Question

Percentage-of-Completion Accounting. Lark Construction Company was hired to build a stadium for $32 million. Work began late in 20x1, and the stadium was completed in

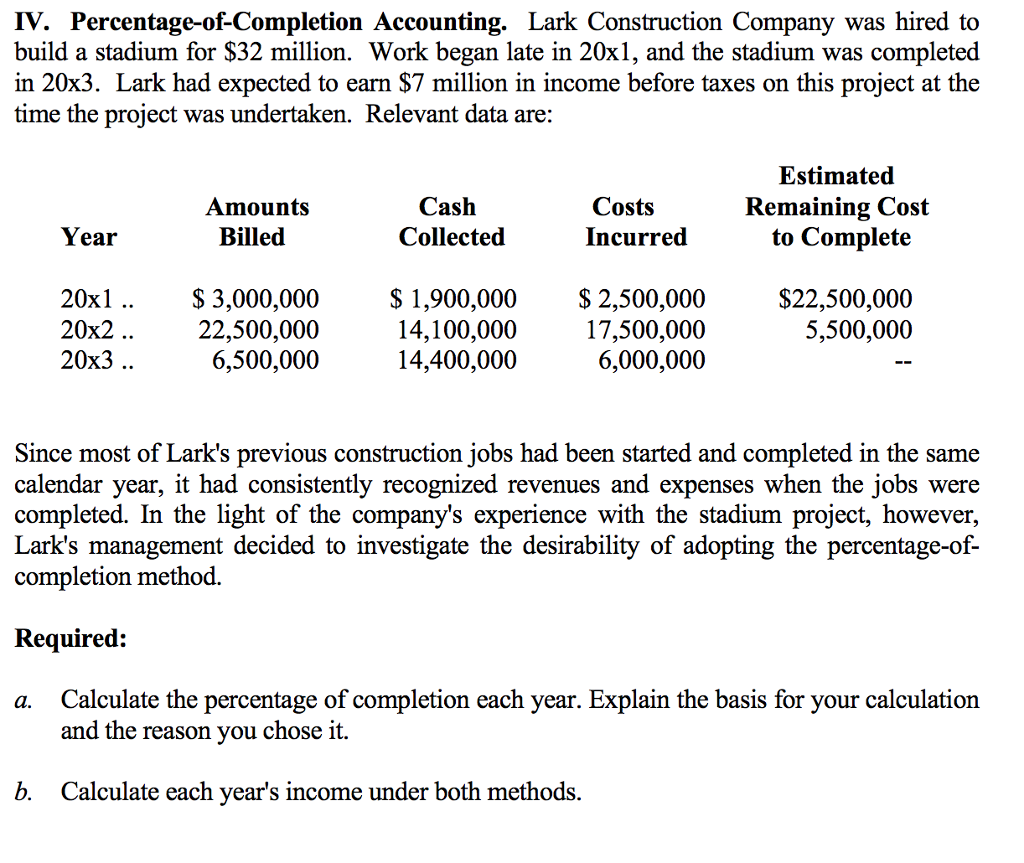

Percentage-of-Completion Accounting. Lark Construction Company was hired to build a stadium for $32 million. Work began late in 20x1, and the stadium was completed in 20x3. Lark had expected to earn $7 million in income before taxes on this project at the time the project was undertaken.

Relevant data are: Estimated Amounts Cash Costs Remaining Cost Year Billed Collected Incurred to Complete 20x1 .. $ 3,000,000 $ 1,900,000 $ 2,500,000 $22,500,000 20x2 .. 22,500,000 14,100,000 17,500,000 5,500,000 20x3 .. 6,500,000 14,400,000 6,000,000 Since most of Lark's previous construction jobs had been started and completed in the same calendar year, it had consistently recognized revenues and expenses when the jobs were completed. In the light of the company's experience with the stadium project, however, Lark's management decided to investigate the desirability of adopting the percentage-ofcompletion method. Required:

a. Calculate the percentage of completion each year. Explain the basis for your calculation and the reason you chose it.

b. Calculate each year's income under both methods.

IV. Percentage-of-Completion Accounting. Lark Construction Company was hired to build a stadium for $32 million. Work began late in 20x1, and the stadium was completed in 20x3. Lark had expected to earn $7 million in income before taxes on this project at the time the project was undertaken. Relevant data are: Estimated Remaining Cost to Complete Costs Amounts Billed Cash Collected Year Incurred 20xl .. 20x2.. 20x3 .. $1,900,000 $2,500,000 14,100,000 14,400,000 $22,500,000 $ 3,000,000 22,500,000 6,500,000 17,500,000 6,000,000 5,500,000 Since most of Lark's previous construction jobs had been started and completed in the same calendar year, it had consistently recognized revenues and expenses when the jobs were completed. In the light of the company's experience with the stadium project, however, Lark's management decided to investigate the desirability of adopting the percentage-of- completion method. Required: Calculate the percentage of completion each year. Explain the basis for your calculation and the reason you chose it. a. b. Calculate each year's income under both methodsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started