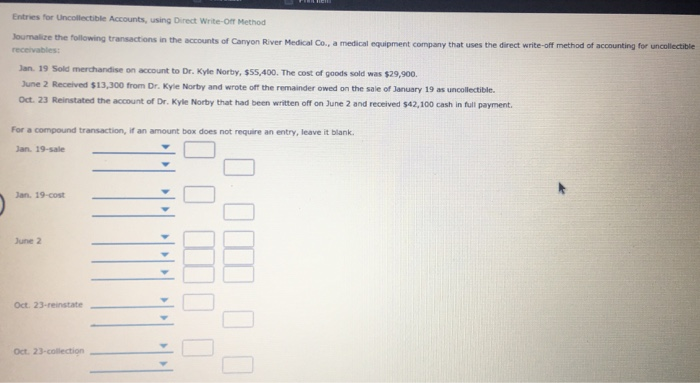

Percent of Sales Method At the end of the current year, Accounts Receivable has a balance of $595,000; Allowance for Doubtful Accounts has a debit balance of $5,500; and sales for the year total $2,680,000. Bad debt expense is estimated at 1/4 of 1% of sales 1. Determine the amount of the adjusting entry for uncollectible accounts 5 6,700 2. Determine the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense. Accounts Receivable 595,000 Allowance for Doubtful Accounts $ 5,500 X Bad Debt Expense 6,7007 3. Determine the net realizable value of accounts receivable. 589,500 X eBook Show Me How Calculator Print Item Providing for Doubtful Accounts At the end of the current year, the accounts receivable account has a debit balance of $651,000 and sales for the year total $7,380,000. a. The allowance account before adjustment has a debit balance of $8,800. Bad debt expense is estimated at 1/2 of 1% of sales. b. The allowance account before adjustment has a debit balance of $8,800. An aging of the accounts in the customer ledger indicates estimated doubtful accounts of $28,200. c. The allowance account before adjustment has a credit balance of $5,100. Bad debt expense is estimated at 3/4 of 1% of sales d. The allowance account before adjustment has a credit balance of $5,100. An aging of the accounts in the customer ledger indicates estimated doubtful accounts of $42,300. Determine the amount of the adjusting entry to provide for doubtful accounts under each of the assumptions (a through d) listed above. b Entries for Uncollectible Accounts, using Direct Write-Off Method Joumalize the following transactions in the accounts of Canyon River Medical Co., a medical equipment company that uses the direct write-off method of accounting for uncollectible receivables: Jan. 19 Sold merchandise on account to Dr. Kyle Norby, $55,400. The cost of goods sold was $29,900 June 2 Received $13,300 from Dr. Kyle Norby and wrote of the remainder owed on the sale of January 19 as uncollectible. Oct. 23 Reinstated the account of Dr. Kyle Norty that had been written off on June 2 and received $42,100 cash in full payment For a compound transaction, if an amount box does not require an entry, leave it blank. Jan. 19-sale Jan. 19-cost June 2 > > > > > Oct. 23-reinstate Oct. 23-collection