Question

Percent of sales method The first step in to express the balance of an accounting item in the income statement or balance sheet as a

Percent of sales method

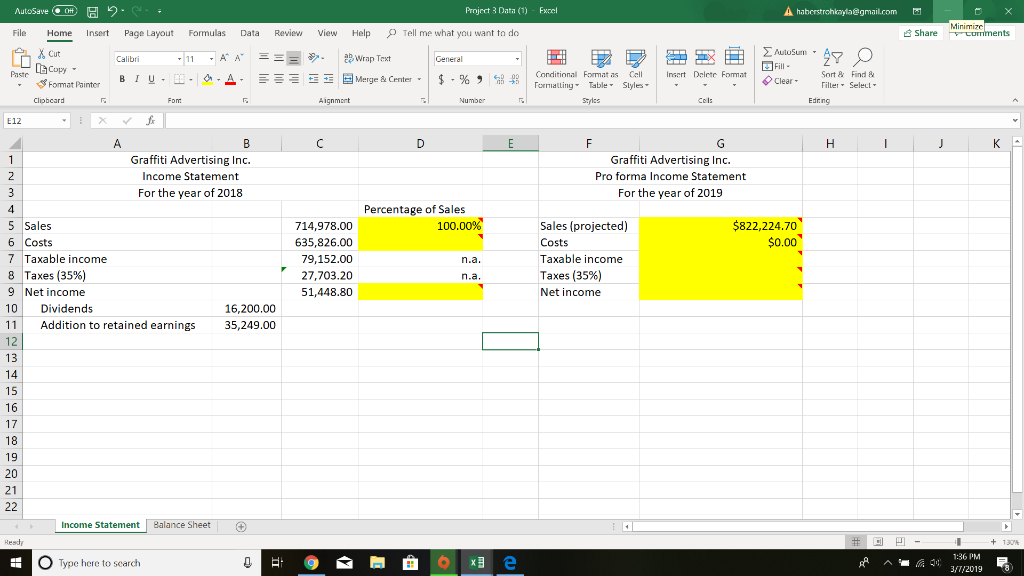

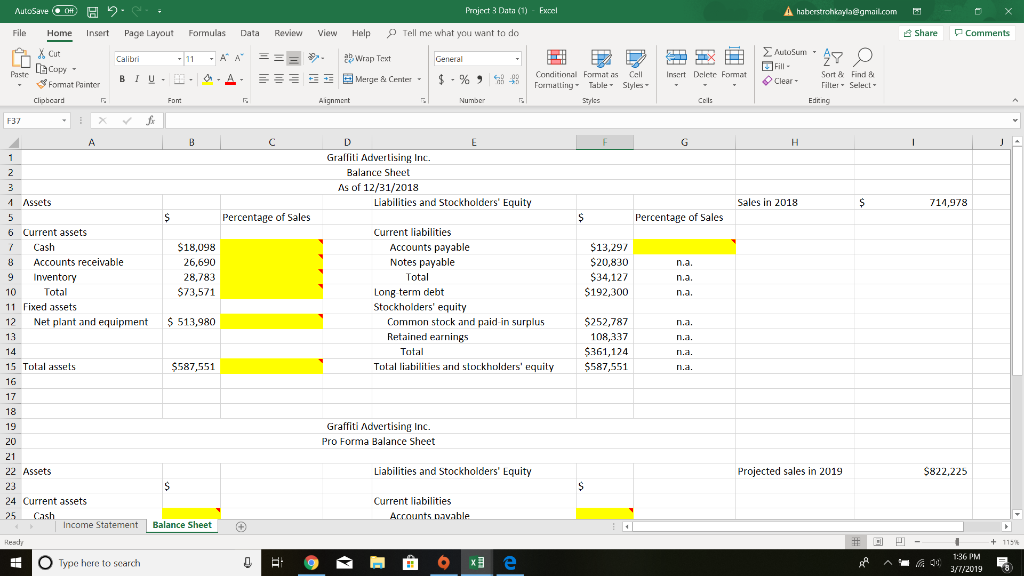

The first step in to express the balance of an accounting item in the income statement or balance sheet as a percent of current sales revenue. Then multiply that percentage by the projected sales revenue to arrive the projected amount for an accounting item in the coming year. For example, Graffitis costs were $635,826, which accounted for 88.93% of current years sales revenue ($635,826/$714,978 = 88.93%). The projected costs for the upcoming year will be 88.93% x $822,224.70 (the projected sales revenue) = $731,199.90.

Some of the accounting items expressed as a percentage of sales are meaningless. This is because either the balance of the accounting item remains unchanged or its proportional change does not correspond to the percentage change in sales. We put a n.a. in the percentage column.

We assume that Graffitis dividend payout ratio remains unchanged for the coming year. Given the $16,200 dividends and net income of $51,448.80 from the income statement, we know that its dividend payout ratio is cash dividend / net income = $16,200/$51,448.80 = 31.4876%. This implies that Graffitis retention ratio is 68.5124%, as the sum of the dividend payout and retention ratios equals to 100%.

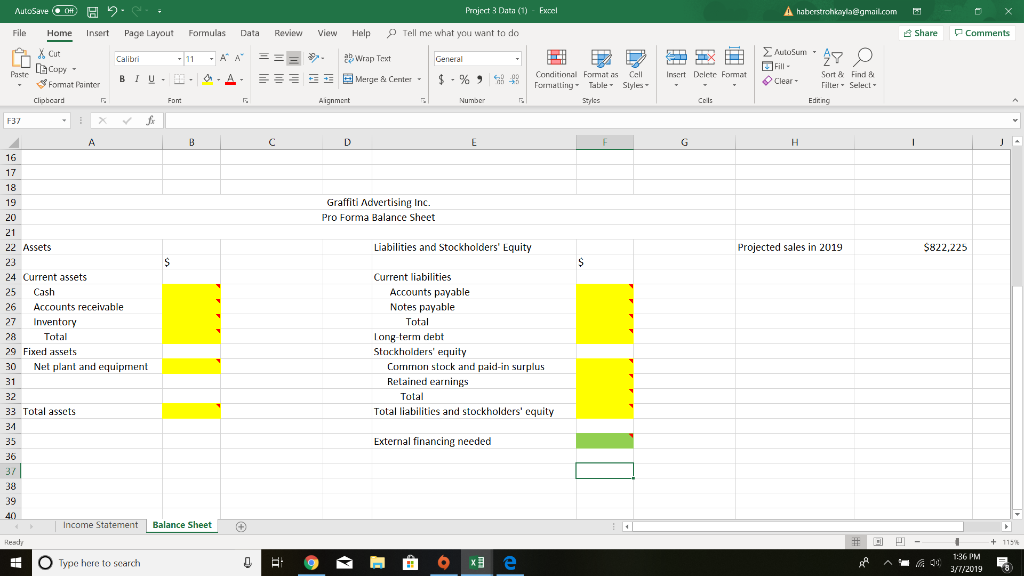

The textbook provides the formula for the projected retained earnings. The projected retained earnings = The retained earnings from the past year + projected net income projected cash dividends to be paid Therefore, you will use the dividend payout ratio in the calculations.

You will find that the pro forma balance sheet is imbalanced as total assets are not equal to total liabilities and stockholders equity. If the projected total assets exceed projected total liabilities and stockholders equity, this indicates that external financing is needed. Please compute the needed amount from external financing. Explanations for each item have been inserted as comments in the Excel file.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started