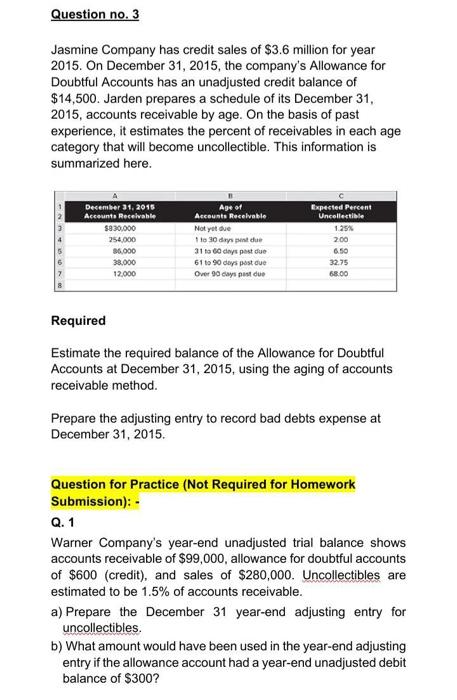

Percent of sales method; write-off At year-end (December 31), Rashed Company estimates its bad debts as 0.75% of its annual credit sales of AED790,000. Rashed records its bad debts expense for that estimate. On the following February 15, Rashed decides that the AED1,250 account of A. Abdulla is uncollectible and writes it off as a bad debt. On March 31tt, Abdulla unexpectedly pays the amount previously written off. Required: Prepare the journal entries of Rashed to record these transactions and events of December 31, February 15, and March 31st.. Question no. 2 Percent of accounts receivable method At each calendar year-end, Futaim Electric Co, uses the percent of accounts receivable method to estimate bad debts. On December 31, 2019, it has outstanding accounts receivable of AED 310,000 , and it estimates that 2.5% will be uncollectible. Required: Prepare the adjusting entry to record bad debts expense for year 2019 under the assumption that the Allowance for Doubtful Accounts has (a) a AED2,400 credit balance before the adjustment and (b) a AED1,800 debit balance before the adjustment. Jasmine Company has credit sales of $3.6 million for year 2015. On December 31, 2015, the company's Allowance for Doubtful Accounts has an unadjusted credit balance of $14,500. Jarden prepares a schedule of its December 31 , 2015 , accounts receivable by age. On the basis of past experience, it estimates the percent of receivables in each age category that will become uncollectible. This information is summarized here. Required Estimate the required balance of the Allowance for Doubtful Accounts at December 31, 2015, using the aging of accounts receivable method. Prepare the adjusting entry to record bad debts expense at December 31, 2015. Question for Practice (Not Required for Homework Submission): - Q. 1 Warner Company's year-end unadjusted trial balance shows accounts receivable of $99,000, allowance for doubtful accounts of $600 (credit), and sales of $280,000. Uncollectibles are estimated to be 1.5% of accounts receivable. a) Prepare the December 31 year-end adjusting entry for uncollectibles. b) What amount would have been used in the year-end adjusting entry if the allowance account had a year-end unadjusted debit balance of $300